Janney Montgomery Scott LLC boosted its stake in shares of HCA Healthcare, Inc. (NYSE:HCA - Free Report) by 18.1% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 18,087 shares of the company's stock after buying an additional 2,766 shares during the quarter. Janney Montgomery Scott LLC's holdings in HCA Healthcare were worth $7,351,000 as of its most recent SEC filing.

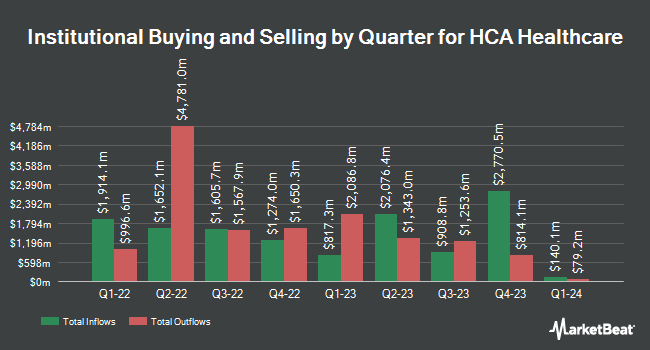

A number of other hedge funds also recently made changes to their positions in HCA. Optas LLC raised its stake in HCA Healthcare by 23.0% during the third quarter. Optas LLC now owns 785 shares of the company's stock worth $319,000 after buying an additional 147 shares during the last quarter. Lmcg Investments LLC acquired a new position in shares of HCA Healthcare in the 3rd quarter valued at about $225,000. Farther Finance Advisors LLC increased its holdings in HCA Healthcare by 28.3% in the third quarter. Farther Finance Advisors LLC now owns 1,157 shares of the company's stock worth $470,000 after purchasing an additional 255 shares in the last quarter. Capital Advisors Inc. OK boosted its holdings in shares of HCA Healthcare by 4.8% during the 3rd quarter. Capital Advisors Inc. OK now owns 1,172 shares of the company's stock worth $476,000 after buying an additional 54 shares in the last quarter. Finally, Stephens Inc. AR lifted its position in shares of HCA Healthcare by 1.0% during the 3rd quarter. Stephens Inc. AR now owns 8,852 shares of the company's stock valued at $3,598,000 after acquiring an additional 91 shares during the period. 62.73% of the stock is currently owned by institutional investors.

HCA Healthcare Stock Performance

HCA stock traded down $1.87 during mid-day trading on Friday, hitting $354.16. The company had a trading volume of 1,252,655 shares, compared to its average volume of 1,542,979. The stock's fifty day moving average price is $389.61 and its two-hundred day moving average price is $356.03. The company has a debt-to-equity ratio of 48.71, a quick ratio of 1.00 and a current ratio of 1.12. HCA Healthcare, Inc. has a 12 month low of $226.48 and a 12 month high of $417.14. The firm has a market cap of $89.71 billion, a PE ratio of 15.90, a price-to-earnings-growth ratio of 1.34 and a beta of 1.68.

HCA Healthcare Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 27th. Shareholders of record on Friday, December 13th will be given a dividend of $0.66 per share. The ex-dividend date is Friday, December 13th. This represents a $2.64 dividend on an annualized basis and a yield of 0.75%. HCA Healthcare's dividend payout ratio is presently 11.85%.

Wall Street Analyst Weigh In

Several equities analysts have recently weighed in on HCA shares. Wells Fargo & Company upped their price objective on shares of HCA Healthcare from $395.00 to $400.00 and gave the company an "equal weight" rating in a report on Wednesday. Cantor Fitzgerald reissued an "overweight" rating and issued a $392.00 price objective on shares of HCA Healthcare in a research note on Tuesday, October 1st. Oppenheimer lifted their price target on shares of HCA Healthcare from $390.00 to $400.00 and gave the company an "outperform" rating in a research report on Monday, October 28th. Royal Bank of Canada raised their price objective on shares of HCA Healthcare from $378.00 to $405.00 and gave the company an "outperform" rating in a research note on Friday, August 23rd. Finally, TD Cowen lowered their target price on shares of HCA Healthcare from $450.00 to $440.00 and set a "buy" rating on the stock in a report on Monday, October 28th. Five research analysts have rated the stock with a hold rating, fourteen have assigned a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $379.17.

Read Our Latest Stock Analysis on HCA Healthcare

Insider Activity at HCA Healthcare

In other HCA Healthcare news, EVP Michael S. Cuffe sold 8,358 shares of the stock in a transaction on Thursday, September 12th. The stock was sold at an average price of $385.42, for a total transaction of $3,221,340.36. Following the sale, the executive vice president now owns 29,678 shares in the company, valued at $11,438,494.76. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. 1.60% of the stock is currently owned by corporate insiders.

HCA Healthcare Profile

(

Free Report)

HCA Healthcare, Inc, through its subsidiaries, owns and operates hospitals and related healthcare entities in the United States. It operates general and acute care hospitals that offers medical and surgical services, including inpatient care, intensive care, cardiac care, diagnostic, and emergency services; and outpatient services, such as outpatient surgery, laboratory, radiology, respiratory therapy, cardiology, and physical therapy.

See Also

Before you consider HCA Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HCA Healthcare wasn't on the list.

While HCA Healthcare currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.