Janus Henderson Group PLC boosted its stake in shares of NewAmsterdam Pharma (NASDAQ:NAMS - Free Report) by 51.1% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 1,540,729 shares of the company's stock after purchasing an additional 520,772 shares during the period. Janus Henderson Group PLC owned approximately 1.71% of NewAmsterdam Pharma worth $25,607,000 at the end of the most recent reporting period.

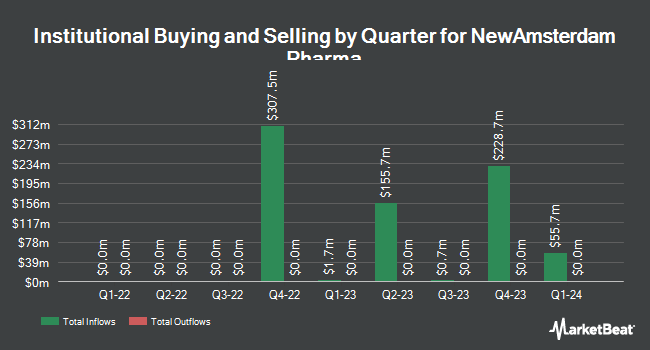

Other hedge funds have also bought and sold shares of the company. Cinctive Capital Management LP grew its holdings in shares of NewAmsterdam Pharma by 77.7% during the third quarter. Cinctive Capital Management LP now owns 66,571 shares of the company's stock valued at $1,105,000 after buying an additional 29,115 shares during the last quarter. ArrowMark Colorado Holdings LLC lifted its position in NewAmsterdam Pharma by 19.5% during the 3rd quarter. ArrowMark Colorado Holdings LLC now owns 354,975 shares of the company's stock worth $5,893,000 after acquiring an additional 57,806 shares during the period. Bellevue Group AG purchased a new stake in NewAmsterdam Pharma during the 3rd quarter valued at about $128,000. Walleye Capital LLC acquired a new position in shares of NewAmsterdam Pharma in the third quarter valued at about $779,000. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its stake in shares of NewAmsterdam Pharma by 1,231.0% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 239,283 shares of the company's stock worth $3,972,000 after purchasing an additional 221,305 shares during the last quarter. Institutional investors and hedge funds own 89.89% of the company's stock.

NewAmsterdam Pharma Price Performance

Shares of NASDAQ NAMS traded up $0.28 during midday trading on Friday, reaching $18.35. 398,520 shares of the stock were exchanged, compared to its average volume of 731,910. The firm has a 50-day simple moving average of $19.87 and a two-hundred day simple moving average of $18.55. NewAmsterdam Pharma has a twelve month low of $8.90 and a twelve month high of $26.35.

Insider Buying and Selling at NewAmsterdam Pharma

In other news, CAO Louise Frederika Kooij sold 45,000 shares of NewAmsterdam Pharma stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $15.72, for a total value of $707,400.00. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, major shareholder Nap B.V. Forgrowth sold 33,273 shares of the business's stock in a transaction on Monday, November 18th. The shares were sold at an average price of $25.08, for a total value of $834,486.84. Following the completion of the sale, the insider now owns 11,778,760 shares in the company, valued at $295,411,300.80. This represents a 0.28 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 86,803 shares of company stock worth $1,755,307 over the last three months. Insiders own 19.50% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts recently weighed in on NAMS shares. Needham & Company LLC reiterated a "buy" rating and issued a $36.00 price target on shares of NewAmsterdam Pharma in a report on Thursday. Piper Sandler reiterated an "overweight" rating and issued a $37.00 price objective on shares of NewAmsterdam Pharma in a research note on Monday, September 23rd. Finally, Royal Bank of Canada restated an "outperform" rating and set a $31.00 target price on shares of NewAmsterdam Pharma in a research report on Thursday, September 5th. Six analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, NewAmsterdam Pharma currently has an average rating of "Buy" and an average target price of $33.80.

View Our Latest Research Report on NAMS

About NewAmsterdam Pharma

(

Free Report)

NewAmsterdam Pharma Company N.V., a late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease. It is developing obicetrapib, an oral low-dose cholesteryl ester transfer protein (CETP) inhibitor, that is in various clinical trials as a monotherapy and a combination therapy with ezetimibe for lowering LDL-C for cardiovascular diseases.

Featured Articles

Before you consider NewAmsterdam Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NewAmsterdam Pharma wasn't on the list.

While NewAmsterdam Pharma currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.