Janney Montgomery Scott LLC raised its position in Southern Copper Co. (NYSE:SCCO - Free Report) by 2.6% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 173,419 shares of the basic materials company's stock after purchasing an additional 4,435 shares during the quarter. Janney Montgomery Scott LLC's holdings in Southern Copper were worth $20,059,000 as of its most recent SEC filing.

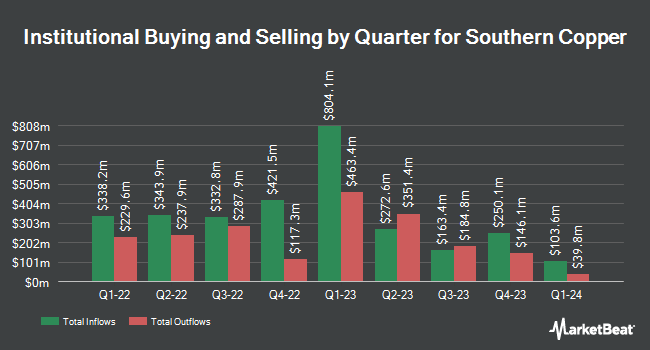

Other hedge funds and other institutional investors have also modified their holdings of the company. Fidelis Capital Partners LLC acquired a new position in shares of Southern Copper in the first quarter valued at approximately $26,000. Creative Financial Designs Inc. ADV boosted its position in Southern Copper by 172.0% in the 3rd quarter. Creative Financial Designs Inc. ADV now owns 223 shares of the basic materials company's stock valued at $26,000 after buying an additional 141 shares during the period. Itau Unibanco Holding S.A. acquired a new position in shares of Southern Copper in the second quarter worth $31,000. McClarren Financial Advisors Inc. increased its position in shares of Southern Copper by 169.2% during the third quarter. McClarren Financial Advisors Inc. now owns 288 shares of the basic materials company's stock worth $33,000 after acquiring an additional 181 shares during the period. Finally, Oakworth Capital Inc. acquired a new stake in shares of Southern Copper in the third quarter valued at $42,000. 7.94% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

SCCO has been the subject of several analyst reports. Scotiabank lowered their target price on Southern Copper from $54.00 to $52.00 and set a "sector underperform" rating for the company in a research note on Tuesday, October 15th. Citigroup boosted their price objective on Southern Copper from $99.44 to $100.00 and gave the stock a "sell" rating in a research report on Wednesday, October 2nd. Morgan Stanley raised their target price on shares of Southern Copper from $97.00 to $100.00 and gave the company an "underweight" rating in a report on Thursday, September 19th. Finally, UBS Group started coverage on shares of Southern Copper in a research report on Friday, July 12th. They issued a "neutral" rating and a $120.00 price objective on the stock. Six investment analysts have rated the stock with a sell rating, one has given a hold rating and three have given a buy rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $90.63.

View Our Latest Research Report on Southern Copper

Southern Copper Stock Down 3.4 %

NYSE:SCCO traded down $3.80 during midday trading on Wednesday, hitting $109.50. 1,247,478 shares of the company were exchanged, compared to its average volume of 1,151,440. Southern Copper Co. has a fifty-two week low of $68.93 and a fifty-two week high of $129.79. The company has a market capitalization of $85.54 billion, a PE ratio of 28.22, a price-to-earnings-growth ratio of 1.14 and a beta of 1.18. The company has a current ratio of 2.77, a quick ratio of 2.31 and a debt-to-equity ratio of 0.64. The company has a fifty day simple moving average of $108.91 and a 200 day simple moving average of $109.99.

Southern Copper Dividend Announcement

The company also recently announced a -- dividend, which will be paid on Thursday, November 21st. Stockholders of record on Wednesday, November 6th will be issued a $0.62 dividend. This represents a dividend yield of 2.1%. The ex-dividend date of this dividend is Wednesday, November 6th. Southern Copper's payout ratio is currently 72.16%.

About Southern Copper

(

Free Report)

Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile. The company is involved in the mining, milling, and flotation of copper ore to produce copper and molybdenum concentrates; smelting of copper concentrates to produce blister and anode copper; refining of anode copper to produce copper cathodes; production of molybdenum concentrate and sulfuric acid; production of refined silver, gold, and other materials; and mining and processing of zinc, copper, molybdenum, silver, gold, and lead.

Featured Stories

Before you consider Southern Copper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southern Copper wasn't on the list.

While Southern Copper currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.