Jacobs Solutions (NYSE:J - Get Free Report) issued an update on its FY 2025 earnings guidance on Tuesday morning. The company provided earnings per share guidance of 5.800-6.200 for the period, compared to the consensus earnings per share estimate of 6.150. The company issued revenue guidance of -.

Jacobs Solutions Price Performance

Shares of NYSE:J traded down $6.79 during trading on Tuesday, reaching $133.56. 1,928,093 shares of the company's stock traded hands, compared to its average volume of 805,130. The company has a quick ratio of 1.14, a current ratio of 1.14 and a debt-to-equity ratio of 0.31. Jacobs Solutions has a fifty-two week low of $100.59 and a fifty-two week high of $150.54. The firm has a market cap of $16.59 billion, a PE ratio of 26.40, a P/E/G ratio of 1.57 and a beta of 0.71. The company has a 50-day simple moving average of $142.57 and a 200-day simple moving average of $142.48.

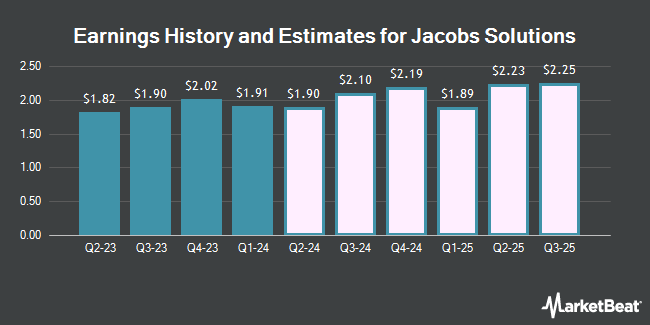

Jacobs Solutions (NYSE:J - Get Free Report) last released its earnings results on Tuesday, November 19th. The company reported $1.37 earnings per share for the quarter, missing analysts' consensus estimates of $2.08 by ($0.71). The business had revenue of $2.96 billion during the quarter, compared to analysts' expectations of $4.50 billion. Jacobs Solutions had a return on equity of 14.76% and a net margin of 3.72%. The company's revenue for the quarter was up 4.4% compared to the same quarter last year. During the same period last year, the business earned $1.90 earnings per share. As a group, analysts predict that Jacobs Solutions will post 7.02 earnings per share for the current year.

Jacobs Solutions Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, November 22nd. Investors of record on Friday, October 25th will be given a $0.29 dividend. The ex-dividend date of this dividend is Friday, October 25th. This represents a $1.16 dividend on an annualized basis and a yield of 0.87%. Jacobs Solutions's dividend payout ratio (DPR) is presently 22.92%.

Analyst Upgrades and Downgrades

Several research analysts have weighed in on J shares. Citigroup upped their target price on shares of Jacobs Solutions from $138.60 to $166.00 and gave the stock a "buy" rating in a research report on Tuesday, October 22nd. Raymond James raised shares of Jacobs Solutions from a "market perform" rating to an "outperform" rating and set a $160.00 price target on the stock in a research note on Friday, October 4th. Truist Financial cut their price target on shares of Jacobs Solutions from $158.00 to $139.00 and set a "hold" rating on the stock in a research note on Wednesday, October 9th. Robert W. Baird cut their price target on shares of Jacobs Solutions from $163.00 to $160.00 and set an "outperform" rating on the stock in a research note on Wednesday, August 7th. Finally, UBS Group increased their price target on shares of Jacobs Solutions from $161.00 to $165.00 and gave the stock a "buy" rating in a research note on Wednesday, August 14th. Four research analysts have rated the stock with a hold rating and nine have issued a buy rating to the stock. According to MarketBeat, Jacobs Solutions has a consensus rating of "Moderate Buy" and an average target price of $159.30.

Get Our Latest Stock Analysis on Jacobs Solutions

Insiders Place Their Bets

In other news, EVP Shelette M. Gustafson sold 4,167 shares of Jacobs Solutions stock in a transaction dated Thursday, August 29th. The shares were sold at an average price of $150.14, for a total value of $625,633.38. Following the completion of the transaction, the executive vice president now directly owns 24,564 shares of the company's stock, valued at approximately $3,688,038.96. The trade was a 14.50 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, Director Christopher M.T. Thompson sold 1,898 shares of Jacobs Solutions stock in a transaction dated Thursday, August 29th. The shares were sold at an average price of $150.85, for a total transaction of $286,313.30. Following the completion of the transaction, the director now directly owns 42,069 shares of the company's stock, valued at $6,346,108.65. This trade represents a 4.32 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.00% of the stock is owned by company insiders.

About Jacobs Solutions

(

Get Free Report)

Jacobs Solutions Inc provides consulting, technical, engineering, scientific, and project delivery services for the government and private sectors in the United States, Europe, Canada, India, Asia, Australia, New Zealand, the Middle East, and Africa. It operates through Critical Mission Solutions, People & Places Solutions, Divergent Solutions, and PA Consulting segments.

See Also

Before you consider Jacobs Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jacobs Solutions wasn't on the list.

While Jacobs Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.