Janus Henderson Group PLC lowered its position in Amphenol Co. (NYSE:APH - Free Report) by 0.7% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 3,323,021 shares of the electronics maker's stock after selling 23,081 shares during the period. Janus Henderson Group PLC owned approximately 0.28% of Amphenol worth $216,526,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

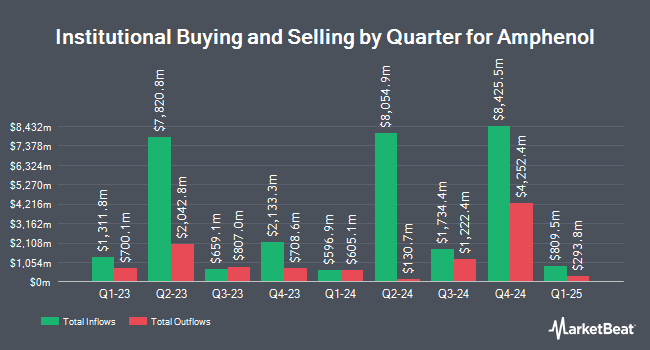

Other institutional investors have also added to or reduced their stakes in the company. Beacon Capital Management LLC raised its stake in shares of Amphenol by 121.2% during the second quarter. Beacon Capital Management LLC now owns 376 shares of the electronics maker's stock valued at $25,000 after acquiring an additional 206 shares in the last quarter. New England Capital Financial Advisors LLC grew its holdings in Amphenol by 100.0% in the second quarter. New England Capital Financial Advisors LLC now owns 376 shares of the electronics maker's stock worth $25,000 after purchasing an additional 188 shares during the last quarter. Sachetta LLC grew its holdings in Amphenol by 131.1% in the second quarter. Sachetta LLC now owns 439 shares of the electronics maker's stock worth $27,000 after purchasing an additional 249 shares during the last quarter. Trifecta Capital Advisors LLC lifted its stake in shares of Amphenol by 352.1% during the third quarter. Trifecta Capital Advisors LLC now owns 434 shares of the electronics maker's stock worth $28,000 after buying an additional 338 shares during the period. Finally, Opal Wealth Advisors LLC acquired a new stake in shares of Amphenol during the second quarter worth $29,000. Institutional investors own 97.01% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts recently issued reports on APH shares. Robert W. Baird boosted their target price on shares of Amphenol from $71.00 to $77.00 and gave the company an "outperform" rating in a research report on Thursday, October 24th. Evercore ISI boosted their target price on shares of Amphenol from $75.00 to $80.00 and gave the company an "outperform" rating in a research report on Thursday, October 24th. TD Cowen boosted their target price on shares of Amphenol from $60.00 to $63.00 and gave the company a "hold" rating in a research report on Friday, October 25th. Bank of America upped their price objective on shares of Amphenol from $70.00 to $74.00 and gave the stock a "neutral" rating in a research report on Thursday, October 24th. Finally, Truist Financial boosted their target price on shares of Amphenol from $76.00 to $82.00 and gave the stock a "buy" rating in a research note on Thursday, October 24th. Five equities research analysts have rated the stock with a hold rating, seven have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $69.63.

Check Out Our Latest Research Report on Amphenol

Amphenol Price Performance

APH traded up $1.25 during midday trading on Wednesday, reaching $74.38. 4,002,883 shares of the company's stock were exchanged, compared to its average volume of 6,577,086. The company has a debt-to-equity ratio of 0.53, a current ratio of 1.99 and a quick ratio of 1.33. The stock has a market capitalization of $89.67 billion, a PE ratio of 42.75, a P/E/G ratio of 2.43 and a beta of 1.24. The business's 50-day moving average price is $68.98 and its 200 day moving average price is $66.86. Amphenol Co. has a 1-year low of $45.47 and a 1-year high of $74.93.

Amphenol (NYSE:APH - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The electronics maker reported $0.50 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.45 by $0.05. The company had revenue of $4.04 billion during the quarter, compared to analysts' expectations of $3.81 billion. Amphenol had a net margin of 15.40% and a return on equity of 24.68%. The firm's quarterly revenue was up 26.3% compared to the same quarter last year. During the same quarter in the previous year, the business posted $0.39 earnings per share. As a group, equities analysts anticipate that Amphenol Co. will post 1.84 EPS for the current fiscal year.

Amphenol Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, January 8th. Stockholders of record on Tuesday, December 17th will be issued a dividend of $0.165 per share. The ex-dividend date of this dividend is Tuesday, December 17th. This represents a $0.66 dividend on an annualized basis and a dividend yield of 0.89%. Amphenol's dividend payout ratio (DPR) is presently 37.93%.

Insider Transactions at Amphenol

In related news, insider Peter Straub sold 132,000 shares of the company's stock in a transaction on Friday, November 8th. The shares were sold at an average price of $74.12, for a total value of $9,783,840.00. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CFO Craig A. Lampo sold 150,000 shares of the company's stock in a transaction on Tuesday, October 29th. The shares were sold at an average price of $68.76, for a total transaction of $10,314,000.00. Following the completion of the sale, the chief financial officer now directly owns 218,116 shares in the company, valued at $14,997,656.16. This represents a 40.75 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 1,842,672 shares of company stock worth $128,858,080 over the last ninety days. 1.80% of the stock is currently owned by corporate insiders.

About Amphenol

(

Free Report)

Amphenol Corporation, together with its subsidiaries, primarily designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally. It operates through three segments: Harsh Environment Solutions, Communications Solutions, and Interconnect and Sensor Systems.

See Also

Before you consider Amphenol, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amphenol wasn't on the list.

While Amphenol currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.