Entropy Technologies LP boosted its position in Jefferies Financial Group Inc. (NYSE:JEF - Free Report) by 74.9% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 24,001 shares of the financial services provider's stock after purchasing an additional 10,279 shares during the period. Entropy Technologies LP's holdings in Jefferies Financial Group were worth $1,477,000 as of its most recent SEC filing.

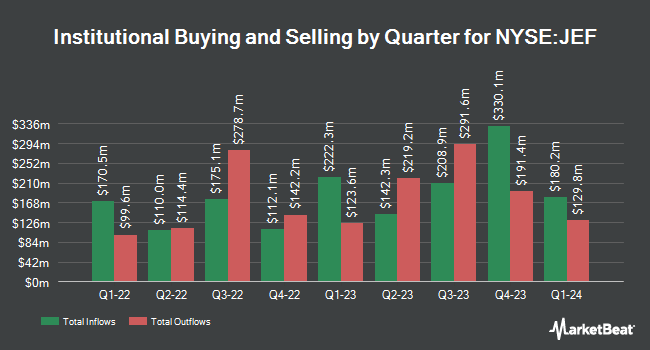

Several other institutional investors and hedge funds have also bought and sold shares of JEF. Lisanti Capital Growth LLC purchased a new position in shares of Jefferies Financial Group in the third quarter worth about $1,718,000. State of New Jersey Common Pension Fund D grew its stake in Jefferies Financial Group by 5.6% in the 3rd quarter. State of New Jersey Common Pension Fund D now owns 46,979 shares of the financial services provider's stock valued at $2,892,000 after buying an additional 2,486 shares in the last quarter. Carmel Capital Partners LLC raised its holdings in Jefferies Financial Group by 70.8% during the 3rd quarter. Carmel Capital Partners LLC now owns 19,474 shares of the financial services provider's stock valued at $1,199,000 after acquiring an additional 8,074 shares during the period. Forum Financial Management LP lifted its position in shares of Jefferies Financial Group by 7.1% during the third quarter. Forum Financial Management LP now owns 7,290 shares of the financial services provider's stock worth $449,000 after acquiring an additional 481 shares in the last quarter. Finally, Phillips Wealth Planners LLC bought a new position in shares of Jefferies Financial Group in the third quarter worth $219,000. 60.88% of the stock is owned by institutional investors.

Insider Transactions at Jefferies Financial Group

In other Jefferies Financial Group news, President Brian P. Friedman sold 200,000 shares of Jefferies Financial Group stock in a transaction that occurred on Thursday, October 10th. The shares were sold at an average price of $63.09, for a total transaction of $12,618,000.00. Following the transaction, the president now owns 604,606 shares of the company's stock, valued at $38,144,592.54. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. In other news, President Brian P. Friedman sold 200,000 shares of the business's stock in a transaction dated Thursday, October 10th. The stock was sold at an average price of $63.09, for a total value of $12,618,000.00. Following the transaction, the president now directly owns 604,606 shares in the company, valued at $38,144,592.54. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director Mitsui Financial Grou Sumitomo acquired 9,247,081 shares of the business's stock in a transaction on Thursday, September 19th. The shares were bought at an average cost of $59.67 per share, with a total value of $551,773,323.27. Following the completion of the acquisition, the director now owns 9,247,081 shares in the company, valued at approximately $551,773,323.27. The disclosure for this purchase can be found here. Insiders have sold 1,286,923 shares of company stock valued at $88,999,151 over the last quarter. 20.40% of the stock is currently owned by company insiders.

Wall Street Analysts Forecast Growth

A number of brokerages recently issued reports on JEF. Oppenheimer increased their price objective on Jefferies Financial Group from $71.00 to $73.00 and gave the stock an "outperform" rating in a report on Tuesday, November 5th. UBS Group began coverage on shares of Jefferies Financial Group in a report on Tuesday, September 17th. They issued a "buy" rating and a $67.00 price target for the company. Finally, Morgan Stanley boosted their price target on shares of Jefferies Financial Group from $59.00 to $64.00 and gave the stock an "equal weight" rating in a research note on Monday, September 23rd.

View Our Latest Stock Analysis on Jefferies Financial Group

Jefferies Financial Group Stock Performance

JEF traded up $0.30 during mid-day trading on Wednesday, reaching $74.62. 1,357,113 shares of the company traded hands, compared to its average volume of 1,263,342. The stock has a market capitalization of $15.33 billion, a P/E ratio of 32.09 and a beta of 1.31. The company has a quick ratio of 1.03, a current ratio of 1.03 and a debt-to-equity ratio of 1.53. The company's fifty day moving average price is $63.38 and its 200-day moving average price is $55.18. Jefferies Financial Group Inc. has a 52-week low of $34.34 and a 52-week high of $75.81.

Jefferies Financial Group (NYSE:JEF - Get Free Report) last posted its quarterly earnings data on Wednesday, September 25th. The financial services provider reported $0.75 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.78 by ($0.03). Jefferies Financial Group had a return on equity of 6.40% and a net margin of 9.27%. The business had revenue of $1.68 billion during the quarter, compared to analysts' expectations of $1.71 billion. During the same period in the previous year, the business posted $0.32 EPS. The business's quarterly revenue was up 42.4% compared to the same quarter last year. On average, sell-side analysts expect that Jefferies Financial Group Inc. will post 3.13 EPS for the current year.

Jefferies Financial Group Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, November 27th. Shareholders of record on Monday, November 18th will be given a $0.35 dividend. This represents a $1.40 dividend on an annualized basis and a yield of 1.88%. The ex-dividend date of this dividend is Monday, November 18th. Jefferies Financial Group's payout ratio is 59.83%.

Jefferies Financial Group Company Profile

(

Free Report)

Jefferies Financial Group Inc operates as an investment banking and capital markets firm in the Americas, Europe, the Middle East, and the Asia-Pacific. The company operates in two segments, Investment Banking and Capital Markets, and Asset Management. It provides investment banking, advisory services with respect to mergers or acquisitions, debt financing, restructurings or recapitalizations, and private capital advisory transactions; underwriting and placement services related to corporate debt, municipal bonds, mortgage-backed and asset-backed securities, equity and equity-linked securities, and loan syndication services; and corporate lending services.

Featured Stories

Before you consider Jefferies Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jefferies Financial Group wasn't on the list.

While Jefferies Financial Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report