Thrivent Financial for Lutherans lessened its holdings in Janus International Group, Inc. (NYSE:JBI - Free Report) by 3.8% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 5,345,183 shares of the company's stock after selling 209,080 shares during the period. Thrivent Financial for Lutherans owned about 3.79% of Janus International Group worth $54,040,000 as of its most recent SEC filing.

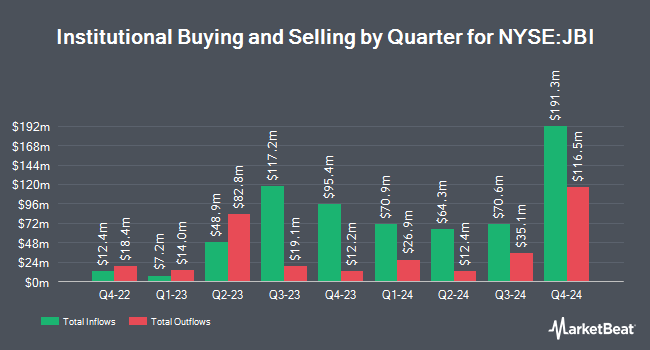

Several other hedge funds and other institutional investors have also modified their holdings of JBI. SG Americas Securities LLC acquired a new stake in shares of Janus International Group in the first quarter worth $257,000. Swiss National Bank increased its position in Janus International Group by 19.0% in the 1st quarter. Swiss National Bank now owns 275,500 shares of the company's stock worth $4,168,000 after purchasing an additional 44,000 shares during the last quarter. Sei Investments Co. raised its stake in shares of Janus International Group by 3.4% during the 1st quarter. Sei Investments Co. now owns 197,487 shares of the company's stock worth $2,988,000 after purchasing an additional 6,424 shares in the last quarter. ProShare Advisors LLC lifted its holdings in shares of Janus International Group by 8.5% during the 1st quarter. ProShare Advisors LLC now owns 15,267 shares of the company's stock valued at $231,000 after buying an additional 1,201 shares during the last quarter. Finally, Vanguard Group Inc. increased its holdings in Janus International Group by 15.6% in the first quarter. Vanguard Group Inc. now owns 13,453,678 shares of the company's stock worth $203,554,000 after buying an additional 1,817,144 shares during the last quarter. Institutional investors and hedge funds own 88.78% of the company's stock.

Analysts Set New Price Targets

JBI has been the subject of a number of analyst reports. KeyCorp reduced their target price on shares of Janus International Group from $13.00 to $11.00 and set an "overweight" rating for the company in a research note on Wednesday, October 30th. UBS Group decreased their price objective on shares of Janus International Group from $12.00 to $8.50 and set a "neutral" rating for the company in a report on Wednesday, October 30th. Jefferies Financial Group lowered Janus International Group from a "buy" rating to a "hold" rating and cut their target price for the company from $12.00 to $7.50 in a report on Monday, November 4th. Benchmark decreased their price target on Janus International Group from $21.00 to $14.00 and set a "buy" rating for the company in a research note on Friday, August 9th. Finally, Wolfe Research downgraded Janus International Group from an "outperform" rating to a "peer perform" rating in a research note on Monday, August 12th. Three equities research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus target price of $10.25.

Check Out Our Latest Analysis on Janus International Group

Janus International Group Stock Performance

NYSE:JBI traded down $0.06 during trading hours on Tuesday, hitting $7.10. 600,826 shares of the company traded hands, compared to its average volume of 2,034,734. Janus International Group, Inc. has a twelve month low of $6.68 and a twelve month high of $15.86. The stock has a market capitalization of $1.00 billion, a price-to-earnings ratio of 9.82 and a beta of 0.92. The company has a current ratio of 2.80, a quick ratio of 2.39 and a debt-to-equity ratio of 1.11. The firm has a 50-day moving average of $9.20 and a 200 day moving average of $11.52.

Janus International Group (NYSE:JBI - Get Free Report) last announced its quarterly earnings data on Tuesday, October 29th. The company reported $0.11 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.20 by ($0.09). Janus International Group had a net margin of 10.62% and a return on equity of 21.10%. The business had revenue of $230.10 million during the quarter, compared to analyst estimates of $248.21 million. During the same quarter in the prior year, the company posted $0.27 EPS. The company's quarterly revenue was down 17.9% compared to the same quarter last year. On average, analysts forecast that Janus International Group, Inc. will post 0.54 EPS for the current year.

Janus International Group Company Profile

(

Free Report)

Janus International Group, Inc manufacturers and supplies turn-key self-storage, and commercial and industrial building solutions in North America and internationally. The company offers roll up and swing doors, hallway systems, relocatable storage moveable additional storage structures units, and other solutions.

Read More

Before you consider Janus International Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Janus International Group wasn't on the list.

While Janus International Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.