Jane Street Group LLC decreased its stake in Hub Group, Inc. (NASDAQ:HUBG - Free Report) by 48.4% in the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 96,643 shares of the transportation company's stock after selling 90,633 shares during the quarter. Jane Street Group LLC owned about 0.16% of Hub Group worth $4,392,000 at the end of the most recent reporting period.

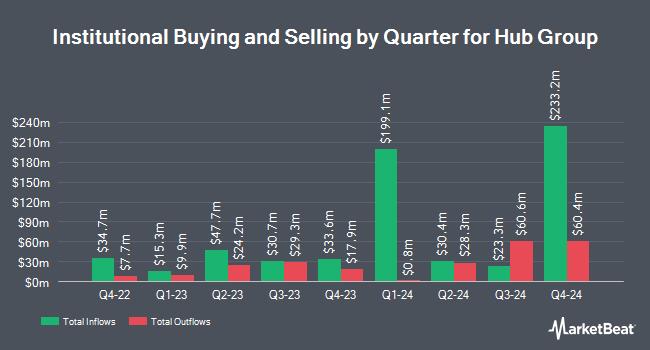

Other large investors have also recently modified their holdings of the company. State Street Corp lifted its position in Hub Group by 0.8% in the third quarter. State Street Corp now owns 2,489,503 shares of the transportation company's stock worth $113,148,000 after buying an additional 20,215 shares during the last quarter. Pacer Advisors Inc. lifted its holdings in shares of Hub Group by 0.4% in the 2nd quarter. Pacer Advisors Inc. now owns 2,356,564 shares of the transportation company's stock worth $101,450,000 after acquiring an additional 8,700 shares during the last quarter. Select Equity Group L.P. boosted its stake in shares of Hub Group by 19.4% during the 2nd quarter. Select Equity Group L.P. now owns 1,836,354 shares of the transportation company's stock worth $79,055,000 after purchasing an additional 298,390 shares during the period. American Century Companies Inc. boosted its stake in shares of Hub Group by 6.1% during the 2nd quarter. American Century Companies Inc. now owns 1,322,166 shares of the transportation company's stock worth $56,919,000 after purchasing an additional 76,431 shares during the period. Finally, Principal Financial Group Inc. grew its holdings in Hub Group by 14.3% during the 3rd quarter. Principal Financial Group Inc. now owns 783,456 shares of the transportation company's stock valued at $35,608,000 after purchasing an additional 97,768 shares during the last quarter. Institutional investors own 46.77% of the company's stock.

Hub Group Stock Down 4.1 %

Hub Group stock traded down $1.98 during midday trading on Wednesday, hitting $46.08. 407,995 shares of the company's stock were exchanged, compared to its average volume of 465,910. The company has a debt-to-equity ratio of 0.12, a quick ratio of 1.30 and a current ratio of 1.30. The company has a market cap of $2.83 billion, a PE ratio of 26.18 and a beta of 0.92. The firm has a 50-day moving average of $47.69 and a two-hundred day moving average of $45.26. Hub Group, Inc. has a 12 month low of $38.07 and a 12 month high of $53.21.

Hub Group (NASDAQ:HUBG - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The transportation company reported $0.52 earnings per share for the quarter, topping the consensus estimate of $0.49 by $0.03. The firm had revenue of $986.89 million during the quarter, compared to analysts' expectations of $1.06 billion. Hub Group had a net margin of 2.74% and a return on equity of 7.44%. The company's revenue was down 3.7% compared to the same quarter last year. During the same quarter in the prior year, the company earned $0.49 EPS. As a group, analysts expect that Hub Group, Inc. will post 1.91 earnings per share for the current fiscal year.

Hub Group Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, December 20th. Stockholders of record on Friday, December 6th will be issued a $0.125 dividend. The ex-dividend date of this dividend is Friday, December 6th. This represents a $0.50 dividend on an annualized basis and a dividend yield of 1.09%. Hub Group's dividend payout ratio is presently 28.41%.

Analysts Set New Price Targets

Several analysts have issued reports on HUBG shares. Susquehanna decreased their price objective on shares of Hub Group from $50.00 to $48.00 and set a "neutral" rating for the company in a research note on Friday, November 1st. Evercore ISI raised their price target on Hub Group from $41.00 to $43.00 and gave the stock an "in-line" rating in a research note on Thursday, October 3rd. TD Cowen upped their price objective on Hub Group from $43.00 to $49.00 and gave the company a "hold" rating in a research report on Thursday, October 31st. Benchmark reiterated a "buy" rating and set a $47.00 target price on shares of Hub Group in a research report on Friday, November 1st. Finally, Barclays boosted their target price on shares of Hub Group from $42.00 to $52.00 and gave the company an "equal weight" rating in a research note on Wednesday, November 13th. Ten equities research analysts have rated the stock with a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat, Hub Group currently has an average rating of "Hold" and a consensus target price of $46.83.

Get Our Latest Research Report on Hub Group

Hub Group Profile

(

Free Report)

Hub Group, Inc, a supply chain solutions provider, offers transportation and logistics management services in North America. The company's transportation services include intermodal, truckload, less-than-truckload, flatbed, temperature-controlled, and dedicated and regional trucking, as well as final mile, railcar, small parcel, and international transportation.

Read More

Before you consider Hub Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hub Group wasn't on the list.

While Hub Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.