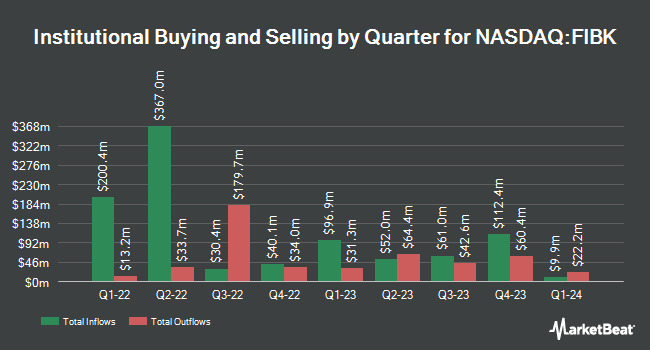

Jennison Associates LLC grew its position in First Interstate BancSystem, Inc. (NASDAQ:FIBK - Free Report) by 57.3% in the 3rd quarter, according to its most recent filing with the SEC. The firm owned 885,802 shares of the financial services provider's stock after buying an additional 322,578 shares during the period. Jennison Associates LLC owned 0.85% of First Interstate BancSystem worth $27,176,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds also recently made changes to their positions in FIBK. CWM LLC lifted its stake in shares of First Interstate BancSystem by 16.0% in the 2nd quarter. CWM LLC now owns 3,123 shares of the financial services provider's stock valued at $87,000 after purchasing an additional 430 shares during the period. Innealta Capital LLC bought a new position in First Interstate BancSystem during the second quarter worth about $106,000. nVerses Capital LLC boosted its holdings in First Interstate BancSystem by 412.5% during the second quarter. nVerses Capital LLC now owns 4,100 shares of the financial services provider's stock worth $114,000 after buying an additional 3,300 shares during the last quarter. Telos Capital Management Inc. acquired a new position in shares of First Interstate BancSystem during the 3rd quarter worth about $201,000. Finally, Washington Trust Bank bought a new stake in shares of First Interstate BancSystem in the 2nd quarter valued at about $204,000. Institutional investors own 88.71% of the company's stock.

Insider Transactions at First Interstate BancSystem

In other First Interstate BancSystem news, Director Jonathan R. Scott sold 6,500 shares of the company's stock in a transaction on Wednesday, November 13th. The shares were sold at an average price of $34.18, for a total transaction of $222,170.00. Following the sale, the director now directly owns 958,710 shares of the company's stock, valued at approximately $32,768,707.80. This represents a 0.67 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, major shareholder Julie A. Scott sold 22,050 shares of First Interstate BancSystem stock in a transaction dated Tuesday, November 12th. The shares were sold at an average price of $33.80, for a total transaction of $745,290.00. Following the completion of the transaction, the insider now directly owns 613,019 shares of the company's stock, valued at approximately $20,720,042.20. This trade represents a 3.47 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 48,770 shares of company stock worth $1,630,272 in the last three months. Insiders own 6.90% of the company's stock.

Wall Street Analyst Weigh In

Several research analysts recently weighed in on FIBK shares. Stephens reissued an "overweight" rating and set a $36.00 price objective on shares of First Interstate BancSystem in a research note on Thursday, October 10th. Wells Fargo & Company lowered shares of First Interstate BancSystem from an "equal weight" rating to an "underweight" rating and decreased their price target for the company from $30.00 to $28.00 in a report on Tuesday, October 1st. DA Davidson upped their price objective on shares of First Interstate BancSystem from $27.00 to $34.00 and gave the company a "neutral" rating in a research report on Monday, July 29th. Barclays lowered First Interstate BancSystem from an "equal weight" rating to an "underweight" rating and reduced their target price for the stock from $32.00 to $30.00 in a report on Thursday, October 31st. Finally, Keefe, Bruyette & Woods increased their price target on First Interstate BancSystem from $29.00 to $31.00 and gave the stock a "market perform" rating in a report on Monday, July 29th. Three research analysts have rated the stock with a sell rating, two have given a hold rating and two have issued a buy rating to the company. Based on data from MarketBeat, the company presently has an average rating of "Hold" and an average price target of $32.50.

Check Out Our Latest Report on First Interstate BancSystem

First Interstate BancSystem Stock Up 1.8 %

NASDAQ FIBK traded up $0.61 on Friday, reaching $34.44. The company had a trading volume of 367,943 shares, compared to its average volume of 670,848. The company's fifty day moving average is $31.42 and its 200-day moving average is $29.46. First Interstate BancSystem, Inc. has a 1-year low of $24.16 and a 1-year high of $34.61. The firm has a market capitalization of $3.60 billion, a price-to-earnings ratio of 14.89 and a beta of 0.81. The company has a debt-to-equity ratio of 0.71, a quick ratio of 0.78 and a current ratio of 0.78.

First Interstate BancSystem (NASDAQ:FIBK - Get Free Report) last issued its quarterly earnings results on Thursday, October 24th. The financial services provider reported $0.54 earnings per share for the quarter, missing the consensus estimate of $0.58 by ($0.04). First Interstate BancSystem had a return on equity of 7.48% and a net margin of 15.94%. During the same quarter in the prior year, the firm earned $0.70 EPS. On average, research analysts forecast that First Interstate BancSystem, Inc. will post 2.28 earnings per share for the current fiscal year.

First Interstate BancSystem Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, November 14th. Shareholders of record on Monday, November 4th were given a dividend of $0.47 per share. The ex-dividend date of this dividend was Monday, November 4th. This represents a $1.88 annualized dividend and a yield of 5.46%. First Interstate BancSystem's dividend payout ratio (DPR) is presently 82.46%.

First Interstate BancSystem Company Profile

(

Free Report)

First Interstate BancSystem, Inc operates as the bank holding company for First Interstate Bank that provides range of banking products and services in the United States. It offers various traditional depository products, including checking, savings, and time deposits; and repurchase agreements primarily for commercial and municipal depositors.

Further Reading

Before you consider First Interstate BancSystem, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Interstate BancSystem wasn't on the list.

While First Interstate BancSystem currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.