Janus Henderson Group PLC decreased its position in MongoDB, Inc. (NASDAQ:MDB - Free Report) by 93.2% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 7,914 shares of the company's stock after selling 108,352 shares during the quarter. Janus Henderson Group PLC's holdings in MongoDB were worth $2,139,000 as of its most recent filing with the Securities and Exchange Commission.

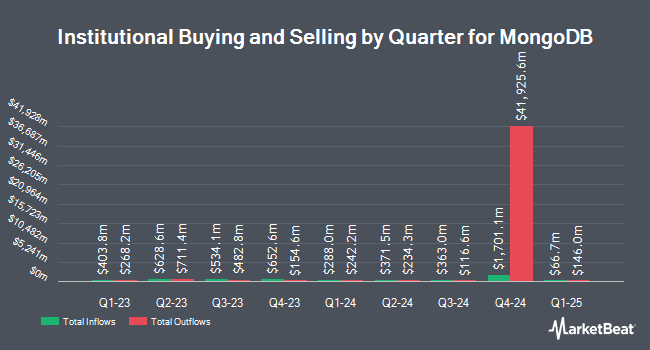

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. MFA Wealth Advisors LLC purchased a new stake in MongoDB in the 2nd quarter valued at about $25,000. Quarry LP raised its stake in MongoDB by 2,580.0% during the second quarter. Quarry LP now owns 134 shares of the company's stock worth $33,000 after purchasing an additional 129 shares during the period. Hantz Financial Services Inc. acquired a new position in shares of MongoDB in the 2nd quarter valued at $35,000. Brooklyn Investment Group purchased a new stake in shares of MongoDB during the 3rd quarter valued at $36,000. Finally, GAMMA Investing LLC raised its position in shares of MongoDB by 178.8% in the 3rd quarter. GAMMA Investing LLC now owns 145 shares of the company's stock worth $39,000 after buying an additional 93 shares during the period. 89.29% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at MongoDB

In other MongoDB news, CRO Cedric Pech sold 302 shares of the company's stock in a transaction dated Wednesday, October 2nd. The shares were sold at an average price of $256.25, for a total transaction of $77,387.50. Following the completion of the sale, the executive now directly owns 33,440 shares in the company, valued at $8,569,000. This represents a 0.90 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CFO Michael Lawrence Gordon sold 5,000 shares of the business's stock in a transaction dated Monday, October 14th. The stock was sold at an average price of $290.31, for a total value of $1,451,550.00. Following the transaction, the chief financial officer now directly owns 80,307 shares of the company's stock, valued at $23,313,925.17. This represents a 5.86 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 26,600 shares of company stock valued at $7,611,849. Insiders own 3.60% of the company's stock.

Wall Street Analyst Weigh In

Several research analysts have commented on MDB shares. Scotiabank raised their price objective on MongoDB from $295.00 to $350.00 and gave the company a "sector perform" rating in a research report on Tuesday. Loop Capital raised their target price on MongoDB from $315.00 to $400.00 and gave the company a "buy" rating in a report on Monday, December 2nd. DA Davidson upped their price target on MongoDB from $340.00 to $405.00 and gave the stock a "buy" rating in a report on Tuesday. Oppenheimer increased their price objective on shares of MongoDB from $350.00 to $400.00 and gave the company an "outperform" rating in a research report on Tuesday. Finally, Citigroup boosted their target price on shares of MongoDB from $350.00 to $400.00 and gave the stock a "buy" rating in a research report on Tuesday, September 3rd. One analyst has rated the stock with a sell rating, six have given a hold rating, twenty have assigned a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $370.08.

Get Our Latest Analysis on MongoDB

MongoDB Stock Performance

NASDAQ:MDB traded down $21.42 during trading hours on Friday, hitting $267.19. 5,086,127 shares of the company's stock traded hands, compared to its average volume of 1,534,332. The stock's fifty day moving average price is $293.13 and its two-hundred day moving average price is $269.12. The firm has a market cap of $19.74 billion, a P/E ratio of -97.51 and a beta of 1.17. MongoDB, Inc. has a twelve month low of $212.74 and a twelve month high of $509.62.

MongoDB (NASDAQ:MDB - Get Free Report) last announced its quarterly earnings data on Monday, December 9th. The company reported $1.16 EPS for the quarter, beating analysts' consensus estimates of $0.68 by $0.48. The firm had revenue of $529.40 million for the quarter, compared to the consensus estimate of $497.39 million. MongoDB had a negative net margin of 10.46% and a negative return on equity of 12.22%. The firm's revenue was up 22.3% on a year-over-year basis. During the same period in the previous year, the firm posted $0.96 earnings per share. On average, equities research analysts predict that MongoDB, Inc. will post -2.29 earnings per share for the current year.

About MongoDB

(

Free Report)

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

See Also

Before you consider MongoDB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MongoDB wasn't on the list.

While MongoDB currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.