Janus Henderson Group PLC cut its holdings in Coca-Cola Consolidated, Inc. (NASDAQ:COKE - Free Report) by 30.2% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 22,808 shares of the company's stock after selling 9,883 shares during the quarter. Janus Henderson Group PLC owned approximately 0.26% of Coca-Cola Consolidated worth $30,022,000 as of its most recent SEC filing.

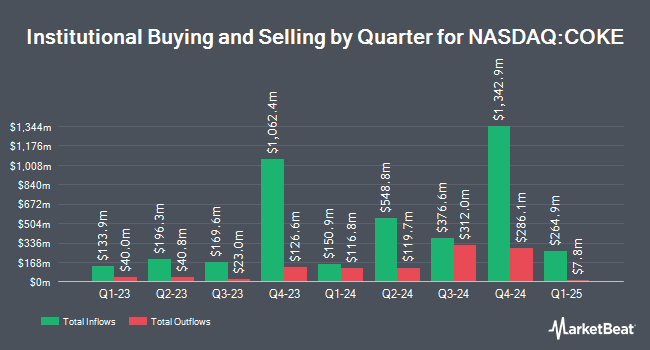

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. V Square Quantitative Management LLC bought a new position in shares of Coca-Cola Consolidated in the 3rd quarter worth $37,000. UMB Bank n.a. raised its holdings in Coca-Cola Consolidated by 41.9% in the third quarter. UMB Bank n.a. now owns 44 shares of the company's stock worth $58,000 after purchasing an additional 13 shares in the last quarter. Strategic Investment Solutions Inc. IL purchased a new stake in shares of Coca-Cola Consolidated during the second quarter valued at about $62,000. GAMMA Investing LLC lifted its position in shares of Coca-Cola Consolidated by 137.0% during the second quarter. GAMMA Investing LLC now owns 64 shares of the company's stock valued at $69,000 after buying an additional 37 shares during the last quarter. Finally, Signaturefd LLC boosted its holdings in shares of Coca-Cola Consolidated by 15.3% in the 2nd quarter. Signaturefd LLC now owns 68 shares of the company's stock valued at $74,000 after buying an additional 9 shares in the last quarter. 48.24% of the stock is currently owned by institutional investors.

Coca-Cola Consolidated Stock Down 2.0 %

Shares of NASDAQ COKE traded down $26.84 during trading hours on Friday, hitting $1,290.72. 32,546 shares of the stock were exchanged, compared to its average volume of 33,043. The firm has a fifty day moving average price of $1,257.54 and a 200-day moving average price of $1,193.93. The company has a market cap of $11.31 billion, a PE ratio of 22.46 and a beta of 0.88. The company has a quick ratio of 2.15, a current ratio of 2.47 and a debt-to-equity ratio of 1.39. Coca-Cola Consolidated, Inc. has a 12 month low of $789.81 and a 12 month high of $1,376.84.

Coca-Cola Consolidated (NASDAQ:COKE - Get Free Report) last posted its quarterly earnings results on Wednesday, October 30th. The company reported $18.81 earnings per share for the quarter. The firm had revenue of $1.77 billion for the quarter. Coca-Cola Consolidated had a net margin of 7.81% and a return on equity of 46.94%.

Coca-Cola Consolidated Company Profile

(

Free Report)

Coca-Cola Consolidated, Inc, together with its subsidiaries, manufactures, markets, and distributes nonalcoholic beverages primarily products of The Coca-Cola Company in the United States. The company offers sparkling beverages; and still beverages, including energy products, as well as noncarbonated beverages comprising bottled water, ready to drink coffee and tea, enhanced water, juices, and sports drinks.

Recommended Stories

Before you consider Coca-Cola Consolidated, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca-Cola Consolidated wasn't on the list.

While Coca-Cola Consolidated currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.