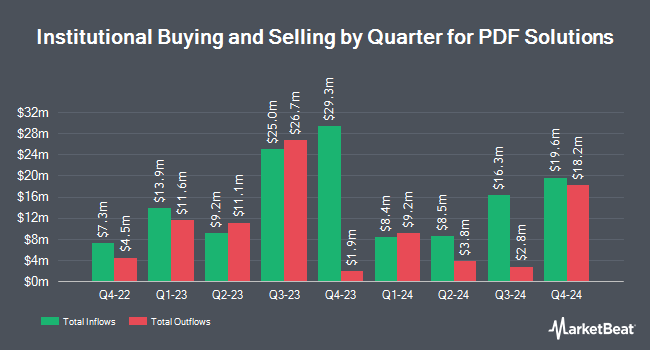

Janus Henderson Group PLC grew its position in shares of PDF Solutions, Inc. (NASDAQ:PDFS - Free Report) by 16.7% in the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 658,547 shares of the technology company's stock after acquiring an additional 94,154 shares during the quarter. Janus Henderson Group PLC owned about 1.70% of PDF Solutions worth $20,863,000 as of its most recent filing with the SEC.

Several other institutional investors have also modified their holdings of PDFS. William Blair Investment Management LLC increased its position in PDF Solutions by 13.9% in the 2nd quarter. William Blair Investment Management LLC now owns 743,635 shares of the technology company's stock valued at $27,053,000 after acquiring an additional 90,789 shares during the period. Herald Investment Management Ltd bought a new stake in shares of PDF Solutions during the second quarter valued at about $2,725,000. Divisar Capital Management LLC raised its stake in shares of PDF Solutions by 9.1% during the second quarter. Divisar Capital Management LLC now owns 595,583 shares of the technology company's stock valued at $21,667,000 after purchasing an additional 49,762 shares in the last quarter. Bank of Montreal Can acquired a new stake in PDF Solutions in the second quarter worth about $1,538,000. Finally, Kings Path Partners LLC bought a new position in PDF Solutions in the 2nd quarter valued at about $1,295,000. Institutional investors own 79.51% of the company's stock.

Analyst Ratings Changes

A number of analysts have recently weighed in on PDFS shares. DA Davidson reaffirmed a "buy" rating and issued a $42.00 price target on shares of PDF Solutions in a research note on Wednesday, August 28th. Rosenblatt Securities restated a "buy" rating and issued a $40.00 target price on shares of PDF Solutions in a research report on Friday, November 8th. Finally, StockNews.com upgraded PDF Solutions from a "hold" rating to a "buy" rating in a research report on Tuesday, November 12th.

Read Our Latest Research Report on PDFS

PDF Solutions Trading Up 0.1 %

Shares of NASDAQ PDFS traded up $0.03 during midday trading on Friday, reaching $30.22. The company's stock had a trading volume of 95,178 shares, compared to its average volume of 181,201. PDF Solutions, Inc. has a one year low of $27.69 and a one year high of $39.70. The company has a market cap of $1.17 billion, a price-to-earnings ratio of 274.73 and a beta of 1.51. The company has a 50 day moving average price of $30.48 and a 200 day moving average price of $32.29.

PDF Solutions Profile

(

Free Report)

PDF Solutions, Inc provides proprietary software and physical intellectual property products for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, China, Japan, and internationally. The company offers Exensio software products, such as Manufacturing Analytics that store collected data in a common environment with a consistent view for enabling product engineers to identify and analyze production yield, performance, reliability, and other issues; Process Control that provides failure detection and classification capabilities for monitoring, alarming, and controlling manufacturing tool sets; Test Operations that offer data collection and analysis capabilities; and Assembly Operations that provide device manufacturers with the capability to link assembly and packaging data, including fabrication and characterization data over the product life cycle.

Further Reading

Before you consider PDF Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PDF Solutions wasn't on the list.

While PDF Solutions currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.