Jensen Investment Management Inc. lifted its holdings in The Clorox Company (NYSE:CLX - Free Report) by 106.1% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 58,155 shares of the company's stock after acquiring an additional 29,940 shares during the period. Jensen Investment Management Inc.'s holdings in Clorox were worth $9,474,000 at the end of the most recent reporting period.

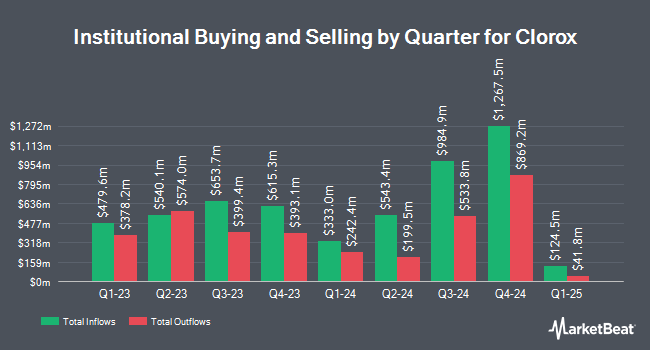

Other institutional investors have also recently made changes to their positions in the company. Texas Permanent School Fund Corp raised its position in shares of Clorox by 1.8% during the first quarter. Texas Permanent School Fund Corp now owns 25,636 shares of the company's stock valued at $3,925,000 after buying an additional 455 shares during the last quarter. Empirical Finance LLC lifted its stake in Clorox by 3.5% in the 1st quarter. Empirical Finance LLC now owns 4,457 shares of the company's stock worth $682,000 after purchasing an additional 152 shares in the last quarter. Envestnet Portfolio Solutions Inc. lifted its stake in Clorox by 13.3% in the 1st quarter. Envestnet Portfolio Solutions Inc. now owns 24,567 shares of the company's stock worth $3,761,000 after purchasing an additional 2,880 shares in the last quarter. Empowered Funds LLC boosted its holdings in shares of Clorox by 8.4% during the 1st quarter. Empowered Funds LLC now owns 20,008 shares of the company's stock valued at $3,063,000 after purchasing an additional 1,558 shares during the last quarter. Finally, Oppenheimer & Co. Inc. grew its position in shares of Clorox by 8.1% during the first quarter. Oppenheimer & Co. Inc. now owns 16,383 shares of the company's stock valued at $2,508,000 after purchasing an additional 1,224 shares in the last quarter. Hedge funds and other institutional investors own 78.53% of the company's stock.

Insider Activity

In other Clorox news, EVP Angela C. Hilt sold 1,733 shares of the firm's stock in a transaction on Friday, September 6th. The stock was sold at an average price of $165.52, for a total transaction of $286,846.16. Following the transaction, the executive vice president now directly owns 13,471 shares in the company, valued at $2,229,719.92. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Insiders own 0.57% of the company's stock.

Clorox Trading Up 1.5 %

CLX traded up $2.39 during trading hours on Friday, reaching $165.16. 1,276,258 shares of the company's stock traded hands, compared to its average volume of 1,255,848. The firm has a 50-day moving average price of $162.14 and a 200 day moving average price of $146.83. The firm has a market capitalization of $20.44 billion, a PE ratio of 57.55, a PEG ratio of 3.01 and a beta of 0.41. The company has a quick ratio of 0.62, a current ratio of 1.00 and a debt-to-equity ratio of 11.08. The Clorox Company has a 52-week low of $127.60 and a 52-week high of $169.09.

Clorox (NYSE:CLX - Get Free Report) last issued its earnings results on Wednesday, October 30th. The company reported $1.86 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.36 by $0.50. The firm had revenue of $1.76 billion during the quarter, compared to analyst estimates of $1.64 billion. Clorox had a net margin of 4.78% and a return on equity of 316.08%. The business's revenue was up 27.0% on a year-over-year basis. During the same period in the previous year, the firm earned $0.49 earnings per share. As a group, sell-side analysts predict that The Clorox Company will post 6.85 EPS for the current fiscal year.

Clorox Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Thursday, November 7th. Stockholders of record on Wednesday, October 23rd were given a dividend of $1.22 per share. This represents a $4.88 dividend on an annualized basis and a dividend yield of 2.95%. The ex-dividend date was Wednesday, October 23rd. Clorox's dividend payout ratio (DPR) is presently 170.04%.

Analyst Upgrades and Downgrades

A number of equities research analysts recently commented on the company. Evercore ISI decreased their target price on Clorox from $140.00 to $139.00 and set an "underperform" rating on the stock in a research report on Monday, October 14th. JPMorgan Chase & Co. upped their price objective on Clorox from $148.00 to $174.00 and gave the stock a "neutral" rating in a report on Friday, October 11th. BNP Paribas raised shares of Clorox to a "strong sell" rating in a report on Friday, September 6th. Jefferies Financial Group raised shares of Clorox from a "hold" rating to a "buy" rating and upped their price target for the company from $174.00 to $187.00 in a research note on Tuesday, October 1st. Finally, TD Cowen upgraded shares of Clorox from a "sell" rating to a "hold" rating and increased their price objective for the company from $155.00 to $170.00 in a research report on Wednesday. Five research analysts have rated the stock with a sell rating, ten have assigned a hold rating and one has assigned a buy rating to the company's stock. According to MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of $155.00.

Check Out Our Latest Analysis on Clorox

Clorox Profile

(

Free Report)

The Clorox Company manufactures and markets consumer and professional products worldwide. It operates through four segments: Health and Wellness, Household, Lifestyle, and International. The Health and Wellness segment offers cleaning products, such as laundry additives and home care products primarily under the Clorox, Clorox2, Scentiva, Pine-Sol, Liquid-Plumr, Tilex, and Formula 409 brands; professional cleaning and disinfecting products under the CloroxPro and Clorox Healthcare brands; professional food service products under the Hidden Valley brand; and vitamins, minerals and supplement products under the RenewLife, Natural Vitality, NeoCell, and Rainbow Light brands in the United States.

Read More

Before you consider Clorox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clorox wasn't on the list.

While Clorox currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.