Jennison Associates LLC decreased its position in Apellis Pharmaceuticals, Inc. (NASDAQ:APLS - Free Report) by 49.3% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 1,821,115 shares of the company's stock after selling 1,770,301 shares during the period. Jennison Associates LLC owned about 1.50% of Apellis Pharmaceuticals worth $52,521,000 as of its most recent SEC filing.

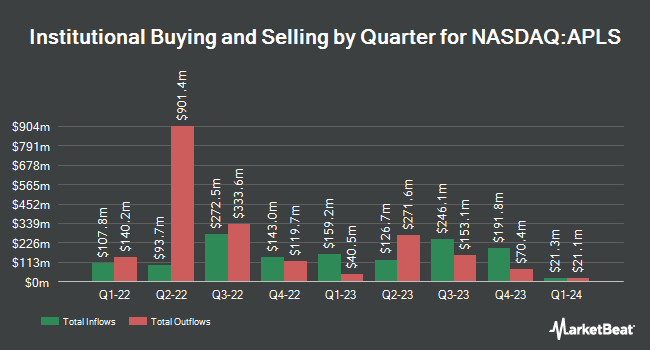

Other hedge funds also recently modified their holdings of the company. Assenagon Asset Management S.A. raised its stake in shares of Apellis Pharmaceuticals by 191.9% in the third quarter. Assenagon Asset Management S.A. now owns 2,144,415 shares of the company's stock valued at $61,845,000 after purchasing an additional 1,409,707 shares in the last quarter. Iron Triangle Partners LP acquired a new position in shares of Apellis Pharmaceuticals in the 1st quarter valued at $32,329,000. Fiera Capital Corp lifted its holdings in shares of Apellis Pharmaceuticals by 47.7% during the 2nd quarter. Fiera Capital Corp now owns 1,401,190 shares of the company's stock worth $53,750,000 after acquiring an additional 452,753 shares during the period. AQR Capital Management LLC boosted its position in shares of Apellis Pharmaceuticals by 337.3% during the 2nd quarter. AQR Capital Management LLC now owns 246,880 shares of the company's stock valued at $9,177,000 after acquiring an additional 190,420 shares in the last quarter. Finally, Redmile Group LLC bought a new stake in Apellis Pharmaceuticals in the first quarter valued at about $9,111,000. Institutional investors own 96.29% of the company's stock.

Apellis Pharmaceuticals Stock Performance

Shares of APLS traded up $2.30 during midday trading on Friday, reaching $30.05. The stock had a trading volume of 1,549,322 shares, compared to its average volume of 1,898,950. The company has a current ratio of 4.36, a quick ratio of 3.73 and a debt-to-equity ratio of 1.91. The firm has a 50 day simple moving average of $29.06 and a 200-day simple moving average of $35.79. The firm has a market cap of $3.74 billion, a PE ratio of -14.85 and a beta of 0.87. Apellis Pharmaceuticals, Inc. has a one year low of $24.34 and a one year high of $73.80.

Apellis Pharmaceuticals (NASDAQ:APLS - Get Free Report) last issued its earnings results on Tuesday, November 5th. The company reported ($0.46) EPS for the quarter, missing the consensus estimate of ($0.32) by ($0.14). Apellis Pharmaceuticals had a negative return on equity of 103.11% and a negative net margin of 34.97%. The business had revenue of $196.83 million for the quarter, compared to the consensus estimate of $200.00 million. During the same quarter in the prior year, the firm posted ($1.17) earnings per share. The business's revenue was up 78.3% compared to the same quarter last year. As a group, sell-side analysts anticipate that Apellis Pharmaceuticals, Inc. will post -1.7 EPS for the current year.

Insider Activity at Apellis Pharmaceuticals

In other Apellis Pharmaceuticals news, Director A. Sinclair Dunlop sold 37,000 shares of the firm's stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $36.23, for a total transaction of $1,340,510.00. Following the completion of the transaction, the director now owns 100,000 shares in the company, valued at approximately $3,623,000. This trade represents a 27.01 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. 6.80% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

A number of equities research analysts have weighed in on APLS shares. The Goldman Sachs Group decreased their price objective on Apellis Pharmaceuticals from $71.00 to $36.00 and set a "buy" rating on the stock in a report on Wednesday, November 6th. Wells Fargo & Company lowered their target price on shares of Apellis Pharmaceuticals from $43.00 to $30.00 and set an "equal weight" rating for the company in a report on Wednesday, November 6th. Royal Bank of Canada reiterated a "sector perform" rating and issued a $25.00 price objective on shares of Apellis Pharmaceuticals in a report on Monday, November 4th. Piper Sandler cut their price target on shares of Apellis Pharmaceuticals from $40.00 to $32.00 and set a "neutral" rating on the stock in a research report on Wednesday, November 6th. Finally, Bank of America decreased their price objective on shares of Apellis Pharmaceuticals from $61.00 to $47.00 and set a "buy" rating for the company in a report on Wednesday, November 6th. Seven investment analysts have rated the stock with a hold rating, eleven have given a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat, Apellis Pharmaceuticals presently has an average rating of "Moderate Buy" and an average target price of $49.94.

Get Our Latest Research Report on APLS

Apellis Pharmaceuticals Company Profile

(

Free Report)

Apellis Pharmaceuticals, Inc, a commercial-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of therapeutic compounds through the inhibition of the complement system for autoimmune and inflammatory diseases. It offers EMPAVELI for the treatment of paroxysmal nocturnal hemoglobinuria, C3 glomerulopathy and immune complex membranoproliferative glomerulonephritis, and hematopoietic stem cell transplantation-associated thrombotic microangiopathy; and SYFOVRE for treating geographic atrophy secondary to age-related macular degeneration and geographic atrophy (GA).

Featured Stories

Before you consider Apellis Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apellis Pharmaceuticals wasn't on the list.

While Apellis Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.