Janus Henderson Group PLC raised its stake in shares of Fair Isaac Co. (NYSE:FICO - Free Report) by 20.8% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 4,320 shares of the technology company's stock after purchasing an additional 744 shares during the quarter. Janus Henderson Group PLC's holdings in Fair Isaac were worth $8,398,000 at the end of the most recent reporting period.

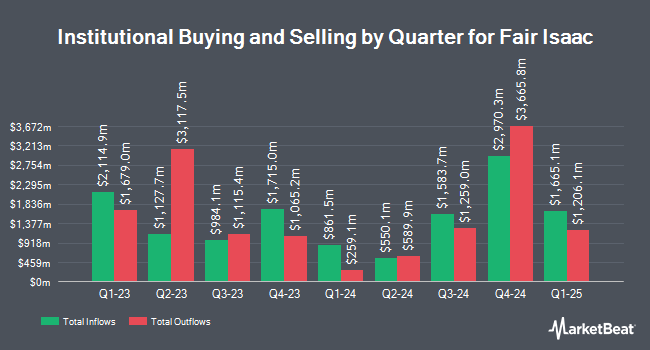

A number of other hedge funds have also bought and sold shares of FICO. Capital Performance Advisors LLP acquired a new position in Fair Isaac during the 3rd quarter valued at approximately $25,000. Tortoise Investment Management LLC increased its stake in shares of Fair Isaac by 81.8% in the second quarter. Tortoise Investment Management LLC now owns 20 shares of the technology company's stock worth $30,000 after acquiring an additional 9 shares during the period. Family Firm Inc. acquired a new stake in shares of Fair Isaac in the second quarter worth $34,000. True Wealth Design LLC increased its stake in shares of Fair Isaac by 900.0% in the third quarter. True Wealth Design LLC now owns 20 shares of the technology company's stock worth $39,000 after acquiring an additional 18 shares during the period. Finally, Meeder Asset Management Inc. increased its stake in shares of Fair Isaac by 37.5% in the third quarter. Meeder Asset Management Inc. now owns 22 shares of the technology company's stock worth $43,000 after acquiring an additional 6 shares during the period. Institutional investors and hedge funds own 85.75% of the company's stock.

Analyst Ratings Changes

A number of analysts have recently weighed in on FICO shares. Robert W. Baird increased their price objective on shares of Fair Isaac from $1,700.00 to $2,000.00 and gave the stock a "neutral" rating in a research note on Thursday, November 7th. The Goldman Sachs Group increased their price objective on shares of Fair Isaac from $2,374.00 to $2,661.00 and gave the stock a "buy" rating in a research note on Thursday. UBS Group started coverage on shares of Fair Isaac in a research note on Tuesday, October 1st. They issued a "neutral" rating and a $2,100.00 price objective on the stock. Barclays increased their price objective on shares of Fair Isaac from $2,150.00 to $2,350.00 and gave the stock an "overweight" rating in a research note on Thursday, November 7th. Finally, Oppenheimer increased their price target on shares of Fair Isaac from $2,324.00 to $2,515.00 and gave the stock an "outperform" rating in a report on Monday, December 2nd. Four investment analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $2,022.67.

Check Out Our Latest Research Report on Fair Isaac

Insider Buying and Selling at Fair Isaac

In related news, EVP Thomas A. Bowers sold 2,680 shares of the business's stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $2,338.21, for a total transaction of $6,266,402.80. Following the transaction, the executive vice president now directly owns 5,769 shares in the company, valued at approximately $13,489,133.49. The trade was a 31.72 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Also, Director Henry Tayloe Stansbury sold 249 shares of the business's stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $2,338.55, for a total transaction of $582,298.95. Following the transaction, the director now owns 92 shares in the company, valued at $215,146.60. The trade was a 73.02 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 9,929 shares of company stock valued at $23,278,612 over the last ninety days. Corporate insiders own 3.54% of the company's stock.

Fair Isaac Trading Down 6.1 %

FICO traded down $144.72 during midday trading on Monday, hitting $2,227.11. 189,007 shares of the company traded hands, compared to its average volume of 168,844. The company has a market capitalization of $54.23 billion, a price-to-earnings ratio of 108.91, a PEG ratio of 4.37 and a beta of 1.36. Fair Isaac Co. has a 52-week low of $1,105.65 and a 52-week high of $2,402.51. The business has a 50 day simple moving average of $2,150.51 and a two-hundred day simple moving average of $1,804.06.

Fair Isaac Profile

(

Free Report)

Fair Isaac Corporation develops analytic, software, and digital decisioning technologies and services that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company operates in two segments, Scores and Software. The Software segment provides pre-configured analytic and decision management solution designed for various business needs or processes, such as account origination, customer management, customer engagement, fraud detection, financial crimes compliance, and marketing, as well as associated professional services.

Featured Articles

Before you consider Fair Isaac, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fair Isaac wasn't on the list.

While Fair Isaac currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.