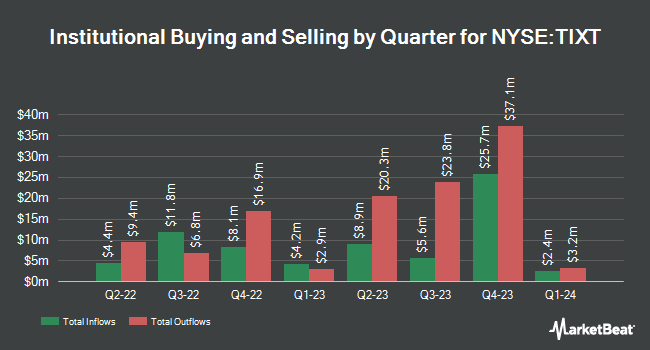

Jane Street Group LLC acquired a new stake in shares of TELUS International (Cda) Inc. (NYSE:TIXT - Free Report) during the third quarter, according to its most recent filing with the SEC. The fund acquired 832,953 shares of the company's stock, valued at approximately $3,257,000. Jane Street Group LLC owned 0.78% of TELUS International (Cda) as of its most recent filing with the SEC.

Other institutional investors have also added to or reduced their stakes in the company. QV Investors Inc. lifted its stake in TELUS International (Cda) by 398.0% in the 3rd quarter. QV Investors Inc. now owns 6,011,720 shares of the company's stock worth $23,496,000 after purchasing an additional 4,804,521 shares in the last quarter. Horrell Capital Management Inc. bought a new stake in TELUS International (Cda) during the third quarter valued at $2,248,000. Mackenzie Financial Corp grew its position in TELUS International (Cda) by 5.9% during the second quarter. Mackenzie Financial Corp now owns 8,440,050 shares of the company's stock worth $48,744,000 after buying an additional 472,103 shares in the last quarter. Northwest & Ethical Investments L.P. increased its stake in TELUS International (Cda) by 256.5% in the 3rd quarter. Northwest & Ethical Investments L.P. now owns 1,821,074 shares of the company's stock worth $7,110,000 after acquiring an additional 1,310,287 shares during the last quarter. Finally, National Bank of Canada FI increased its stake in TELUS International (Cda) by 971.6% in the 2nd quarter. National Bank of Canada FI now owns 75,443 shares of the company's stock worth $441,000 after acquiring an additional 68,403 shares during the last quarter. Hedge funds and other institutional investors own 59.55% of the company's stock.

TELUS International (Cda) Trading Up 2.0 %

Shares of TIXT stock traded up $0.07 on Friday, hitting $3.64. 688,865 shares of the company's stock traded hands, compared to its average volume of 331,063. The company has a debt-to-equity ratio of 0.72, a quick ratio of 1.02 and a current ratio of 1.02. The stock has a market capitalization of $1.00 billion, a price-to-earnings ratio of -72.80, a P/E/G ratio of 1.22 and a beta of 0.70. The company's fifty day simple moving average is $3.80 and its 200 day simple moving average is $4.39. TELUS International has a one year low of $2.83 and a one year high of $11.51.

TELUS International (Cda) (NYSE:TIXT - Get Free Report) last announced its quarterly earnings data on Friday, November 8th. The company reported $0.05 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.02 by $0.03. TELUS International (Cda) had a return on equity of 9.67% and a net margin of 1.17%. The firm had revenue of $658.00 million for the quarter, compared to analysts' expectations of $650.10 million. During the same period last year, the firm earned $0.19 earnings per share. Equities analysts forecast that TELUS International will post 0.43 EPS for the current year.

Wall Street Analysts Forecast Growth

Separately, Desjardins raised TELUS International (Cda) to a "hold" rating in a report on Thursday, September 26th. Two equities research analysts have rated the stock with a sell rating, thirteen have given a hold rating and one has assigned a buy rating to the company's stock. According to MarketBeat.com, TELUS International (Cda) has a consensus rating of "Hold" and an average price target of $7.37.

Check Out Our Latest Report on TIXT

About TELUS International (Cda)

(

Free Report)

TELUS International (Cda) Inc design, builds, and delivers digital solutions for customer experience (CX) in the Asia-Pacific, the Central America, Europe, Africa, North America, and internationally. The company provides digital experience solutions, such as AI and bots, omnichannel CX, enterprise mobility solutions, cloud contact center, big data analytics, platform transformation, and UX/UI design; and customer experience solutions, including work anywhere/work from home, contact center outsourcing, technical support, sales growth and customer retention, healthcare/patient experience, and debt collection.

Read More

Before you consider TELUS International (Cda), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TELUS International (Cda) wasn't on the list.

While TELUS International (Cda) currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.