Janney Montgomery Scott LLC increased its holdings in Main Street Capital Co. (NYSE:MAIN - Free Report) by 188.3% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 20,176 shares of the financial services provider's stock after buying an additional 13,177 shares during the quarter. Janney Montgomery Scott LLC's holdings in Main Street Capital were worth $1,012,000 at the end of the most recent reporting period.

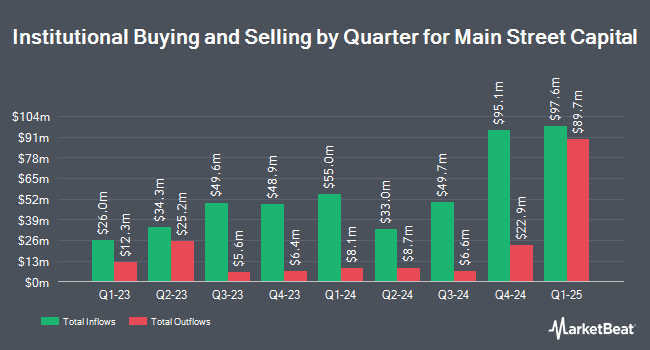

Other large investors also recently added to or reduced their stakes in the company. Pembroke Management LTD raised its stake in shares of Main Street Capital by 0.6% in the third quarter. Pembroke Management LTD now owns 76,928 shares of the financial services provider's stock worth $3,857,000 after buying an additional 433 shares during the period. Farther Finance Advisors LLC raised its stake in Main Street Capital by 1,641.4% during the 3rd quarter. Farther Finance Advisors LLC now owns 2,943 shares of the financial services provider's stock worth $148,000 after acquiring an additional 2,774 shares during the period. Americana Partners LLC lifted its holdings in Main Street Capital by 1.5% during the third quarter. Americana Partners LLC now owns 74,479 shares of the financial services provider's stock valued at $3,734,000 after purchasing an additional 1,074 shares in the last quarter. Focus Financial Network Inc. boosted its position in shares of Main Street Capital by 6.0% in the third quarter. Focus Financial Network Inc. now owns 24,262 shares of the financial services provider's stock worth $1,217,000 after purchasing an additional 1,365 shares during the period. Finally, Adell Harriman & Carpenter Inc. boosted its position in shares of Main Street Capital by 3.5% in the third quarter. Adell Harriman & Carpenter Inc. now owns 419,255 shares of the financial services provider's stock worth $21,021,000 after purchasing an additional 14,045 shares during the period. 20.31% of the stock is currently owned by institutional investors.

Main Street Capital Price Performance

Shares of NYSE MAIN remained flat at $52.16 during mid-day trading on Friday. 551,786 shares of the stock traded hands, compared to its average volume of 367,056. The company has a debt-to-equity ratio of 0.13, a current ratio of 0.08 and a quick ratio of 0.07. Main Street Capital Co. has a 52-week low of $40.51 and a 52-week high of $52.89. The business has a 50-day moving average of $50.90 and a 200-day moving average of $50.14. The company has a market capitalization of $4.60 billion, a P/E ratio of 9.45 and a beta of 1.29.

Main Street Capital Increases Dividend

The company also recently disclosed a monthly dividend, which will be paid on Friday, March 14th. Shareholders of record on Friday, March 7th will be given a dividend of $0.25 per share. This is a boost from Main Street Capital's previous monthly dividend of $0.25. The ex-dividend date is Friday, March 7th. This represents a $3.00 dividend on an annualized basis and a yield of 5.75%. Main Street Capital's payout ratio is 53.26%.

Analysts Set New Price Targets

A number of research analysts recently weighed in on the stock. Royal Bank of Canada restated an "outperform" rating and set a $52.00 target price on shares of Main Street Capital in a research note on Wednesday, August 14th. B. Riley boosted their price objective on Main Street Capital from $49.00 to $51.00 and gave the company a "neutral" rating in a research report on Monday, November 11th. Finally, Oppenheimer increased their target price on Main Street Capital from $43.00 to $44.00 and gave the stock a "market perform" rating in a research report on Tuesday, August 13th. Four equities research analysts have rated the stock with a hold rating and one has given a buy rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average price target of $48.80.

Read Our Latest Stock Analysis on MAIN

Main Street Capital Profile

(

Free Report)

Main Street Capital Corporation is a business development company specializes in equity capital to lower middle market companies. The firm specializing in recapitalizations, management buyouts, refinancing, family estate planning, management buyouts, refinancing, industry consolidation, mature, later stage emerging growth.

Featured Articles

Before you consider Main Street Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Main Street Capital wasn't on the list.

While Main Street Capital currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.