State Street Corp grew its holdings in shares of J&J Snack Foods Corp. (NASDAQ:JJSF - Free Report) by 2.9% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 602,295 shares of the company's stock after purchasing an additional 17,062 shares during the period. State Street Corp owned 3.10% of J&J Snack Foods worth $104,140,000 as of its most recent SEC filing.

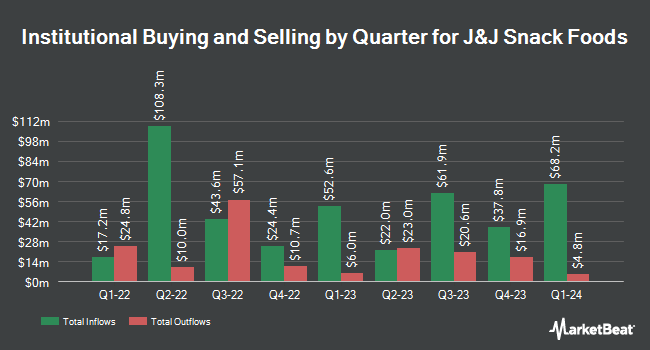

Several other hedge funds and other institutional investors have also modified their holdings of the business. SG Americas Securities LLC bought a new position in J&J Snack Foods during the 2nd quarter worth $978,000. Louisiana State Employees Retirement System grew its position in shares of J&J Snack Foods by 1.3% during the second quarter. Louisiana State Employees Retirement System now owns 7,800 shares of the company's stock worth $1,266,000 after acquiring an additional 100 shares during the last quarter. Bank of New York Mellon Corp increased its holdings in shares of J&J Snack Foods by 16.7% in the 2nd quarter. Bank of New York Mellon Corp now owns 223,242 shares of the company's stock worth $36,248,000 after acquiring an additional 31,897 shares during the period. Allspring Global Investments Holdings LLC increased its holdings in shares of J&J Snack Foods by 6.1% in the 2nd quarter. Allspring Global Investments Holdings LLC now owns 1,562,491 shares of the company's stock worth $253,702,000 after acquiring an additional 89,160 shares during the period. Finally, Mitsubishi UFJ Asset Management UK Ltd. lifted its position in J&J Snack Foods by 20.0% in the 2nd quarter. Mitsubishi UFJ Asset Management UK Ltd. now owns 6,000 shares of the company's stock valued at $974,000 after purchasing an additional 1,000 shares during the last quarter. 76.04% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Separately, Benchmark restated a "buy" rating and issued a $200.00 target price on shares of J&J Snack Foods in a research report on Friday, November 15th.

Read Our Latest Stock Analysis on J&J Snack Foods

J&J Snack Foods Stock Down 0.2 %

J&J Snack Foods stock traded down $0.33 during mid-day trading on Monday, hitting $167.67. 63,863 shares of the company's stock traded hands, compared to its average volume of 85,450. J&J Snack Foods Corp. has a one year low of $133.23 and a one year high of $180.80. The company has a market cap of $3.26 billion, a PE ratio of 37.68 and a beta of 0.64. The firm has a 50 day moving average price of $169.02 and a 200 day moving average price of $167.83.

J&J Snack Foods (NASDAQ:JJSF - Get Free Report) last posted its quarterly earnings data on Wednesday, November 13th. The company reported $1.60 earnings per share for the quarter, missing the consensus estimate of $1.85 by ($0.25). The company had revenue of $426.76 million during the quarter, compared to analyst estimates of $428.33 million. J&J Snack Foods had a return on equity of 10.32% and a net margin of 5.50%. The business's revenue for the quarter was down 3.9% compared to the same quarter last year. During the same period in the previous year, the company earned $1.73 EPS. On average, analysts expect that J&J Snack Foods Corp. will post 5.49 earnings per share for the current fiscal year.

J&J Snack Foods Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, January 7th. Stockholders of record on Tuesday, December 17th will be issued a $0.78 dividend. This represents a $3.12 annualized dividend and a dividend yield of 1.86%. The ex-dividend date of this dividend is Tuesday, December 17th. J&J Snack Foods's dividend payout ratio (DPR) is presently 70.11%.

About J&J Snack Foods

(

Free Report)

J&J Snack Foods Corp. manufactures, markets, and distributes nutritional snack foods and beverages to the food service and retail supermarket industries in the United States, Mexico, and Canada. It operates through three segments: Food Service, Retail Supermarkets, and Frozen Beverages. It offers soft pretzels under the SUPERPRETZEL, SUPERPRETZEL BAVARIAN, NEW YORK PRETZEL, BAVARIAN BAKERY, and BRAUHAUS brands, as well as under the private labels; frozen novelty under the DIPPIN'DOTS, LUIGI'S, WHOLE FRUIT, DOGSTERS, PHILLY SWIRL, ICEE, and MINUTE MAID brands; churros under the HOLA! and CALIFORNIA CHURROS brands; and handheld products under the SUPREME STUFFERS and SWEET STUFFERS brands.

Read More

Before you consider J&J Snack Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and J&J Snack Foods wasn't on the list.

While J&J Snack Foods currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.