Janney Montgomery Scott LLC increased its position in shares of ADT Inc. (NYSE:ADT - Free Report) by 46.8% during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 130,838 shares of the security and automation business's stock after purchasing an additional 41,682 shares during the period. Janney Montgomery Scott LLC's holdings in ADT were worth $904,000 at the end of the most recent reporting period.

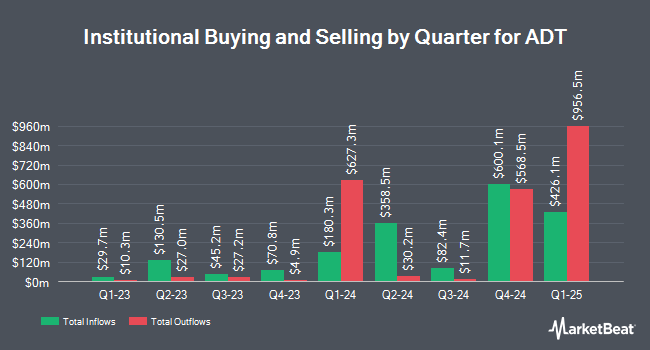

A number of other large investors also recently modified their holdings of the company. Abich Financial Wealth Management LLC purchased a new position in shares of ADT in the third quarter valued at about $70,000. KBC Group NV raised its stake in ADT by 46.9% during the 3rd quarter. KBC Group NV now owns 10,577 shares of the security and automation business's stock valued at $76,000 after purchasing an additional 3,375 shares during the period. Capstone Investment Advisors LLC bought a new stake in ADT during the 3rd quarter valued at approximately $76,000. Creative Planning purchased a new position in ADT in the 3rd quarter worth approximately $78,000. Finally, Claro Advisors LLC bought a new position in ADT in the 4th quarter worth approximately $88,000. Hedge funds and other institutional investors own 87.22% of the company's stock.

Analyst Ratings Changes

ADT has been the topic of several recent analyst reports. Royal Bank of Canada reiterated a "sector perform" rating and set a $9.00 price objective on shares of ADT in a research report on Wednesday, January 29th. Morgan Stanley lifted their price target on shares of ADT from $8.50 to $9.00 and gave the company an "equal weight" rating in a report on Thursday, December 12th. Finally, The Goldman Sachs Group increased their price objective on shares of ADT from $8.20 to $9.20 and gave the company a "buy" rating in a report on Friday, October 25th.

Read Our Latest Stock Analysis on ADT

ADT Stock Up 0.6 %

Shares of ADT opened at $7.56 on Friday. The company has a debt-to-equity ratio of 1.93, a current ratio of 0.81 and a quick ratio of 0.64. The stock has a market capitalization of $6.85 billion, a price-to-earnings ratio of 8.21 and a beta of 1.50. ADT Inc. has a 1 year low of $6.10 and a 1 year high of $8.25. The business's 50 day simple moving average is $7.25 and its 200-day simple moving average is $7.29.

ADT Company Profile

(

Free Report)

ADT Inc provides security, interactive, and smart home solutions to residential and small business customers in the United States. It operates through two segments, Consumer and Small Business, and Solar. The company provides burglar and life safety alarms, smart security cameras, smart home automation systems, and video surveillance systems.

Read More

Want to see what other hedge funds are holding ADT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for ADT Inc. (NYSE:ADT - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Before you consider ADT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ADT wasn't on the list.

While ADT currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.