Jennison Associates LLC increased its stake in shares of The Progressive Co. (NYSE:PGR - Free Report) by 21.6% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 4,749,628 shares of the insurance provider's stock after buying an additional 842,109 shares during the quarter. Jennison Associates LLC owned 0.81% of Progressive worth $1,205,266,000 at the end of the most recent reporting period.

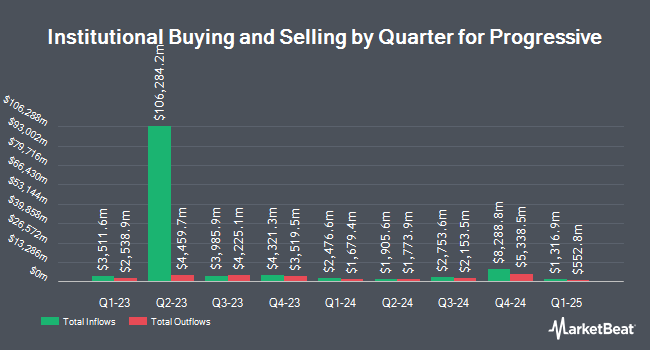

Several other large investors have also recently added to or reduced their stakes in PGR. Avior Wealth Management LLC raised its position in shares of Progressive by 3.1% in the 3rd quarter. Avior Wealth Management LLC now owns 3,221 shares of the insurance provider's stock valued at $817,000 after acquiring an additional 96 shares during the period. B. Metzler seel. Sohn & Co. Holding AG bought a new position in Progressive in the third quarter valued at approximately $8,935,000. Banque Cantonale Vaudoise lifted its position in Progressive by 56.8% in the 3rd quarter. Banque Cantonale Vaudoise now owns 32,883 shares of the insurance provider's stock valued at $8,344,000 after acquiring an additional 11,913 shares in the last quarter. OneAscent Financial Services LLC bought a new stake in Progressive in the 3rd quarter valued at approximately $592,000. Finally, Caprock Group LLC lifted its position in shares of Progressive by 7.3% in the third quarter. Caprock Group LLC now owns 14,547 shares of the insurance provider's stock worth $3,691,000 after purchasing an additional 995 shares in the last quarter. 85.34% of the stock is owned by institutional investors.

Analyst Ratings Changes

Several research firms recently issued reports on PGR. BMO Capital Markets reduced their price target on shares of Progressive from $239.00 to $237.00 and set an "outperform" rating on the stock in a research report on Wednesday, August 7th. HSBC upgraded shares of Progressive from a "hold" rating to a "buy" rating and set a $253.00 price target for the company in a report on Monday, August 12th. Morgan Stanley upped their price objective on Progressive from $300.00 to $310.00 and gave the company an "overweight" rating in a research note on Friday, October 18th. Hsbc Global Res raised Progressive from a "hold" rating to a "strong-buy" rating in a report on Monday, August 12th. Finally, Wells Fargo & Company upped their price target on shares of Progressive from $281.00 to $282.00 and gave the company an "overweight" rating in a research report on Tuesday, September 10th. Five equities research analysts have rated the stock with a hold rating, thirteen have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $269.81.

Read Our Latest Research Report on PGR

Progressive Stock Up 0.7 %

Shares of NYSE PGR traded up $1.86 during midday trading on Wednesday, reaching $256.37. 784,561 shares of the company's stock were exchanged, compared to its average volume of 2,449,841. The business's fifty day moving average price is $252.43 and its two-hundred day moving average price is $230.76. The Progressive Co. has a 52-week low of $149.14 and a 52-week high of $263.85. The stock has a market capitalization of $150.18 billion, a PE ratio of 18.50, a price-to-earnings-growth ratio of 0.71 and a beta of 0.36. The company has a debt-to-equity ratio of 0.25, a quick ratio of 0.30 and a current ratio of 0.30.

Progressive (NYSE:PGR - Get Free Report) last issued its earnings results on Tuesday, October 15th. The insurance provider reported $3.58 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $3.40 by $0.18. The business had revenue of $19.43 billion for the quarter, compared to analysts' expectations of $18.95 billion. Progressive had a return on equity of 33.10% and a net margin of 11.27%. Analysts forecast that The Progressive Co. will post 13.09 EPS for the current year.

Insider Buying and Selling

In other Progressive news, insider Steven Broz sold 2,982 shares of the firm's stock in a transaction on Monday, September 23rd. The stock was sold at an average price of $260.00, for a total transaction of $775,320.00. Following the transaction, the insider now owns 29,334 shares in the company, valued at $7,626,840. This trade represents a 9.23 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Susan Patricia Griffith sold 43,370 shares of Progressive stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $252.20, for a total value of $10,937,914.00. Following the completion of the transaction, the chief executive officer now owns 473,735 shares in the company, valued at approximately $119,475,967. The trade was a 8.39 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 59,209 shares of company stock worth $14,975,979 in the last three months. Insiders own 0.34% of the company's stock.

About Progressive

(

Free Report)

The Progressive Corporation, an insurance holding company, provides personal and commercial auto, personal residential and commercial property, business related general liability, and other specialty property-casualty insurance products and related services in the United States. It operates in three segments: Personal Lines, Commercial Lines, and Property.

Further Reading

Before you consider Progressive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progressive wasn't on the list.

While Progressive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.