Janney Montgomery Scott LLC lifted its stake in shares of MidCap Financial Investment Co. (NASDAQ:MFIC - Free Report) by 269.8% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 63,291 shares of the company's stock after acquiring an additional 46,176 shares during the period. Janney Montgomery Scott LLC owned 0.10% of MidCap Financial Investment worth $847,000 as of its most recent SEC filing.

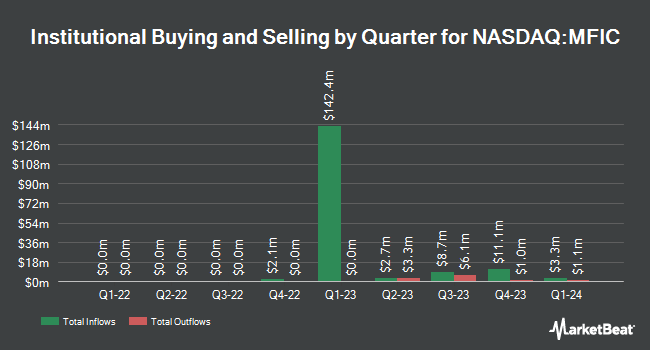

Several other large investors have also modified their holdings of the stock. Allspring Global Investments Holdings LLC increased its holdings in MidCap Financial Investment by 0.5% in the 3rd quarter. Allspring Global Investments Holdings LLC now owns 2,156,843 shares of the company's stock valued at $28,880,000 after purchasing an additional 10,669 shares in the last quarter. Van ECK Associates Corp boosted its stake in MidCap Financial Investment by 17.6% during the 2nd quarter. Van ECK Associates Corp now owns 1,514,663 shares of the company's stock valued at $22,932,000 after acquiring an additional 226,313 shares during the last quarter. Hennion & Walsh Asset Management Inc. increased its position in shares of MidCap Financial Investment by 22.1% in the 3rd quarter. Hennion & Walsh Asset Management Inc. now owns 321,316 shares of the company's stock worth $4,302,000 after purchasing an additional 58,188 shares during the last quarter. Foundations Investment Advisors LLC acquired a new stake in shares of MidCap Financial Investment in the 3rd quarter valued at about $4,172,000. Finally, Condor Capital Management lifted its position in shares of MidCap Financial Investment by 16.3% during the second quarter. Condor Capital Management now owns 306,024 shares of the company's stock worth $4,633,000 after purchasing an additional 42,939 shares during the last quarter. 28.45% of the stock is currently owned by hedge funds and other institutional investors.

MidCap Financial Investment Trading Up 1.0 %

Shares of NASDAQ MFIC traded up $0.14 during mid-day trading on Friday, hitting $13.75. The company's stock had a trading volume of 301,096 shares, compared to its average volume of 360,611. The stock has a market cap of $1.29 billion, a price-to-earnings ratio of 8.81 and a beta of 1.50. The company's fifty day simple moving average is $13.46 and its 200-day simple moving average is $14.36. The company has a debt-to-equity ratio of 1.25, a current ratio of 8.51 and a quick ratio of 3.02. MidCap Financial Investment Co. has a one year low of $12.26 and a one year high of $16.36.

MidCap Financial Investment Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Thursday, December 26th. Shareholders of record on Tuesday, December 10th will be issued a $0.38 dividend. The ex-dividend date is Tuesday, December 10th. This represents a $1.52 annualized dividend and a dividend yield of 11.05%. MidCap Financial Investment's dividend payout ratio (DPR) is currently 97.44%.

Analysts Set New Price Targets

MFIC has been the topic of several research reports. Compass Point upgraded shares of MidCap Financial Investment from a "neutral" rating to a "buy" rating and set a $16.00 price objective on the stock in a research note on Thursday, July 25th. Keefe, Bruyette & Woods upgraded shares of MidCap Financial Investment from a "market perform" rating to an "outperform" rating and set a $15.00 target price on the stock in a report on Monday, August 5th. Wells Fargo & Company lowered their price objective on shares of MidCap Financial Investment from $15.00 to $14.00 and set an "overweight" rating on the stock in a research report on Tuesday, October 29th. Finally, JPMorgan Chase & Co. decreased their target price on MidCap Financial Investment from $15.00 to $14.00 and set a "neutral" rating for the company in a research report on Monday, July 29th. Three research analysts have rated the stock with a hold rating and four have issued a buy rating to the stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $14.86.

Get Our Latest Stock Analysis on MFIC

MidCap Financial Investment Profile

(

Free Report)

MidCap Financial Investment Corporation (Former name Apollo Investment Corporation) is business development company and a closed-end, externally managed, non-diversified management investment company. It is elected to be treated as a business development company (BDC) under the Investment Company Act of 1940 (the 1940 Act) specializing in private equity investments in leveraged buyouts, acquisitions, recapitalizations, growth capital, refinancing and private middle market companies.

Read More

Before you consider MidCap Financial Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MidCap Financial Investment wasn't on the list.

While MidCap Financial Investment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.