Jane Street Group LLC lifted its stake in shares of F.N.B. Co. (NYSE:FNB - Free Report) by 780.7% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 357,057 shares of the bank's stock after buying an additional 316,515 shares during the period. Jane Street Group LLC owned about 0.10% of F.N.B. worth $5,038,000 as of its most recent SEC filing.

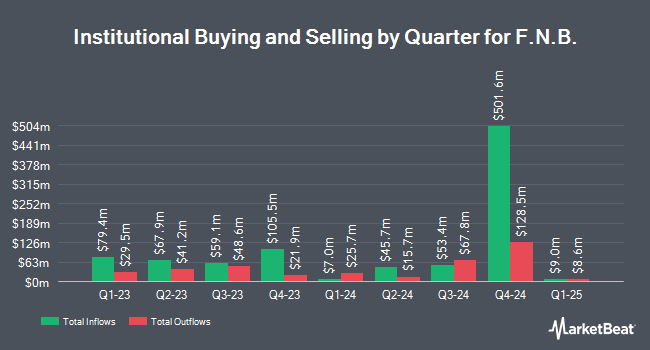

Other institutional investors also recently modified their holdings of the company. Kovitz Investment Group Partners LLC boosted its position in F.N.B. by 60.6% during the third quarter. Kovitz Investment Group Partners LLC now owns 18,242 shares of the bank's stock valued at $246,000 after acquiring an additional 6,880 shares during the last quarter. Wellington Management Group LLP lifted its position in F.N.B. by 1.1% in the 3rd quarter. Wellington Management Group LLP now owns 1,044,815 shares of the bank's stock valued at $14,742,000 after acquiring an additional 11,454 shares in the last quarter. State Street Corp increased its stake in F.N.B. by 1.9% in the 3rd quarter. State Street Corp now owns 15,185,397 shares of the bank's stock valued at $214,266,000 after buying an additional 278,825 shares during the last quarter. Stifel Financial Corp increased its stake in F.N.B. by 6.6% in the 3rd quarter. Stifel Financial Corp now owns 28,669 shares of the bank's stock valued at $405,000 after buying an additional 1,768 shares during the last quarter. Finally, Quantinno Capital Management LP increased its stake in shares of F.N.B. by 10.7% during the 3rd quarter. Quantinno Capital Management LP now owns 133,693 shares of the bank's stock worth $1,886,000 after purchasing an additional 12,939 shares during the last quarter. 79.25% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity at F.N.B.

In other F.N.B. news, CEO Vincent J. Delie, Jr. sold 125,000 shares of the stock in a transaction that occurred on Friday, December 6th. The shares were sold at an average price of $16.50, for a total transaction of $2,062,500.00. Following the sale, the chief executive officer now directly owns 1,652,229 shares in the company, valued at $27,261,778.50. This represents a 7.03 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 1.03% of the stock is owned by corporate insiders.

Wall Street Analyst Weigh In

A number of research analysts recently weighed in on the stock. Raymond James lifted their price objective on shares of F.N.B. from $17.00 to $19.00 and gave the company an "outperform" rating in a research note on Thursday, November 21st. Keefe, Bruyette & Woods lifted their price objective on shares of F.N.B. from $16.00 to $18.00 and gave the stock a "market perform" rating in a report on Wednesday, December 4th. Piper Sandler reaffirmed an "overweight" rating on shares of F.N.B. in a report on Friday, October 18th. Stephens boosted their target price on F.N.B. from $16.00 to $18.00 and gave the company an "overweight" rating in a research note on Monday, October 21st. Finally, Wells Fargo & Company upped their price target on F.N.B. from $16.00 to $19.00 and gave the company an "overweight" rating in a research report on Tuesday, December 3rd. Two analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $17.67.

View Our Latest Analysis on FNB

F.N.B. Stock Performance

Shares of FNB traded down $0.42 during trading hours on Tuesday, reaching $15.41. 3,303,686 shares of the company traded hands, compared to its average volume of 2,223,474. F.N.B. Co. has a 12-month low of $12.49 and a 12-month high of $17.70. The company has a quick ratio of 0.92, a current ratio of 0.93 and a debt-to-equity ratio of 0.40. The stock has a market capitalization of $5.54 billion, a P/E ratio of 14.13 and a beta of 0.99. The business has a fifty day moving average price of $15.69 and a 200-day moving average price of $14.58.

F.N.B. (NYSE:FNB - Get Free Report) last issued its quarterly earnings data on Thursday, October 17th. The bank reported $0.34 earnings per share for the quarter, missing analysts' consensus estimates of $0.36 by ($0.02). The firm had revenue of $413.02 million during the quarter, compared to analyst estimates of $409.80 million. F.N.B. had a return on equity of 8.49% and a net margin of 16.29%. Equities analysts anticipate that F.N.B. Co. will post 1.34 EPS for the current fiscal year.

F.N.B. Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Sunday, December 15th. Investors of record on Monday, December 2nd were paid a dividend of $0.12 per share. The ex-dividend date was Monday, December 2nd. This represents a $0.48 annualized dividend and a yield of 3.12%. F.N.B.'s dividend payout ratio is presently 44.04%.

F.N.B. Company Profile

(

Free Report)

F.N.B. Corporation, a bank and financial holding company, provides a range of financial products and services primarily to consumers, corporations, governments, and small- to medium-sized businesses in the United States. The company operates through three segments: Community Banking, Wealth Management, and Insurance.

Further Reading

Before you consider F.N.B., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and F.N.B. wasn't on the list.

While F.N.B. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.