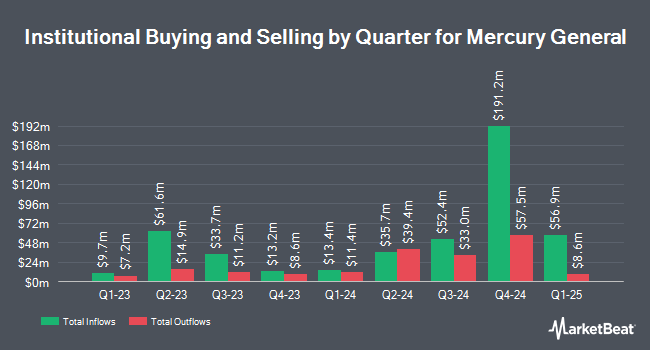

Jane Street Group LLC grew its stake in Mercury General Co. (NYSE:MCY - Free Report) by 60.4% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 72,573 shares of the insurance provider's stock after purchasing an additional 27,327 shares during the period. Jane Street Group LLC owned about 0.13% of Mercury General worth $4,571,000 at the end of the most recent quarter.

Several other institutional investors have also recently made changes to their positions in MCY. Point72 Asset Management L.P. purchased a new position in shares of Mercury General in the 3rd quarter valued at about $13,068,000. Assenagon Asset Management S.A. increased its position in shares of Mercury General by 607.5% in the third quarter. Assenagon Asset Management S.A. now owns 214,427 shares of the insurance provider's stock valued at $13,505,000 after buying an additional 184,121 shares in the last quarter. Phase 2 Partners LLC raised its stake in shares of Mercury General by 142.1% during the 3rd quarter. Phase 2 Partners LLC now owns 273,955 shares of the insurance provider's stock worth $17,254,000 after buying an additional 160,808 shares during the period. Hennessy Advisors Inc. acquired a new position in shares of Mercury General during the 2nd quarter worth approximately $8,492,000. Finally, Philadelphia Financial Management of San Francisco LLC purchased a new position in shares of Mercury General during the 3rd quarter valued at approximately $8,243,000. 42.39% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Mercury General news, VP Heidi C. Sullivan sold 1,076 shares of the firm's stock in a transaction that occurred on Tuesday, December 3rd. The shares were sold at an average price of $77.28, for a total value of $83,153.28. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. 35.50% of the stock is currently owned by corporate insiders.

Mercury General Price Performance

Shares of MCY traded down $3.15 during mid-day trading on Wednesday, hitting $67.41. 324,400 shares of the company were exchanged, compared to its average volume of 237,461. The stock has a market cap of $3.73 billion, a price-to-earnings ratio of 6.68 and a beta of 0.84. Mercury General Co. has a 1-year low of $36.96 and a 1-year high of $80.72. The company has a 50 day moving average of $71.83 and a 200-day moving average of $63.05. The company has a debt-to-equity ratio of 0.31, a quick ratio of 0.33 and a current ratio of 0.33.

Mercury General (NYSE:MCY - Get Free Report) last announced its earnings results on Tuesday, October 29th. The insurance provider reported $2.54 EPS for the quarter, beating analysts' consensus estimates of $1.15 by $1.39. The business had revenue of $1.53 billion during the quarter, compared to analysts' expectations of $1.37 billion. Mercury General had a return on equity of 18.04% and a net margin of 10.18%. During the same quarter in the prior year, the firm earned $1.14 earnings per share. Analysts expect that Mercury General Co. will post 6.35 EPS for the current fiscal year.

Mercury General Cuts Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, December 26th. Shareholders of record on Thursday, December 12th will be issued a $0.317 dividend. The ex-dividend date of this dividend is Thursday, December 12th. This represents a $1.27 dividend on an annualized basis and a yield of 1.88%. Mercury General's payout ratio is currently 12.59%.

Analyst Ratings Changes

Separately, StockNews.com cut shares of Mercury General from a "strong-buy" rating to a "buy" rating in a research report on Wednesday.

Get Our Latest Stock Analysis on MCY

Mercury General Profile

(

Free Report)

Mercury General Corporation, together with its subsidiaries, engages in writing personal automobile insurance in the United States. The company also writes homeowners, commercial automobile, commercial property, mechanical protection, and umbrella insurance products. Its automobile insurance products include collision, property damage, bodily injury, comprehensive, personal injury protection, underinsured and uninsured motorist, and other hazards; and homeowners insurance products comprise dwelling, liability, personal property, and other coverages.

Featured Articles

Before you consider Mercury General, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mercury General wasn't on the list.

While Mercury General currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.