Janus Henderson Group PLC reduced its stake in Mirion Technologies, Inc. (NYSE:MIR - Free Report) by 6.7% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 8,100,777 shares of the company's stock after selling 584,490 shares during the quarter. Janus Henderson Group PLC owned about 3.49% of Mirion Technologies worth $89,675,000 as of its most recent filing with the Securities & Exchange Commission.

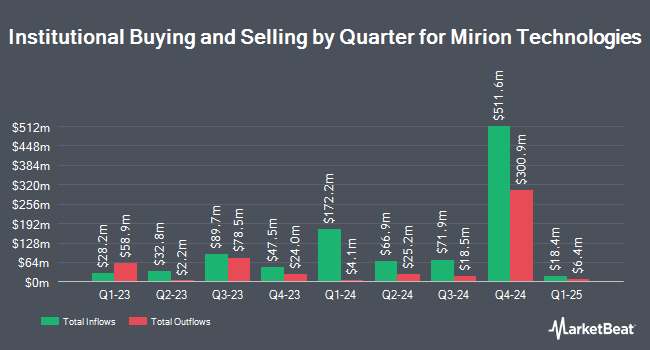

A number of other hedge funds have also recently made changes to their positions in the stock. Millennium Management LLC lifted its position in Mirion Technologies by 509.8% in the 2nd quarter. Millennium Management LLC now owns 533,534 shares of the company's stock valued at $5,730,000 after acquiring an additional 446,034 shares in the last quarter. Corsair Capital Management L.P. lifted its position in Mirion Technologies by 83.9% in the 3rd quarter. Corsair Capital Management L.P. now owns 3,160,850 shares of the company's stock valued at $34,991,000 after acquiring an additional 1,441,846 shares in the last quarter. State of New Jersey Common Pension Fund D bought a new position in Mirion Technologies in the 2nd quarter valued at approximately $1,890,000. Telemark Asset Management LLC bought a new position in Mirion Technologies in the 3rd quarter valued at approximately $4,428,000. Finally, Concentric Capital Strategies LP bought a new position in Mirion Technologies in the 3rd quarter valued at approximately $1,234,000. 78.51% of the stock is owned by institutional investors.

Insider Transactions at Mirion Technologies

In other Mirion Technologies news, CEO Thomas D. Logan sold 7,500 shares of the stock in a transaction on Tuesday, September 24th. The stock was sold at an average price of $10.47, for a total value of $78,525.00. Following the completion of the sale, the chief executive officer now owns 1,544,017 shares in the company, valued at approximately $16,165,857.99. This represents a 0.48 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, insider Emmanuelle Lee sold 5,000 shares of the stock in a transaction on Tuesday, September 24th. The stock was sold at an average price of $10.60, for a total value of $53,000.00. Following the completion of the sale, the insider now owns 138,193 shares of the company's stock, valued at $1,464,845.80. The trade was a 3.49 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 23,405 shares of company stock worth $285,939 in the last three months. Corporate insiders own 2.20% of the company's stock.

Mirion Technologies Stock Performance

Shares of NYSE MIR traded up $0.96 during midday trading on Thursday, hitting $18.03. 5,196,190 shares of the stock traded hands, compared to its average volume of 1,400,492. The company has a debt-to-equity ratio of 0.43, a quick ratio of 1.55 and a current ratio of 2.16. The firm has a market capitalization of $4.19 billion, a P/E ratio of -53.03 and a beta of 0.76. Mirion Technologies, Inc. has a one year low of $9.07 and a one year high of $18.67. The firm has a 50-day moving average of $14.55 and a two-hundred day moving average of $11.92.

Mirion Technologies (NYSE:MIR - Get Free Report) last posted its quarterly earnings data on Tuesday, October 29th. The company reported $0.08 EPS for the quarter, missing the consensus estimate of $0.10 by ($0.02). The company had revenue of $206.80 million during the quarter, compared to analysts' expectations of $203.67 million. Mirion Technologies had a positive return on equity of 4.33% and a negative net margin of 7.84%. The company's revenue for the quarter was up 8.2% on a year-over-year basis. During the same quarter last year, the company earned $0.03 earnings per share. On average, equities analysts forecast that Mirion Technologies, Inc. will post 0.36 EPS for the current fiscal year.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on MIR shares. The Goldman Sachs Group increased their price target on Mirion Technologies from $13.00 to $16.00 and gave the company a "buy" rating in a report on Thursday, October 31st. Citigroup increased their price target on Mirion Technologies from $18.00 to $20.00 and gave the company a "buy" rating in a report on Wednesday. Finally, B. Riley started coverage on Mirion Technologies in a report on Thursday, September 26th. They set a "buy" rating and a $14.00 price target on the stock.

Check Out Our Latest Research Report on MIR

Mirion Technologies Company Profile

(

Free Report)

Mirion Technologies, Inc provides radiation detection, measurement, analysis, and monitoring products and services in the United States, Canada, the United Kingdom, France, Germany, Finland, China, Belgium, Netherlands, Estonia, South Korea, and Japan. It operates through two segments, Medical and Technologies.

See Also

Before you consider Mirion Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mirion Technologies wasn't on the list.

While Mirion Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.