Johnson Controls International (NYSE:JCI - Get Free Report) had its price objective hoisted by equities research analysts at Robert W. Baird from $80.00 to $85.00 in a research report issued to clients and investors on Thursday,Benzinga reports. The brokerage presently has a "neutral" rating on the stock. Robert W. Baird's target price would indicate a potential upside of 3.71% from the stock's current price.

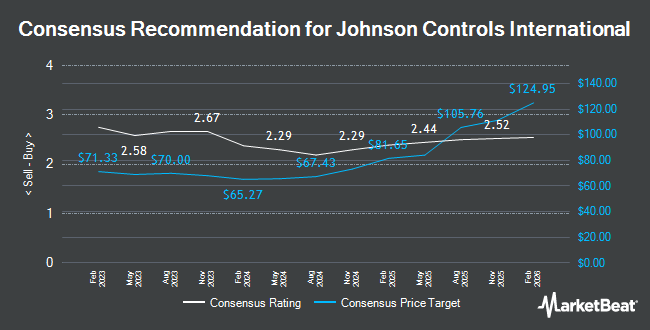

Other research analysts have also recently issued reports about the stock. Barclays lifted their price target on shares of Johnson Controls International from $62.00 to $64.00 and gave the company an "equal weight" rating in a research report on Wednesday, October 2nd. Oppenheimer lifted their price objective on shares of Johnson Controls International from $79.00 to $86.00 and gave the company an "outperform" rating in a research note on Wednesday, October 2nd. Bank of America lifted their price target on shares of Johnson Controls International from $80.00 to $95.00 and gave the stock a "buy" rating in a research note on Friday, September 27th. Wells Fargo & Company boosted their target price on shares of Johnson Controls International from $84.00 to $90.00 and gave the company an "overweight" rating in a research note on Thursday. Finally, Royal Bank of Canada boosted their target price on shares of Johnson Controls International from $81.00 to $86.00 and gave the company a "sector perform" rating in a research note on Thursday. Eleven investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $75.57.

View Our Latest Research Report on Johnson Controls International

Johnson Controls International Price Performance

NYSE:JCI traded up $0.49 during mid-day trading on Thursday, hitting $81.96. 2,262,842 shares of the company's stock traded hands, compared to its average volume of 4,939,359. The company has a debt-to-equity ratio of 0.46, a quick ratio of 0.73 and a current ratio of 0.96. The firm's 50 day simple moving average is $74.87 and its 200 day simple moving average is $70.72. Johnson Controls International has a 1 year low of $50.00 and a 1 year high of $82.21. The company has a market cap of $54.75 billion, a PE ratio of 34.26, a price-to-earnings-growth ratio of 2.12 and a beta of 1.29.

Johnson Controls International (NYSE:JCI - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The company reported $1.28 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.25 by $0.03. Johnson Controls International had a net margin of 6.02% and a return on equity of 13.64%. The company had revenue of $6.25 billion for the quarter, compared to analysts' expectations of $7.26 billion. Sell-side analysts expect that Johnson Controls International will post 3.68 EPS for the current year.

Insiders Place Their Bets

In other Johnson Controls International news, CEO George Oliver sold 110,615 shares of the business's stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $72.67, for a total value of $8,038,392.05. Following the sale, the chief executive officer now directly owns 1,243,751 shares in the company, valued at approximately $90,383,385.17. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other Johnson Controls International news, CEO George Oliver sold 110,615 shares of the business's stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $72.67, for a total transaction of $8,038,392.05. Following the sale, the chief executive officer now owns 1,243,751 shares in the company, valued at approximately $90,383,385.17. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, COO Nathan D. Manning sold 1,167 shares of the business's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $72.75, for a total value of $84,899.25. Following the sale, the chief operating officer now owns 143,488 shares in the company, valued at approximately $10,438,752. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 226,141 shares of company stock worth $16,904,519. 0.69% of the stock is owned by corporate insiders.

Institutional Trading of Johnson Controls International

Several institutional investors and hedge funds have recently bought and sold shares of the stock. Capital World Investors increased its holdings in shares of Johnson Controls International by 85.5% in the 1st quarter. Capital World Investors now owns 14,142,736 shares of the company's stock valued at $923,804,000 after purchasing an additional 6,520,580 shares during the period. Dimensional Fund Advisors LP increased its holdings in shares of Johnson Controls International by 8.9% in the 2nd quarter. Dimensional Fund Advisors LP now owns 5,855,075 shares of the company's stock valued at $389,214,000 after purchasing an additional 479,548 shares during the period. Raymond James & Associates increased its holdings in shares of Johnson Controls International by 5.6% in the 3rd quarter. Raymond James & Associates now owns 4,735,147 shares of the company's stock valued at $367,495,000 after purchasing an additional 249,405 shares during the period. Barrow Hanley Mewhinney & Strauss LLC grew its stake in shares of Johnson Controls International by 686.4% in the 2nd quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 4,445,418 shares of the company's stock valued at $295,487,000 after buying an additional 3,880,146 shares in the last quarter. Finally, Envestnet Asset Management Inc. grew its stake in shares of Johnson Controls International by 2.5% in the 2nd quarter. Envestnet Asset Management Inc. now owns 2,401,984 shares of the company's stock valued at $159,660,000 after buying an additional 59,274 shares in the last quarter. Institutional investors and hedge funds own 90.05% of the company's stock.

Johnson Controls International Company Profile

(

Get Free Report)

Johnson Controls International plc, together with its subsidiaries, engages in engineering, manufacturing, commissioning, and retrofitting building products and systems in the United States, Europe, the Asia Pacific, and internationally. It operates in four segments: Building Solutions North America, Building Solutions EMEA/LA, Building Solutions Asia Pacific, and Global Products.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Johnson Controls International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Johnson Controls International wasn't on the list.

While Johnson Controls International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report