Jennison Associates LLC decreased its holdings in Casella Waste Systems, Inc. (NASDAQ:CWST - Free Report) by 4.7% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 389,351 shares of the industrial products company's stock after selling 19,345 shares during the quarter. Jennison Associates LLC owned about 0.67% of Casella Waste Systems worth $38,737,000 as of its most recent SEC filing.

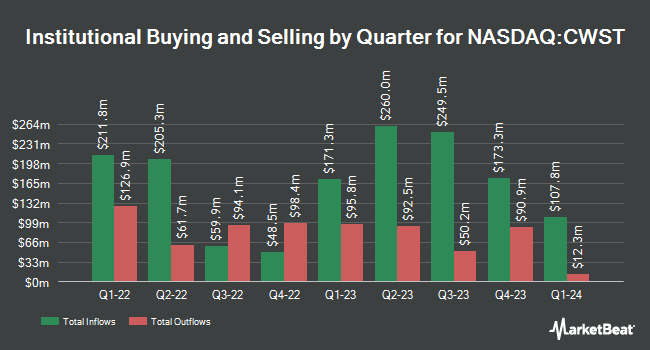

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. US Bancorp DE grew its stake in shares of Casella Waste Systems by 7.9% during the first quarter. US Bancorp DE now owns 3,715 shares of the industrial products company's stock worth $367,000 after acquiring an additional 272 shares during the last quarter. State Board of Administration of Florida Retirement System grew its position in Casella Waste Systems by 1.0% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 16,286 shares of the industrial products company's stock worth $1,610,000 after purchasing an additional 160 shares during the last quarter. Vanguard Group Inc. increased its stake in Casella Waste Systems by 1.1% during the 1st quarter. Vanguard Group Inc. now owns 5,536,410 shares of the industrial products company's stock valued at $547,385,000 after purchasing an additional 57,540 shares in the last quarter. Capital Research Global Investors lifted its stake in shares of Casella Waste Systems by 277.1% during the first quarter. Capital Research Global Investors now owns 723,405 shares of the industrial products company's stock worth $71,523,000 after buying an additional 531,573 shares during the period. Finally, Lazard Asset Management LLC acquired a new position in shares of Casella Waste Systems in the 1st quarter valued at $5,351,000. 99.51% of the stock is currently owned by hedge funds and other institutional investors.

Casella Waste Systems Stock Up 1.3 %

Casella Waste Systems stock traded up $1.45 during mid-day trading on Friday, reaching $112.78. 156,122 shares of the company's stock were exchanged, compared to its average volume of 315,082. The company has a fifty day moving average of $102.90 and a 200-day moving average of $101.90. The company has a market cap of $7.14 billion, a P/E ratio of 927.75, a P/E/G ratio of 6.48 and a beta of 0.99. The company has a quick ratio of 2.48, a current ratio of 2.55 and a debt-to-equity ratio of 0.68. Casella Waste Systems, Inc. has a twelve month low of $79.16 and a twelve month high of $112.85.

Casella Waste Systems (NASDAQ:CWST - Get Free Report) last posted its quarterly earnings results on Wednesday, October 30th. The industrial products company reported $0.27 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.28 by ($0.01). Casella Waste Systems had a net margin of 0.46% and a return on equity of 3.04%. The company had revenue of $411.63 million during the quarter, compared to analyst estimates of $412.59 million. During the same period in the prior year, the business earned $0.35 EPS. Casella Waste Systems's revenue for the quarter was up 16.7% on a year-over-year basis. Sell-side analysts expect that Casella Waste Systems, Inc. will post 0.65 EPS for the current year.

Insider Activity at Casella Waste Systems

In other Casella Waste Systems news, SVP Paul Ligon sold 1,730 shares of the stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $106.81, for a total value of $184,781.30. Following the transaction, the senior vice president now directly owns 21,085 shares in the company, valued at $2,252,088.85. This represents a 7.58 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. 4.24% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

A number of brokerages have commented on CWST. Raymond James lifted their price target on Casella Waste Systems from $121.00 to $122.00 and gave the stock a "strong-buy" rating in a research report on Thursday, September 19th. William Blair began coverage on Casella Waste Systems in a report on Thursday, October 3rd. They set an "outperform" rating for the company. Stifel Nicolaus reiterated a "buy" rating and issued a $117.00 price target (up previously from $110.00) on shares of Casella Waste Systems in a report on Monday, August 5th. Finally, Deutsche Bank Aktiengesellschaft reduced their price target on shares of Casella Waste Systems from $114.00 to $107.00 and set a "hold" rating for the company in a research report on Friday, November 1st. Two research analysts have rated the stock with a hold rating, three have given a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $111.50.

View Our Latest Stock Analysis on Casella Waste Systems

About Casella Waste Systems

(

Free Report)

Casella Waste Systems, Inc, together with its subsidiaries, operates as a vertically integrated solid waste services company in the United States. It offers resource management services primarily in the areas of solid waste collection and disposal, transfer, recycling, and organics services to residential, commercial, municipal, institutional, and industrial customers.

Featured Articles

Before you consider Casella Waste Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Casella Waste Systems wasn't on the list.

While Casella Waste Systems currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.