Janus Henderson Group PLC increased its position in shares of Brunswick Co. (NYSE:BC - Free Report) by 1,120.5% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 354,631 shares of the company's stock after acquiring an additional 325,574 shares during the period. Janus Henderson Group PLC owned approximately 0.54% of Brunswick worth $29,725,000 at the end of the most recent quarter.

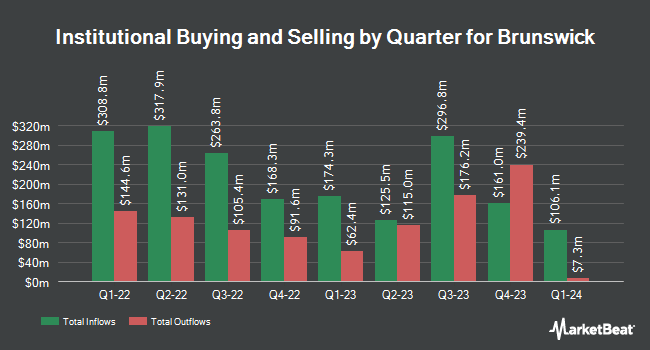

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. QRG Capital Management Inc. boosted its stake in shares of Brunswick by 12.3% during the 2nd quarter. QRG Capital Management Inc. now owns 13,341 shares of the company's stock worth $971,000 after acquiring an additional 1,456 shares in the last quarter. SG Americas Securities LLC acquired a new position in Brunswick in the 2nd quarter worth approximately $676,000. Gateway Investment Advisers LLC acquired a new stake in Brunswick during the 2nd quarter valued at $380,000. M&G Plc raised its stake in Brunswick by 15.1% during the 2nd quarter. M&G Plc now owns 55,218 shares of the company's stock valued at $4,031,000 after purchasing an additional 7,261 shares during the period. Finally, Envestnet Portfolio Solutions Inc. raised its position in Brunswick by 36.0% during the second quarter. Envestnet Portfolio Solutions Inc. now owns 3,952 shares of the company's stock valued at $288,000 after buying an additional 1,047 shares during the period. 99.34% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

BC has been the topic of several research analyst reports. Benchmark reaffirmed a "buy" rating and set a $100.00 target price on shares of Brunswick in a research note on Friday, October 25th. B. Riley lowered shares of Brunswick from a "buy" rating to a "neutral" rating and decreased their target price for the company from $95.00 to $88.00 in a research note on Tuesday, November 26th. Finally, Citigroup upped their price target on shares of Brunswick from $92.00 to $101.00 and gave the stock a "buy" rating in a research note on Friday, September 27th. Seven analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $88.54.

Read Our Latest Report on BC

Insider Buying and Selling at Brunswick

In other Brunswick news, Director Nancy E. Cooper sold 366 shares of Brunswick stock in a transaction that occurred on Friday, November 1st. The stock was sold at an average price of $80.19, for a total value of $29,349.54. Following the transaction, the director now directly owns 24,557 shares of the company's stock, valued at $1,969,225.83. The trade was a 1.47 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, Director Joseph W. Mcclanathan sold 4,745 shares of the stock in a transaction that occurred on Friday, October 25th. The shares were sold at an average price of $80.14, for a total value of $380,264.30. Following the completion of the sale, the director now directly owns 19,218 shares of the company's stock, valued at $1,540,130.52. This represents a 19.80 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 28,940 shares of company stock worth $2,321,176 over the last 90 days. Insiders own 0.81% of the company's stock.

Brunswick Stock Down 1.1 %

Shares of NYSE:BC traded down $0.83 on Friday, reaching $76.81. The company had a trading volume of 593,309 shares, compared to its average volume of 440,355. The company has a quick ratio of 0.74, a current ratio of 1.97 and a debt-to-equity ratio of 1.17. The stock has a market capitalization of $5.07 billion, a P/E ratio of 19.11 and a beta of 1.50. The stock has a 50-day moving average price of $81.34 and a 200 day moving average price of $78.62. Brunswick Co. has a twelve month low of $69.05 and a twelve month high of $99.68.

Brunswick Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Shareholders of record on Wednesday, November 20th will be given a dividend of $0.42 per share. The ex-dividend date is Wednesday, November 20th. This represents a $1.68 dividend on an annualized basis and a yield of 2.19%. Brunswick's payout ratio is currently 41.79%.

Brunswick Company Profile

(

Free Report)

Brunswick Corporation designs, manufactures, and markets recreation products in the United States, Europe, the Asia-Pacific, Canada, and internationally. It operates through four segments: Propulsion, Engine P&A, Navico Group, and Boat. The Propulsion segment provides outboard, sterndrive, inboard engines, propulsion-related controls, rigging, and propellers for boat builders through marine retail dealers under the Mercury, Mercury MerCruiser, Mariner, Mercury Racing, Mercury Diesel, Avator, and Fliteboard brands.

Recommended Stories

Before you consider Brunswick, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brunswick wasn't on the list.

While Brunswick currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.