Jacobs Levy Equity Management Inc. decreased its position in shares of Semtech Co. (NASDAQ:SMTC - Free Report) by 5.9% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 360,006 shares of the semiconductor company's stock after selling 22,764 shares during the quarter. Jacobs Levy Equity Management Inc. owned approximately 0.48% of Semtech worth $16,438,000 at the end of the most recent reporting period.

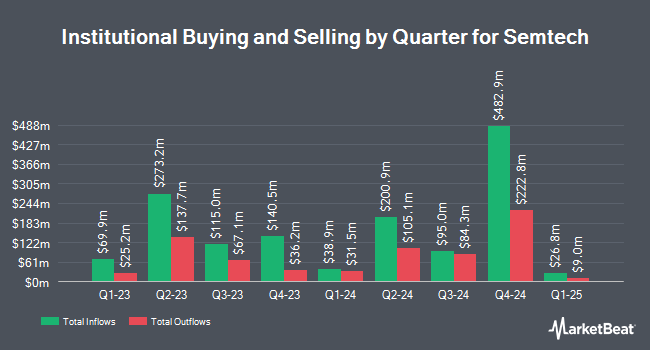

Other hedge funds also recently modified their holdings of the company. Mutual of America Capital Management LLC boosted its holdings in shares of Semtech by 6.3% during the 3rd quarter. Mutual of America Capital Management LLC now owns 11,285 shares of the semiconductor company's stock valued at $515,000 after acquiring an additional 673 shares in the last quarter. Intech Investment Management LLC boosted its holdings in shares of Semtech by 128.3% during the 3rd quarter. Intech Investment Management LLC now owns 30,521 shares of the semiconductor company's stock valued at $1,394,000 after acquiring an additional 17,150 shares in the last quarter. Assenagon Asset Management S.A. acquired a new stake in shares of Semtech during the 2nd quarter valued at $13,239,000. Natixis Advisors LLC boosted its holdings in shares of Semtech by 100.2% during the 3rd quarter. Natixis Advisors LLC now owns 35,610 shares of the semiconductor company's stock valued at $1,626,000 after acquiring an additional 17,823 shares in the last quarter. Finally, Harbor Capital Advisors Inc. boosted its holdings in shares of Semtech by 135.9% during the 3rd quarter. Harbor Capital Advisors Inc. now owns 42,560 shares of the semiconductor company's stock valued at $1,943,000 after acquiring an additional 24,517 shares in the last quarter.

Semtech Stock Performance

Shares of SMTC stock traded down $3.72 during mid-day trading on Thursday, hitting $65.38. The company's stock had a trading volume of 2,197,731 shares, compared to its average volume of 1,836,623. The company's fifty day simple moving average is $48.51 and its 200-day simple moving average is $40.20. Semtech Co. has a 52 week low of $16.65 and a 52 week high of $70.27. The company has a market cap of $4.92 billion, a PE ratio of -5.01 and a beta of 1.65.

Semtech (NASDAQ:SMTC - Get Free Report) last issued its earnings results on Monday, November 25th. The semiconductor company reported $0.26 EPS for the quarter, beating the consensus estimate of $0.23 by $0.03. The company had revenue of $236.80 million during the quarter, compared to the consensus estimate of $232.89 million. Semtech had a negative return on equity of 154.99% and a negative net margin of 99.08%. The firm's revenue for the quarter was up 17.9% compared to the same quarter last year. During the same period last year, the business posted $0.02 EPS. On average, equities analysts anticipate that Semtech Co. will post -0.02 earnings per share for the current year.

Analyst Upgrades and Downgrades

Several research analysts recently issued reports on SMTC shares. Craig Hallum raised their target price on Semtech from $48.00 to $70.00 and gave the stock a "buy" rating in a research report on Tuesday, November 26th. Needham & Company LLC reaffirmed a "buy" rating and set a $70.00 target price (up from $50.00) on shares of Semtech in a research report on Tuesday, November 26th. Summit Insights lowered Semtech from a "buy" rating to a "hold" rating in a research report on Wednesday, August 28th. Susquehanna raised their target price on Semtech from $55.00 to $60.00 and gave the stock a "positive" rating in a research report on Thursday, November 21st. Finally, Benchmark raised their target price on Semtech from $56.00 to $82.00 and gave the stock a "buy" rating in a research report on Tuesday, November 26th. Three analysts have rated the stock with a hold rating and ten have issued a buy rating to the company. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $67.70.

Get Our Latest Stock Analysis on SMTC

Semtech Company Profile

(

Free Report)

Semtech Corporation designs, develops, manufactures, and markets analog and mixed-signal semiconductor and advanced algorithms. It provides signal integrity products, including a portfolio of optical data communications and video transport products used in various infrastructure, and industrial applications; a portfolio of integrated circuits for data centers, enterprise networks, passive optical networks, wireless base station optical transceivers, and high-speed interface applications; and video products for broadcast applications, as well as video-over-IP technology for professional audio video applications.

Featured Articles

Before you consider Semtech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Semtech wasn't on the list.

While Semtech currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.