Janney Montgomery Scott LLC boosted its position in shares of Twilio Inc. (NYSE:TWLO - Free Report) by 56.1% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The firm owned 30,463 shares of the technology company's stock after buying an additional 10,954 shares during the quarter. Janney Montgomery Scott LLC's holdings in Twilio were worth $1,987,000 at the end of the most recent reporting period.

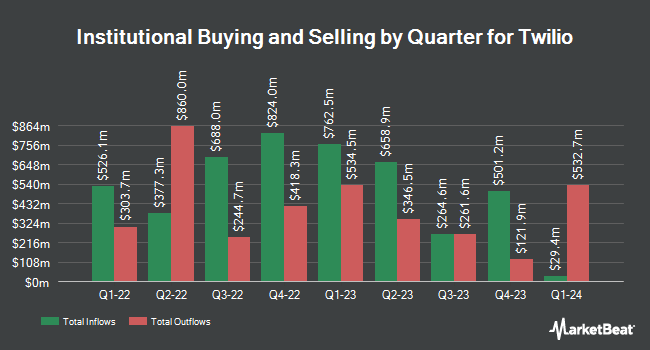

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in TWLO. Empowered Funds LLC grew its position in Twilio by 17.3% during the first quarter. Empowered Funds LLC now owns 7,526 shares of the technology company's stock valued at $460,000 after buying an additional 1,108 shares during the period. Illinois Municipal Retirement Fund acquired a new stake in shares of Twilio in the first quarter valued at about $507,000. Forsta AP Fonden grew its position in shares of Twilio by 17.4% in the first quarter. Forsta AP Fonden now owns 37,100 shares of the technology company's stock valued at $2,269,000 after purchasing an additional 5,500 shares during the period. Sei Investments Co. grew its position in shares of Twilio by 2.2% in the first quarter. Sei Investments Co. now owns 17,842 shares of the technology company's stock valued at $1,091,000 after purchasing an additional 378 shares during the period. Finally, Avantax Advisory Services Inc. grew its position in shares of Twilio by 59.7% in the first quarter. Avantax Advisory Services Inc. now owns 13,550 shares of the technology company's stock valued at $829,000 after purchasing an additional 5,063 shares during the period. Institutional investors and hedge funds own 84.27% of the company's stock.

Twilio Trading Up 3.5 %

Shares of Twilio stock traded up $3.40 on Wednesday, reaching $99.87. The company had a trading volume of 4,711,867 shares, compared to its average volume of 2,699,187. The firm's 50 day moving average price is $69.98 and its two-hundred day moving average price is $62.73. The firm has a market cap of $15.32 billion, a PE ratio of -38.85, a PEG ratio of 2.79 and a beta of 1.32. Twilio Inc. has a 52-week low of $52.51 and a 52-week high of $100.07. The company has a debt-to-equity ratio of 0.12, a quick ratio of 5.06 and a current ratio of 5.06.

Analysts Set New Price Targets

Several analysts have recently issued reports on TWLO shares. Mizuho lifted their target price on shares of Twilio from $60.00 to $70.00 and gave the company a "neutral" rating in a research report on Thursday, October 31st. Wells Fargo & Company upgraded shares of Twilio from an "equal weight" rating to an "overweight" rating and lifted their target price for the company from $80.00 to $120.00 in a research report on Tuesday. StockNews.com upgraded shares of Twilio from a "hold" rating to a "buy" rating in a research report on Friday, September 13th. Jefferies Financial Group raised their price target on shares of Twilio from $60.00 to $85.00 and gave the stock a "hold" rating in a research note on Thursday, October 31st. Finally, Morgan Stanley raised their price target on shares of Twilio from $70.00 to $77.00 and gave the stock an "equal weight" rating in a research note on Thursday, October 31st. Two investment analysts have rated the stock with a sell rating, eleven have assigned a hold rating and ten have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $81.36.

View Our Latest Report on TWLO

Insider Activity

In other news, CEO Khozema Shipchandler sold 11,073 shares of the business's stock in a transaction that occurred on Monday, September 30th. The shares were sold at an average price of $65.03, for a total value of $720,077.19. Following the sale, the chief executive officer now directly owns 278,134 shares of the company's stock, valued at approximately $18,087,054.02. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. In related news, insider Dana Wagner sold 1,989 shares of Twilio stock in a transaction that occurred on Thursday, August 15th. The shares were sold at an average price of $60.69, for a total value of $120,712.41. Following the completion of the transaction, the insider now owns 157,328 shares in the company, valued at approximately $9,548,236.32. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CEO Khozema Shipchandler sold 11,073 shares of Twilio stock in a transaction that occurred on Monday, September 30th. The shares were sold at an average price of $65.03, for a total transaction of $720,077.19. Following the completion of the transaction, the chief executive officer now owns 278,134 shares of the company's stock, valued at $18,087,054.02. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 56,418 shares of company stock valued at $3,749,556. Company insiders own 4.50% of the company's stock.

About Twilio

(

Free Report)

Twilio Inc, together with its subsidiaries, provides customer engagement platform solutions in the United States and internationally. It operates through two segments, Twilio Communications and Twilio Segment. The company provides various application programming interfaces and software solutions for communications between customers and end users, including messaging, voice, email, flex, marketing campaigns, and user identity and authentication.

Further Reading

Before you consider Twilio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Twilio wasn't on the list.

While Twilio currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.