Janus Henderson Group PLC lowered its position in Nomad Foods Limited (NYSE:NOMD - Free Report) by 48.3% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 725,137 shares of the company's stock after selling 677,021 shares during the quarter. Janus Henderson Group PLC owned 0.44% of Nomad Foods worth $13,821,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

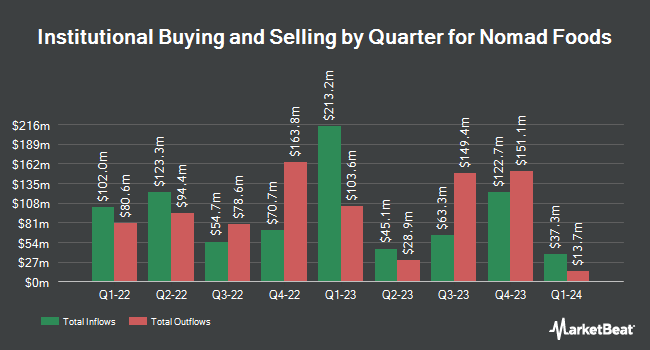

A number of other large investors have also added to or reduced their stakes in NOMD. Vanguard Group Inc. lifted its holdings in Nomad Foods by 628.5% during the 1st quarter. Vanguard Group Inc. now owns 889,467 shares of the company's stock worth $17,398,000 after buying an additional 767,366 shares during the period. Renaissance Technologies LLC boosted its holdings in Nomad Foods by 8.3% in the second quarter. Renaissance Technologies LLC now owns 4,179,679 shares of the company's stock valued at $68,881,000 after acquiring an additional 320,900 shares during the last quarter. Assenagon Asset Management S.A. increased its position in Nomad Foods by 123.2% during the 2nd quarter. Assenagon Asset Management S.A. now owns 548,738 shares of the company's stock valued at $9,043,000 after purchasing an additional 302,913 shares during the period. Loomis Sayles & Co. L P raised its holdings in Nomad Foods by 25.6% during the 3rd quarter. Loomis Sayles & Co. L P now owns 1,418,497 shares of the company's stock worth $27,036,000 after purchasing an additional 289,090 shares during the last quarter. Finally, Thompson Siegel & Walmsley LLC lifted its position in shares of Nomad Foods by 47.4% in the 2nd quarter. Thompson Siegel & Walmsley LLC now owns 472,133 shares of the company's stock worth $7,781,000 after purchasing an additional 151,810 shares during the period. Institutional investors own 75.26% of the company's stock.

Nomad Foods Stock Down 3.7 %

Shares of Nomad Foods stock traded down $0.66 during trading on Friday, reaching $17.07. 1,200,360 shares of the company traded hands, compared to its average volume of 1,011,620. The company has a debt-to-equity ratio of 0.79, a current ratio of 1.20 and a quick ratio of 0.72. The firm has a market capitalization of $2.78 billion, a PE ratio of 12.83 and a beta of 0.78. The company has a 50 day moving average price of $17.63 and a 200-day moving average price of $17.89. Nomad Foods Limited has a 1-year low of $15.99 and a 1-year high of $20.05.

Nomad Foods Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, November 26th. Stockholders of record on Friday, November 8th were given a dividend of $0.15 per share. The ex-dividend date was Friday, November 8th. This represents a $0.60 dividend on an annualized basis and a dividend yield of 3.51%. Nomad Foods's dividend payout ratio (DPR) is presently 45.11%.

Analyst Ratings Changes

NOMD has been the subject of several recent analyst reports. StockNews.com upgraded shares of Nomad Foods from a "hold" rating to a "buy" rating in a research report on Monday, November 18th. Deutsche Bank Aktiengesellschaft dropped their price objective on Nomad Foods from $25.00 to $23.00 and set a "buy" rating on the stock in a research note on Monday, November 4th.

Get Our Latest Stock Report on NOMD

Nomad Foods Profile

(

Free Report)

Nomad Foods Limited, together with its subsidiaries, manufactures, markets, and distributes a range of frozen food products in the United Kingdom and internationally. The company offers frozen fish products, including fish fingers, coated fish, and natural fish; ready-to-cook vegetable products, such as peas and spinach; and frozen poultry and meat products comprising nuggets, grills, and burgers.

Featured Articles

Before you consider Nomad Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nomad Foods wasn't on the list.

While Nomad Foods currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.