Amalgamated Bank trimmed its stake in shares of Jacobs Solutions Inc. (NYSE:J - Free Report) by 19.0% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 25,557 shares of the company's stock after selling 5,987 shares during the quarter. Amalgamated Bank's holdings in Jacobs Solutions were worth $3,345,000 at the end of the most recent reporting period.

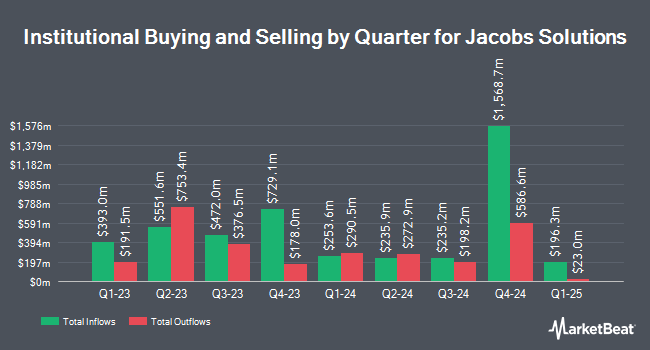

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. Greenwood Capital Associates LLC acquired a new stake in shares of Jacobs Solutions during the third quarter valued at about $2,330,000. Asset Management One Co. Ltd. raised its holdings in Jacobs Solutions by 6.8% in the 3rd quarter. Asset Management One Co. Ltd. now owns 76,308 shares of the company's stock valued at $9,989,000 after buying an additional 4,858 shares during the last quarter. QRG Capital Management Inc. boosted its position in Jacobs Solutions by 1.8% during the 3rd quarter. QRG Capital Management Inc. now owns 66,608 shares of the company's stock worth $8,920,000 after buying an additional 1,172 shares during the period. National Pension Service grew its holdings in Jacobs Solutions by 4.8% during the 3rd quarter. National Pension Service now owns 210,447 shares of the company's stock worth $27,548,000 after acquiring an additional 9,553 shares during the last quarter. Finally, Intact Investment Management Inc. grew its holdings in Jacobs Solutions by 12.4% during the 3rd quarter. Intact Investment Management Inc. now owns 4,360 shares of the company's stock worth $571,000 after acquiring an additional 480 shares during the last quarter. Institutional investors own 85.65% of the company's stock.

Wall Street Analyst Weigh In

Several research firms have recently weighed in on J. StockNews.com cut shares of Jacobs Solutions from a "strong-buy" rating to a "buy" rating in a research report on Thursday, October 31st. Raymond James upgraded Jacobs Solutions from a "market perform" rating to an "outperform" rating and set a $160.00 price target for the company in a report on Friday, October 4th. Royal Bank of Canada boosted their price objective on Jacobs Solutions from $161.00 to $167.00 and gave the company an "outperform" rating in a research note on Wednesday, August 7th. Truist Financial cut their price target on Jacobs Solutions from $158.00 to $139.00 and set a "hold" rating on the stock in a report on Wednesday, October 9th. Finally, Citigroup lifted their price objective on shares of Jacobs Solutions from $138.60 to $166.00 and gave the company a "buy" rating in a research note on Tuesday, October 22nd. Four investment analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company. According to data from MarketBeat, Jacobs Solutions currently has an average rating of "Moderate Buy" and an average price target of $159.30.

Get Our Latest Stock Report on Jacobs Solutions

Insider Activity

In other news, SVP William B. Allen, Jr. sold 1,451 shares of the company's stock in a transaction dated Friday, August 16th. The stock was sold at an average price of $146.51, for a total transaction of $212,586.01. Following the sale, the senior vice president now directly owns 26,699 shares in the company, valued at $3,911,670.49. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. In related news, Director Christopher M.T. Thompson sold 1,898 shares of the company's stock in a transaction that occurred on Thursday, August 29th. The shares were sold at an average price of $150.85, for a total value of $286,313.30. Following the transaction, the director now directly owns 42,069 shares in the company, valued at approximately $6,346,108.65. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, SVP William B. Allen, Jr. sold 1,451 shares of the firm's stock in a transaction that occurred on Friday, August 16th. The shares were sold at an average price of $146.51, for a total transaction of $212,586.01. Following the completion of the sale, the senior vice president now directly owns 26,699 shares in the company, valued at $3,911,670.49. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 7,516 shares of company stock valued at $1,124,533 over the last quarter. Company insiders own 1.00% of the company's stock.

Jacobs Solutions Stock Performance

NYSE:J traded up $1.58 during trading on Friday, reaching $146.43. The company's stock had a trading volume of 850,894 shares, compared to its average volume of 622,362. The firm has a market cap of $18.19 billion, a price-to-earnings ratio of 28.94, a price-to-earnings-growth ratio of 1.49 and a beta of 0.71. The company has a debt-to-equity ratio of 0.31, a quick ratio of 1.14 and a current ratio of 1.14. Jacobs Solutions Inc. has a 12 month low of $100.59 and a 12 month high of $148.89. The firm has a 50 day moving average of $142.98 and a 200-day moving average of $142.61.

Jacobs Solutions Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Friday, November 22nd. Investors of record on Friday, October 25th will be paid a $0.29 dividend. This represents a $1.16 dividend on an annualized basis and a yield of 0.79%. The ex-dividend date of this dividend is Friday, October 25th. Jacobs Solutions's dividend payout ratio is currently 22.92%.

Jacobs Solutions Company Profile

(

Free Report)

Jacobs Solutions Inc provides consulting, technical, engineering, scientific, and project delivery services for the government and private sectors in the United States, Europe, Canada, India, Asia, Australia, New Zealand, the Middle East, and Africa. It operates through Critical Mission Solutions, People & Places Solutions, Divergent Solutions, and PA Consulting segments.

Recommended Stories

Before you consider Jacobs Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jacobs Solutions wasn't on the list.

While Jacobs Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.