Jennison Associates LLC increased its position in CF Industries Holdings, Inc. (NYSE:CF - Free Report) by 21.5% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 118,412 shares of the basic materials company's stock after acquiring an additional 20,941 shares during the period. Jennison Associates LLC owned approximately 0.07% of CF Industries worth $10,160,000 at the end of the most recent reporting period.

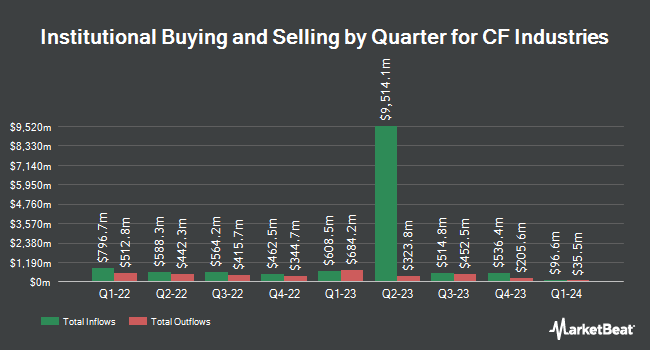

Several other hedge funds have also recently bought and sold shares of CF. Natixis grew its stake in shares of CF Industries by 19.5% in the first quarter. Natixis now owns 11,721 shares of the basic materials company's stock worth $975,000 after purchasing an additional 1,916 shares in the last quarter. CreativeOne Wealth LLC raised its position in shares of CF Industries by 62.3% during the 1st quarter. CreativeOne Wealth LLC now owns 6,470 shares of the basic materials company's stock worth $539,000 after buying an additional 2,484 shares in the last quarter. SVB Wealth LLC lifted its stake in shares of CF Industries by 31.9% in the 1st quarter. SVB Wealth LLC now owns 4,593 shares of the basic materials company's stock worth $382,000 after acquiring an additional 1,110 shares during the period. Earnest Partners LLC boosted its holdings in shares of CF Industries by 6.3% in the first quarter. Earnest Partners LLC now owns 2,133,854 shares of the basic materials company's stock valued at $177,558,000 after acquiring an additional 125,616 shares in the last quarter. Finally, Ascent Group LLC increased its stake in shares of CF Industries by 10.0% during the first quarter. Ascent Group LLC now owns 3,804 shares of the basic materials company's stock valued at $317,000 after acquiring an additional 346 shares during the period. 93.06% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

CF has been the subject of a number of research reports. BMO Capital Markets increased their price target on CF Industries from $95.00 to $100.00 and gave the company an "outperform" rating in a research note on Friday, August 9th. Royal Bank of Canada raised their target price on CF Industries from $95.00 to $100.00 and gave the company an "outperform" rating in a research note on Monday, November 4th. Redburn Atlantic assumed coverage on shares of CF Industries in a report on Friday, October 18th. They issued a "neutral" rating and a $77.00 price target for the company. UBS Group raised their price objective on shares of CF Industries from $80.00 to $85.00 and gave the company a "neutral" rating in a research report on Monday, August 26th. Finally, Bank of America downgraded shares of CF Industries from a "neutral" rating to an "underperform" rating and set a $83.00 target price on the stock. in a report on Wednesday, October 16th. Two analysts have rated the stock with a sell rating, five have given a hold rating and five have given a buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus price target of $88.42.

Read Our Latest Analysis on CF Industries

Insider Buying and Selling

In other CF Industries news, EVP Susan L. Menzel sold 2,000 shares of the business's stock in a transaction that occurred on Friday, October 4th. The shares were sold at an average price of $90.00, for a total value of $180,000.00. Following the completion of the sale, the executive vice president now directly owns 66,268 shares of the company's stock, valued at $5,964,120. The trade was a 2.93 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, VP Ashraf K. Malik sold 7,000 shares of the stock in a transaction on Thursday, November 21st. The stock was sold at an average price of $90.78, for a total transaction of $635,460.00. Following the transaction, the vice president now directly owns 22,211 shares in the company, valued at $2,016,314.58. The trade was a 23.96 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 19,201 shares of company stock worth $1,727,694. Corporate insiders own 0.42% of the company's stock.

CF Industries Stock Down 0.9 %

NYSE:CF traded down $0.85 during trading hours on Friday, hitting $89.79. 1,542,292 shares of the stock traded hands, compared to its average volume of 1,937,570. The firm has a 50 day moving average price of $85.25 and a 200 day moving average price of $79.33. The firm has a market cap of $15.63 billion, a price-to-earnings ratio of 14.21, a PEG ratio of 2.39 and a beta of 0.97. CF Industries Holdings, Inc. has a fifty-two week low of $69.13 and a fifty-two week high of $91.06. The company has a current ratio of 2.81, a quick ratio of 2.52 and a debt-to-equity ratio of 0.38.

CF Industries (NYSE:CF - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The basic materials company reported $1.55 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.05 by $0.50. The firm had revenue of $1.37 billion during the quarter, compared to the consensus estimate of $1.28 billion. CF Industries had a return on equity of 14.57% and a net margin of 19.45%. The business's revenue for the quarter was up 7.6% on a year-over-year basis. During the same period in the prior year, the business earned $0.85 EPS. Equities research analysts anticipate that CF Industries Holdings, Inc. will post 6.32 earnings per share for the current year.

CF Industries Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, November 29th. Stockholders of record on Friday, November 15th will be paid a $0.50 dividend. This represents a $2.00 dividend on an annualized basis and a dividend yield of 2.23%. The ex-dividend date of this dividend is Friday, November 15th. CF Industries's dividend payout ratio (DPR) is presently 31.65%.

CF Industries Profile

(

Free Report)

CF Industries Holdings, Inc, together with its subsidiaries, engages in the manufacture and sale of hydrogen and nitrogen products for energy, fertilizer, emissions abatement, and other industrial activities in North America, Europe, and internationally. It operates through Ammonia, Granular Urea, UAN, AN, and Other segments.

Featured Articles

Before you consider CF Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CF Industries wasn't on the list.

While CF Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.