Janney Montgomery Scott LLC acquired a new stake in BellRing Brands, Inc. (NYSE:BRBR - Free Report) during the fourth quarter, according to its most recent 13F filing with the SEC. The fund acquired 14,123 shares of the company's stock, valued at approximately $1,064,000.

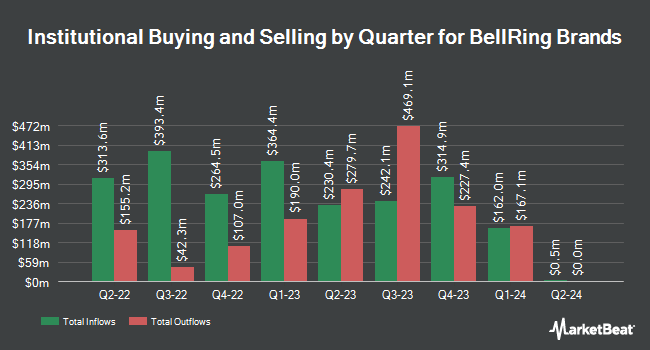

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Creative Planning grew its holdings in BellRing Brands by 10.3% during the 2nd quarter. Creative Planning now owns 22,121 shares of the company's stock valued at $1,264,000 after buying an additional 2,072 shares in the last quarter. Handelsbanken Fonder AB grew its holdings in BellRing Brands by 13.1% during the 3rd quarter. Handelsbanken Fonder AB now owns 35,480 shares of the company's stock valued at $2,154,000 after buying an additional 4,100 shares in the last quarter. CWM LLC grew its holdings in BellRing Brands by 264.3% during the 3rd quarter. CWM LLC now owns 3,927 shares of the company's stock valued at $238,000 after buying an additional 2,849 shares in the last quarter. Carnegie Investment Counsel grew its holdings in BellRing Brands by 17.8% during the 3rd quarter. Carnegie Investment Counsel now owns 55,667 shares of the company's stock valued at $3,380,000 after buying an additional 8,423 shares in the last quarter. Finally, Exchange Traded Concepts LLC grew its holdings in BellRing Brands by 19.1% during the 3rd quarter. Exchange Traded Concepts LLC now owns 13,103 shares of the company's stock valued at $796,000 after buying an additional 2,097 shares in the last quarter. 94.97% of the stock is currently owned by institutional investors.

BellRing Brands Trading Down 1.0 %

BRBR stock traded down $0.78 during midday trading on Friday, hitting $76.49. The company had a trading volume of 663,201 shares, compared to its average volume of 1,229,046. BellRing Brands, Inc. has a 52 week low of $48.06 and a 52 week high of $80.67. The stock's 50 day moving average price is $75.91 and its 200 day moving average price is $66.68. The stock has a market cap of $9.85 billion, a price-to-earnings ratio of 35.91, a PEG ratio of 2.34 and a beta of 0.86.

BellRing Brands (NYSE:BRBR - Get Free Report) last announced its quarterly earnings data on Monday, February 3rd. The company reported $0.58 earnings per share for the quarter, beating the consensus estimate of $0.47 by $0.11. BellRing Brands had a negative return on equity of 130.14% and a net margin of 13.32%. Analysts predict that BellRing Brands, Inc. will post 2.23 earnings per share for the current year.

Wall Street Analyst Weigh In

Several brokerages have recently commented on BRBR. Citigroup boosted their price objective on BellRing Brands from $83.00 to $90.00 and gave the stock a "buy" rating in a report on Wednesday, January 29th. Evercore ISI boosted their price objective on BellRing Brands from $70.00 to $78.00 and gave the stock an "outperform" rating in a report on Wednesday, November 20th. DA Davidson reissued a "neutral" rating and set a $75.00 price objective on shares of BellRing Brands in a report on Tuesday, November 19th. Barclays boosted their price objective on BellRing Brands from $79.00 to $85.00 and gave the stock an "overweight" rating in a report on Tuesday, February 4th. Finally, Bank of America boosted their price objective on BellRing Brands from $75.00 to $82.00 and gave the stock a "buy" rating in a report on Wednesday, November 20th. Three research analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $77.87.

Read Our Latest Research Report on BellRing Brands

About BellRing Brands

(

Free Report)

BellRing Brands, Inc, together with its subsidiaries, provides various nutrition products in the United States. The company offers ready-to-drink (RTD) protein shakes, other RTD beverages, powders, nutrition bars, and other products primarily under the Premier Protein and Dymatize brands. It distributes its products through club, food, drug, mass, eCommerce, specialty, and convenience channels.

Recommended Stories

Before you consider BellRing Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BellRing Brands wasn't on the list.

While BellRing Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.