UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lowered its holdings in Janus International Group, Inc. (NYSE:JBI - Free Report) by 22.3% in the third quarter, according to its most recent Form 13F filing with the SEC. The fund owned 266,122 shares of the company's stock after selling 76,321 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned about 0.19% of Janus International Group worth $2,690,000 at the end of the most recent reporting period.

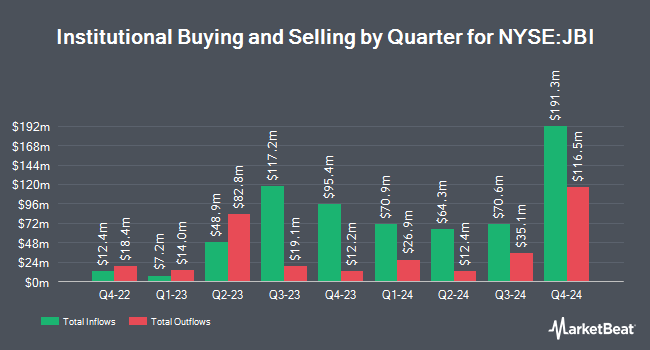

A number of other institutional investors and hedge funds have also recently bought and sold shares of JBI. Point72 Hong Kong Ltd purchased a new position in Janus International Group in the second quarter valued at about $60,000. Amalgamated Bank boosted its holdings in Janus International Group by 73.2% in the second quarter. Amalgamated Bank now owns 4,909 shares of the company's stock valued at $62,000 after purchasing an additional 2,074 shares during the last quarter. Quarry LP boosted its holdings in Janus International Group by 216.4% in the second quarter. Quarry LP now owns 6,527 shares of the company's stock valued at $82,000 after purchasing an additional 4,464 shares during the last quarter. Comerica Bank boosted its holdings in Janus International Group by 78.8% in the first quarter. Comerica Bank now owns 6,721 shares of the company's stock valued at $102,000 after purchasing an additional 2,962 shares during the last quarter. Finally, SkyView Investment Advisors LLC purchased a new position in Janus International Group in the second quarter valued at about $126,000. Hedge funds and other institutional investors own 88.78% of the company's stock.

Janus International Group Stock Performance

NYSE:JBI traded up $0.18 during trading hours on Friday, reaching $7.92. 1,921,631 shares of the stock were exchanged, compared to its average volume of 1,993,779. The company has a quick ratio of 2.39, a current ratio of 2.80 and a debt-to-equity ratio of 1.11. The firm has a 50 day simple moving average of $8.28 and a 200-day simple moving average of $10.66. Janus International Group, Inc. has a 52 week low of $6.68 and a 52 week high of $15.86. The stock has a market capitalization of $1.12 billion, a P/E ratio of 11.00 and a beta of 0.91.

Janus International Group (NYSE:JBI - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The company reported $0.11 earnings per share for the quarter, missing analysts' consensus estimates of $0.20 by ($0.09). The company had revenue of $230.10 million for the quarter, compared to analyst estimates of $248.21 million. Janus International Group had a return on equity of 21.10% and a net margin of 10.62%. The firm's revenue for the quarter was down 17.9% compared to the same quarter last year. During the same quarter in the previous year, the company posted $0.27 earnings per share. As a group, sell-side analysts forecast that Janus International Group, Inc. will post 0.54 earnings per share for the current fiscal year.

Analyst Ratings Changes

JBI has been the subject of a number of analyst reports. KeyCorp reduced their price target on Janus International Group from $13.00 to $11.00 and set an "overweight" rating for the company in a report on Wednesday, October 30th. UBS Group reduced their target price on Janus International Group from $12.00 to $8.50 and set a "neutral" rating on the stock in a report on Wednesday, October 30th. Finally, Jefferies Financial Group downgraded Janus International Group from a "buy" rating to a "hold" rating and reduced their target price for the stock from $12.00 to $7.50 in a report on Monday, November 4th. Three investment analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $10.25.

Get Our Latest Analysis on Janus International Group

Janus International Group Profile

(

Free Report)

Janus International Group, Inc manufacturers and supplies turn-key self-storage, and commercial and industrial building solutions in North America and internationally. The company offers roll up and swing doors, hallway systems, relocatable storage moveable additional storage structures units, and other solutions.

Recommended Stories

Before you consider Janus International Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Janus International Group wasn't on the list.

While Janus International Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.