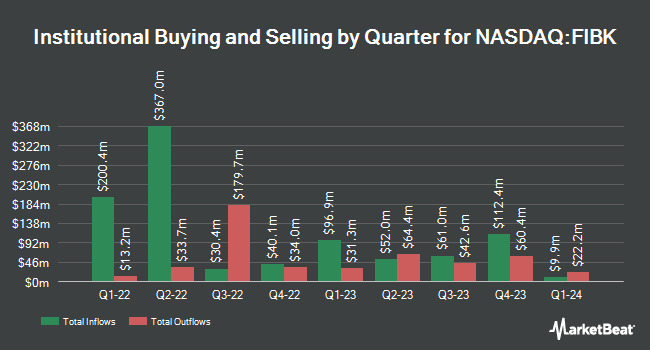

Jane Street Group LLC increased its holdings in First Interstate BancSystem, Inc. (NASDAQ:FIBK - Free Report) by 13.9% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 188,084 shares of the financial services provider's stock after buying an additional 22,899 shares during the period. Jane Street Group LLC owned 0.18% of First Interstate BancSystem worth $5,770,000 as of its most recent filing with the Securities and Exchange Commission.

Other institutional investors have also made changes to their positions in the company. Point72 DIFC Ltd bought a new stake in shares of First Interstate BancSystem during the 3rd quarter valued at $34,000. Point72 Asia Singapore Pte. Ltd. acquired a new stake in First Interstate BancSystem during the third quarter worth about $69,000. CWM LLC increased its holdings in First Interstate BancSystem by 16.0% in the 2nd quarter. CWM LLC now owns 3,123 shares of the financial services provider's stock valued at $87,000 after buying an additional 430 shares during the period. Innealta Capital LLC acquired a new position in shares of First Interstate BancSystem in the 2nd quarter valued at approximately $106,000. Finally, nVerses Capital LLC lifted its holdings in shares of First Interstate BancSystem by 412.5% during the 2nd quarter. nVerses Capital LLC now owns 4,100 shares of the financial services provider's stock worth $114,000 after acquiring an additional 3,300 shares during the period. 88.71% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In related news, Director Jonathan R. Scott sold 6,500 shares of the business's stock in a transaction on Wednesday, November 13th. The shares were sold at an average price of $34.18, for a total value of $222,170.00. Following the transaction, the director now owns 958,710 shares in the company, valued at $32,768,707.80. The trade was a 0.67 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, major shareholder Julie A. Scott sold 20,220 shares of the stock in a transaction dated Friday, November 8th. The stock was sold at an average price of $32.78, for a total value of $662,811.60. Following the sale, the insider now owns 635,069 shares of the company's stock, valued at approximately $20,817,561.82. The trade was a 3.09 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 54,837 shares of company stock valued at $1,839,583. 6.90% of the stock is currently owned by company insiders.

First Interstate BancSystem Trading Up 0.8 %

Shares of NASDAQ:FIBK traded up $0.26 during midday trading on Monday, hitting $34.34. 506,049 shares of the stock were exchanged, compared to its average volume of 673,175. The business's 50-day moving average price is $32.79 and its 200 day moving average price is $30.30. First Interstate BancSystem, Inc. has a 12 month low of $24.16 and a 12 month high of $36.77. The company has a debt-to-equity ratio of 0.71, a quick ratio of 0.78 and a current ratio of 0.78. The stock has a market capitalization of $3.59 billion, a price-to-earnings ratio of 14.88 and a beta of 0.84.

First Interstate BancSystem (NASDAQ:FIBK - Get Free Report) last posted its earnings results on Thursday, October 24th. The financial services provider reported $0.54 earnings per share for the quarter, missing analysts' consensus estimates of $0.58 by ($0.04). First Interstate BancSystem had a return on equity of 7.48% and a net margin of 15.94%. During the same quarter in the prior year, the business earned $0.70 EPS. Analysts predict that First Interstate BancSystem, Inc. will post 2.28 earnings per share for the current year.

First Interstate BancSystem Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Thursday, November 14th. Investors of record on Monday, November 4th were given a dividend of $0.47 per share. This represents a $1.88 annualized dividend and a yield of 5.47%. The ex-dividend date was Monday, November 4th. First Interstate BancSystem's dividend payout ratio is currently 82.46%.

Analyst Ratings Changes

Several research analysts have commented on FIBK shares. Barclays boosted their price objective on shares of First Interstate BancSystem from $30.00 to $31.00 and gave the company an "underweight" rating in a research report on Thursday, December 5th. StockNews.com raised First Interstate BancSystem from a "sell" rating to a "hold" rating in a report on Thursday, November 28th. Piper Sandler reduced their price objective on First Interstate BancSystem from $38.00 to $36.00 and set an "overweight" rating on the stock in a research note on Monday, October 28th. DA Davidson raised First Interstate BancSystem from a "neutral" rating to a "buy" rating and boosted their target price for the stock from $32.00 to $42.00 in a research note on Tuesday, November 26th. Finally, Wells Fargo & Company raised their price target on shares of First Interstate BancSystem from $28.00 to $30.00 and gave the company an "underweight" rating in a research note on Tuesday, December 3rd. Two investment analysts have rated the stock with a sell rating, two have assigned a hold rating and three have given a buy rating to the stock. According to MarketBeat, the company presently has an average rating of "Hold" and a consensus target price of $35.17.

Read Our Latest Research Report on FIBK

First Interstate BancSystem Company Profile

(

Free Report)

First Interstate BancSystem, Inc operates as the bank holding company for First Interstate Bank that provides range of banking products and services in the United States. It offers various traditional depository products, including checking, savings, and time deposits; and repurchase agreements primarily for commercial and municipal depositors.

Featured Articles

Before you consider First Interstate BancSystem, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Interstate BancSystem wasn't on the list.

While First Interstate BancSystem currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.