Mercury Systems (NASDAQ:MRCY - Get Free Report) was upgraded by investment analysts at Jefferies Financial Group from an "underperform" rating to a "hold" rating in a report issued on Monday, Marketbeat reports. The brokerage currently has a $42.00 price objective on the technology company's stock, up from their previous price objective of $30.00. Jefferies Financial Group's target price would suggest a potential downside of 4.24% from the stock's current price.

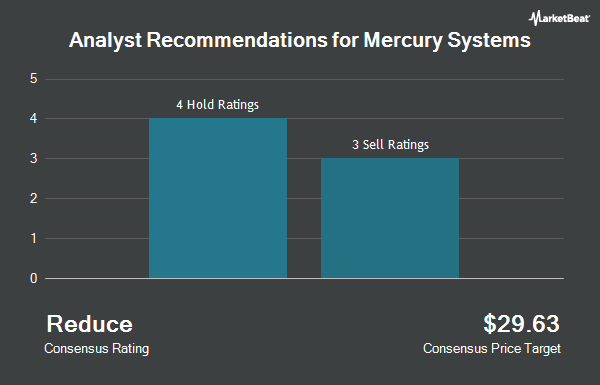

Several other analysts have also recently commented on the company. JPMorgan Chase & Co. boosted their price target on Mercury Systems from $36.00 to $40.00 and gave the stock a "neutral" rating in a research report on Thursday. Royal Bank of Canada boosted their price target on shares of Mercury Systems from $30.00 to $35.00 and gave the stock a "sector perform" rating in a research report on Wednesday, August 14th. Truist Financial upped their price objective on shares of Mercury Systems from $26.00 to $31.00 and gave the company a "hold" rating in a research note on Wednesday, August 14th. Robert W. Baird boosted their target price on Mercury Systems from $26.00 to $37.00 and gave the stock a "neutral" rating in a report on Wednesday, August 14th. Finally, Alembic Global Advisors upgraded Mercury Systems from a "neutral" rating to an "overweight" rating and set a $48.00 price target for the company in a research report on Monday, August 19th. Three research analysts have rated the stock with a sell rating, five have given a hold rating and one has issued a buy rating to the company. According to data from MarketBeat, Mercury Systems presently has a consensus rating of "Hold" and an average price target of $35.50.

Check Out Our Latest Analysis on MRCY

Mercury Systems Price Performance

Shares of MRCY stock traded up $1.16 during trading hours on Monday, hitting $43.86. 396,461 shares of the company's stock were exchanged, compared to its average volume of 586,706. Mercury Systems has a fifty-two week low of $25.31 and a fifty-two week high of $44.23. The firm has a market cap of $2.62 billion, a P/E ratio of -21.40 and a beta of 0.71. The company has a quick ratio of 2.64, a current ratio of 4.10 and a debt-to-equity ratio of 0.41. The firm has a 50 day moving average of $36.18 and a two-hundred day moving average of $33.40.

Mercury Systems (NASDAQ:MRCY - Get Free Report) last posted its quarterly earnings data on Tuesday, August 13th. The technology company reported $0.09 earnings per share for the quarter, topping analysts' consensus estimates of ($0.23) by $0.32. Mercury Systems had a negative net margin of 13.80% and a negative return on equity of 3.96%. The company had revenue of $248.56 million during the quarter, compared to analysts' expectations of $223.80 million. Sell-side analysts forecast that Mercury Systems will post -0.52 EPS for the current year.

Insiders Place Their Bets

In other news, Director Jana Partners Management, Lp acquired 13,600 shares of the company's stock in a transaction dated Tuesday, August 27th. The stock was acquired at an average cost of $37.25 per share, with a total value of $506,600.00. Following the completion of the purchase, the director now owns 6,944,633 shares of the company's stock, valued at $258,687,579.25. This represents a 0.00 % increase in their position. The acquisition was disclosed in a document filed with the SEC, which is available at this link. In other Mercury Systems news, Director Jana Partners Management, Lp purchased 13,600 shares of the firm's stock in a transaction on Tuesday, August 27th. The stock was bought at an average price of $37.25 per share, with a total value of $506,600.00. Following the transaction, the director now directly owns 6,944,633 shares of the company's stock, valued at approximately $258,687,579.25. This represents a 0.00 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO William L. Ballhaus sold 6,549 shares of the company's stock in a transaction on Monday, August 19th. The stock was sold at an average price of $39.49, for a total value of $258,620.01. Following the sale, the chief executive officer now directly owns 353,481 shares in the company, valued at $13,958,964.69. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 22,099 shares of company stock valued at $865,740 over the last 90 days. 1.60% of the stock is owned by company insiders.

Hedge Funds Weigh In On Mercury Systems

Institutional investors and hedge funds have recently made changes to their positions in the stock. William Blair Investment Management LLC grew its holdings in Mercury Systems by 0.6% during the 2nd quarter. William Blair Investment Management LLC now owns 6,416,449 shares of the technology company's stock worth $173,180,000 after acquiring an additional 36,923 shares in the last quarter. Dimensional Fund Advisors LP lifted its position in shares of Mercury Systems by 1.0% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,027,158 shares of the technology company's stock worth $54,713,000 after purchasing an additional 20,604 shares during the last quarter. Westwood Holdings Group Inc. grew its stake in shares of Mercury Systems by 14.7% during the first quarter. Westwood Holdings Group Inc. now owns 1,554,166 shares of the technology company's stock worth $45,848,000 after purchasing an additional 199,600 shares in the last quarter. Conestoga Capital Advisors LLC raised its stake in Mercury Systems by 1.6% in the third quarter. Conestoga Capital Advisors LLC now owns 1,329,265 shares of the technology company's stock valued at $49,183,000 after buying an additional 20,300 shares in the last quarter. Finally, Clearline Capital LP lifted its holdings in Mercury Systems by 18.4% during the 2nd quarter. Clearline Capital LP now owns 526,611 shares of the technology company's stock worth $14,213,000 after buying an additional 81,826 shares during the last quarter. 95.99% of the stock is owned by institutional investors and hedge funds.

About Mercury Systems

(

Get Free Report)

Mercury Systems, Inc, a technology company, manufactures and sells components, products, modules, and subsystems for aerospace and defense industries in the United States, Europe, and the Asia Pacific. Its products and solutions are deployed in approximately 300 programs with 25 defense contractors and commercial aviation customers.

Featured Articles

Before you consider Mercury Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mercury Systems wasn't on the list.

While Mercury Systems currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report