Janus Henderson Group PLC decreased its position in shares of Rogers Co. (NYSE:ROG - Free Report) by 92.0% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 7,886 shares of the electronics maker's stock after selling 90,691 shares during the period. Janus Henderson Group PLC's holdings in Rogers were worth $892,000 at the end of the most recent quarter.

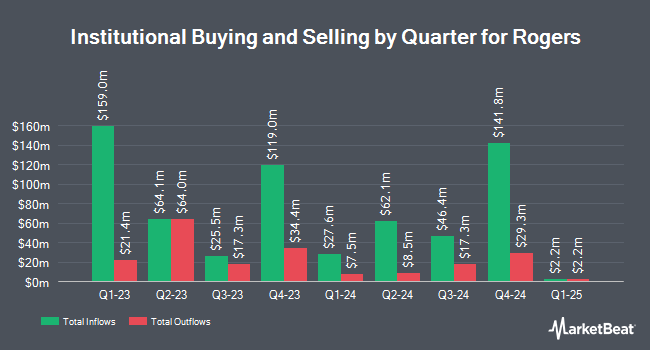

A number of other institutional investors and hedge funds have also recently bought and sold shares of the company. Wealth Enhancement Advisory Services LLC acquired a new position in shares of Rogers during the second quarter valued at about $217,000. Raymond James & Associates acquired a new position in Rogers in the second quarter worth about $3,720,000. Nisa Investment Advisors LLC raised its position in Rogers by 1.2% in the second quarter. Nisa Investment Advisors LLC now owns 7,865 shares of the electronics maker's stock worth $949,000 after purchasing an additional 94 shares in the last quarter. Fifth Third Bancorp raised its position in Rogers by 26.5% in the second quarter. Fifth Third Bancorp now owns 2,967 shares of the electronics maker's stock worth $358,000 after purchasing an additional 622 shares in the last quarter. Finally, Louisiana State Employees Retirement System raised its position in Rogers by 1.2% in the second quarter. Louisiana State Employees Retirement System now owns 8,400 shares of the electronics maker's stock worth $1,013,000 after purchasing an additional 100 shares in the last quarter. Institutional investors and hedge funds own 96.02% of the company's stock.

Insiders Place Their Bets

In other Rogers news, SVP Michael Reed Webb sold 416 shares of the company's stock in a transaction dated Friday, November 8th. The shares were sold at an average price of $108.82, for a total transaction of $45,269.12. Following the sale, the senior vice president now directly owns 4,400 shares of the company's stock, valued at approximately $478,808. This represents a 8.64 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Insiders own 1.35% of the company's stock.

Rogers Trading Down 1.7 %

NYSE:ROG traded down $1.82 during mid-day trading on Friday, hitting $104.89. The company's stock had a trading volume of 156,717 shares, compared to its average volume of 111,110. Rogers Co. has a fifty-two week low of $96.10 and a fifty-two week high of $138.85. The company has a market capitalization of $1.96 billion, a price-to-earnings ratio of 39.14 and a beta of 0.52. The stock has a fifty day moving average of $104.32 and a 200-day moving average of $110.30.

Rogers (NYSE:ROG - Get Free Report) last posted its quarterly earnings results on Thursday, October 24th. The electronics maker reported $0.98 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.85 by $0.13. Rogers had a net margin of 5.91% and a return on equity of 4.19%. The firm had revenue of $210.30 million during the quarter, compared to analyst estimates of $220.20 million. During the same quarter in the prior year, the business posted $1.24 earnings per share. On average, equities analysts anticipate that Rogers Co. will post 2.71 earnings per share for the current fiscal year.

About Rogers

(

Free Report)

Rogers Corporation engages in the design, development, manufacture, and sale of engineered materials and components worldwide. It operates through Advanced Electronics Solutions (AES), Elastomeric Material Solutions (EMS), and Other segments. The AES segment offers circuit materials, ceramic substrate materials, busbars, and cooling solutions for applications in electric and hybrid electric vehicles (EV/HEV), wireless infrastructure, automotive, renewable energy, aerospace and defense, mass transit, industrial, connected devices, and wired infrastructure.

Read More

Before you consider Rogers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rogers wasn't on the list.

While Rogers currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.