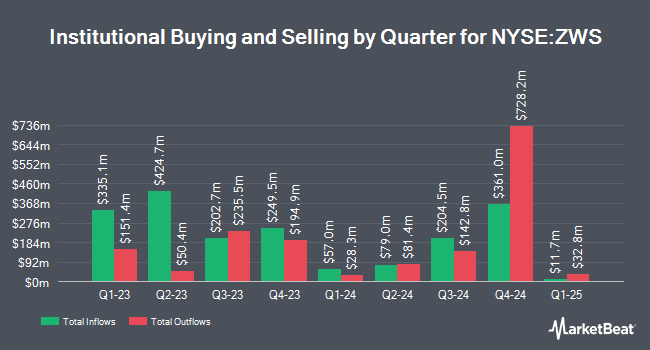

Jane Street Group LLC lowered its position in shares of Zurn Elkay Water Solutions Co. (NYSE:ZWS - Free Report) by 61.5% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 91,487 shares of the company's stock after selling 146,065 shares during the period. Jane Street Group LLC owned 0.05% of Zurn Elkay Water Solutions worth $3,288,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors have also bought and sold shares of ZWS. Quarry LP boosted its position in shares of Zurn Elkay Water Solutions by 178.7% during the 2nd quarter. Quarry LP now owns 836 shares of the company's stock valued at $25,000 after acquiring an additional 536 shares during the last quarter. Tortoise Investment Management LLC lifted its position in Zurn Elkay Water Solutions by 76.7% during the second quarter. Tortoise Investment Management LLC now owns 859 shares of the company's stock valued at $25,000 after purchasing an additional 373 shares during the last quarter. International Assets Investment Management LLC purchased a new position in Zurn Elkay Water Solutions in the 2nd quarter worth approximately $29,000. V Square Quantitative Management LLC bought a new position in shares of Zurn Elkay Water Solutions in the 3rd quarter worth $36,000. Finally, Whittier Trust Co. of Nevada Inc. raised its position in shares of Zurn Elkay Water Solutions by 732.4% during the 2nd quarter. Whittier Trust Co. of Nevada Inc. now owns 1,440 shares of the company's stock valued at $42,000 after buying an additional 1,267 shares in the last quarter. Institutional investors own 83.33% of the company's stock.

Zurn Elkay Water Solutions Trading Up 0.9 %

Shares of NYSE ZWS traded up $0.33 during midday trading on Friday, reaching $37.48. The company had a trading volume of 3,747,659 shares, compared to its average volume of 1,101,397. The stock has a market cap of $6.36 billion, a PE ratio of 47.44, a price-to-earnings-growth ratio of 2.02 and a beta of 1.14. Zurn Elkay Water Solutions Co. has a one year low of $27.55 and a one year high of $41.15. The firm's fifty day moving average price is $38.56 and its 200-day moving average price is $34.16. The company has a quick ratio of 1.71, a current ratio of 2.70 and a debt-to-equity ratio of 0.31.

Zurn Elkay Water Solutions (NYSE:ZWS - Get Free Report) last announced its quarterly earnings data on Tuesday, October 29th. The company reported $0.34 earnings per share for the quarter, beating the consensus estimate of $0.32 by $0.02. Zurn Elkay Water Solutions had a return on equity of 13.30% and a net margin of 8.87%. The firm had revenue of $410.00 million during the quarter, compared to the consensus estimate of $406.15 million. During the same quarter in the previous year, the company posted $0.29 earnings per share. The business's revenue was up 2.9% on a year-over-year basis. On average, equities research analysts anticipate that Zurn Elkay Water Solutions Co. will post 1.24 earnings per share for the current year.

Zurn Elkay Water Solutions Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, December 6th. Shareholders of record on Wednesday, November 20th were issued a $0.09 dividend. This represents a $0.36 dividend on an annualized basis and a yield of 0.96%. The ex-dividend date was Wednesday, November 20th. This is a positive change from Zurn Elkay Water Solutions's previous quarterly dividend of $0.08. Zurn Elkay Water Solutions's dividend payout ratio (DPR) is 45.57%.

Insider Buying and Selling at Zurn Elkay Water Solutions

In other Zurn Elkay Water Solutions news, CEO Todd A. Adams sold 120,000 shares of the company's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $39.83, for a total value of $4,779,600.00. Following the completion of the transaction, the chief executive officer now directly owns 2,242,867 shares in the company, valued at approximately $89,333,392.61. This represents a 5.08 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, VP Jeffrey J. Lavalle sold 3,132 shares of the firm's stock in a transaction dated Thursday, November 7th. The stock was sold at an average price of $39.15, for a total transaction of $122,617.80. Following the completion of the sale, the vice president now directly owns 35,422 shares of the company's stock, valued at approximately $1,386,771.30. This represents a 8.12 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 147,202 shares of company stock worth $5,813,358. 3.00% of the stock is currently owned by company insiders.

Wall Street Analysts Forecast Growth

ZWS has been the topic of a number of research analyst reports. Robert W. Baird increased their target price on Zurn Elkay Water Solutions from $37.00 to $39.00 and gave the company a "neutral" rating in a research note on Thursday, October 31st. Stifel Nicolaus increased their price objective on Zurn Elkay Water Solutions from $36.00 to $38.00 and gave the company a "hold" rating in a research report on Wednesday, December 11th. Mizuho boosted their target price on Zurn Elkay Water Solutions from $34.00 to $37.00 and gave the stock a "neutral" rating in a research report on Thursday, October 31st. Finally, Oppenheimer upped their target price on Zurn Elkay Water Solutions from $37.00 to $40.00 and gave the stock an "outperform" rating in a research note on Tuesday, October 22nd. Three research analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $38.50.

View Our Latest Research Report on ZWS

Zurn Elkay Water Solutions Company Profile

(

Free Report)

Zurn Elkay Water Solutions Corporation engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally. It offers water safety and control products, such as backflow preventers, fire system valves, pressure reducing valves, thermostatic mixing valves, PEX pipings, fittings, and installation tools under the Zurn and Wilkins brand names.

Further Reading

Before you consider Zurn Elkay Water Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zurn Elkay Water Solutions wasn't on the list.

While Zurn Elkay Water Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.