Jane Street Group LLC increased its position in shares of Ingredion Incorporated (NYSE:INGR - Free Report) by 375.4% in the third quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 38,363 shares of the company's stock after buying an additional 30,294 shares during the quarter. Jane Street Group LLC owned 0.06% of Ingredion worth $5,272,000 as of its most recent SEC filing.

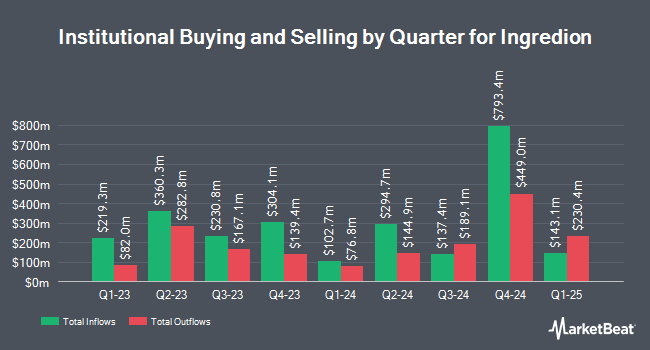

Other hedge funds have also modified their holdings of the company. Dimensional Fund Advisors LP boosted its stake in shares of Ingredion by 4.9% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,685,339 shares of the company's stock worth $308,009,000 after acquiring an additional 125,543 shares during the period. State Street Corp boosted its stake in shares of Ingredion by 0.8% during the 3rd quarter. State Street Corp now owns 2,436,601 shares of the company's stock worth $334,862,000 after acquiring an additional 19,560 shares during the period. Pacer Advisors Inc. boosted its stake in shares of Ingredion by 92.4% during the 2nd quarter. Pacer Advisors Inc. now owns 1,764,012 shares of the company's stock worth $202,332,000 after acquiring an additional 846,967 shares during the period. Massachusetts Financial Services Co. MA boosted its stake in shares of Ingredion by 2.4% during the 3rd quarter. Massachusetts Financial Services Co. MA now owns 1,539,179 shares of the company's stock worth $211,529,000 after acquiring an additional 36,421 shares during the period. Finally, Cooke & Bieler LP boosted its stake in shares of Ingredion by 2.7% during the 2nd quarter. Cooke & Bieler LP now owns 1,018,002 shares of the company's stock worth $116,765,000 after acquiring an additional 27,087 shares during the period. 85.27% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several research firms recently weighed in on INGR. Stephens raised Ingredion to a "hold" rating in a report on Monday, December 2nd. BMO Capital Markets lifted their price target on Ingredion from $128.00 to $147.00 and gave the stock a "market perform" rating in a report on Wednesday, November 6th. UBS Group lifted their price target on Ingredion from $165.00 to $173.00 and gave the stock a "buy" rating in a report on Friday, November 15th. Barclays lifted their price target on Ingredion from $145.00 to $168.00 and gave the stock an "overweight" rating in a report on Wednesday, November 6th. Finally, Oppenheimer lifted their price objective on Ingredion from $147.00 to $178.00 and gave the company an "outperform" rating in a report on Wednesday, November 6th. Two investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $155.17.

Check Out Our Latest Research Report on Ingredion

Insider Buying and Selling

In other Ingredion news, CEO James P. Zallie sold 371 shares of the company's stock in a transaction dated Thursday, October 10th. The stock was sold at an average price of $133.58, for a total value of $49,558.18. Following the sale, the chief executive officer now owns 52,159 shares in the company, valued at approximately $6,967,399.22. The trade was a 0.71 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, SVP Larry Fernandes sold 6,122 shares of the business's stock in a transaction dated Friday, November 15th. The shares were sold at an average price of $140.66, for a total value of $861,120.52. Following the completion of the transaction, the senior vice president now directly owns 29,034 shares in the company, valued at $4,083,922.44. This represents a 17.41 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 66,198 shares of company stock worth $9,702,461 in the last 90 days. Insiders own 1.80% of the company's stock.

Ingredion Price Performance

NYSE INGR traded down $0.82 during midday trading on Tuesday, hitting $142.16. The company had a trading volume of 458,258 shares, compared to its average volume of 391,312. Ingredion Incorporated has a twelve month low of $105.78 and a twelve month high of $155.44. The firm has a 50-day moving average price of $141.76 and a 200-day moving average price of $130.80. The company has a current ratio of 2.67, a quick ratio of 1.69 and a debt-to-equity ratio of 0.44. The company has a market capitalization of $9.26 billion, a PE ratio of 13.88, a P/E/G ratio of 1.24 and a beta of 0.74.

Ingredion (NYSE:INGR - Get Free Report) last issued its quarterly earnings results on Tuesday, November 5th. The company reported $3.05 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.58 by $0.47. Ingredion had a return on equity of 17.75% and a net margin of 9.05%. The company had revenue of $1.87 billion for the quarter, compared to analyst estimates of $1.94 billion. During the same quarter last year, the company posted $2.33 EPS. The company's revenue for the quarter was down 8.0% compared to the same quarter last year. As a group, analysts anticipate that Ingredion Incorporated will post 10.59 earnings per share for the current fiscal year.

Ingredion Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, January 21st. Stockholders of record on Thursday, January 2nd will be paid a $0.80 dividend. The ex-dividend date of this dividend is Thursday, January 2nd. This represents a $3.20 annualized dividend and a dividend yield of 2.25%. Ingredion's payout ratio is 31.22%.

Ingredion Company Profile

(

Free Report)

Ingredion Incorporated, together with its subsidiaries, manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries in North America, South America, the Asia Pacific, Europe, the Middle East, and Africa.

Featured Stories

Before you consider Ingredion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ingredion wasn't on the list.

While Ingredion currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.