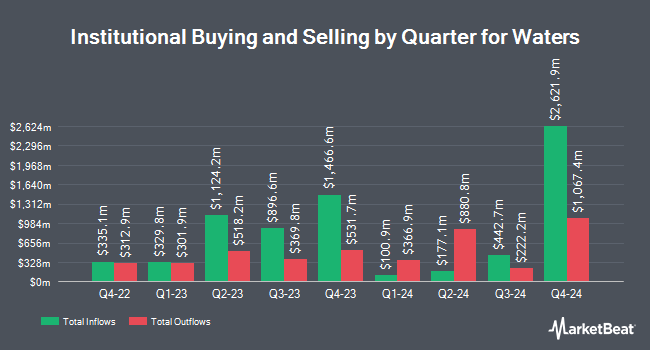

Janus Henderson Group PLC boosted its stake in Waters Co. (NYSE:WAT - Free Report) by 0.7% in the third quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 885,593 shares of the medical instruments supplier's stock after buying an additional 6,256 shares during the period. Janus Henderson Group PLC owned 1.49% of Waters worth $318,717,000 at the end of the most recent quarter.

Several other large investors also recently made changes to their positions in WAT. Northwestern Mutual Wealth Management Co. grew its holdings in Waters by 96.8% during the second quarter. Northwestern Mutual Wealth Management Co. now owns 868 shares of the medical instruments supplier's stock valued at $252,000 after purchasing an additional 427 shares during the last quarter. Toronto Dominion Bank grew its position in shares of Waters by 8.6% in the 2nd quarter. Toronto Dominion Bank now owns 26,234 shares of the medical instruments supplier's stock valued at $7,611,000 after purchasing an additional 2,086 shares during the period. Dimensional Fund Advisors LP lifted its stake in Waters by 21.0% in the 2nd quarter. Dimensional Fund Advisors LP now owns 448,304 shares of the medical instruments supplier's stock valued at $130,053,000 after acquiring an additional 77,951 shares in the last quarter. Magnetar Financial LLC bought a new stake in shares of Waters during the 2nd quarter worth approximately $2,944,000. Finally, Cetera Investment Advisers grew its holdings in Waters by 310.2% in the 1st quarter. Cetera Investment Advisers now owns 4,635 shares of the medical instruments supplier's stock valued at $1,596,000 after buying an additional 3,505 shares in the last quarter. Institutional investors own 94.01% of the company's stock.

Waters Price Performance

NYSE WAT traded up $4.35 during trading on Wednesday, hitting $391.35. 655,677 shares of the company's stock were exchanged, compared to its average volume of 441,962. The stock's 50 day moving average price is $361.00 and its two-hundred day moving average price is $333.62. Waters Co. has a fifty-two week low of $279.24 and a fifty-two week high of $395.44. The company has a market cap of $23.24 billion, a PE ratio of 36.93, a P/E/G ratio of 7.08 and a beta of 1.01. The company has a current ratio of 2.02, a quick ratio of 1.38 and a debt-to-equity ratio of 1.14.

Waters (NYSE:WAT - Get Free Report) last posted its quarterly earnings results on Friday, November 1st. The medical instruments supplier reported $2.93 earnings per share for the quarter, topping the consensus estimate of $2.68 by $0.25. The company had revenue of $740.30 million during the quarter, compared to the consensus estimate of $712.99 million. Waters had a return on equity of 49.93% and a net margin of 21.43%. The firm's quarterly revenue was up 4.0% compared to the same quarter last year. During the same quarter in the prior year, the company earned $2.84 EPS. Research analysts expect that Waters Co. will post 11.79 EPS for the current year.

Wall Street Analyst Weigh In

Several research firms have commented on WAT. Cfra set a $389.00 target price on Waters in a research report on Thursday, October 17th. Wells Fargo & Company boosted their target price on Waters from $380.00 to $415.00 and gave the stock an "overweight" rating in a research report on Monday, November 4th. Evercore ISI upped their price target on Waters from $335.00 to $355.00 and gave the company an "in-line" rating in a research report on Tuesday, October 1st. Stifel Nicolaus lifted their price objective on Waters from $332.00 to $360.00 and gave the company a "hold" rating in a research note on Monday, November 4th. Finally, Deutsche Bank Aktiengesellschaft lifted their target price on Waters from $310.00 to $325.00 and gave the company a "hold" rating in a research report on Monday, November 4th. One research analyst has rated the stock with a sell rating, ten have issued a hold rating, three have issued a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, Waters currently has a consensus rating of "Hold" and a consensus price target of $365.85.

Get Our Latest Stock Report on Waters

About Waters

(

Free Report)

Waters Corporation provides analytical workflow solutions in Asia, the Americas, and Europe. It operates through two segments: Waters and TA. The company designs, manufactures, sells, and services high and ultra-performance liquid chromatography, as well as mass spectrometry (MS) technology systems and support products, including chromatography columns, other consumable products, and post-warranty service plans.

Featured Articles

Before you consider Waters, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Waters wasn't on the list.

While Waters currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.