Johnson Investment Counsel Inc. lowered its stake in shares of American Express (NYSE:AXP - Free Report) by 2.3% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 164,605 shares of the payment services company's stock after selling 3,958 shares during the quarter. Johnson Investment Counsel Inc.'s holdings in American Express were worth $48,853,000 as of its most recent filing with the Securities and Exchange Commission.

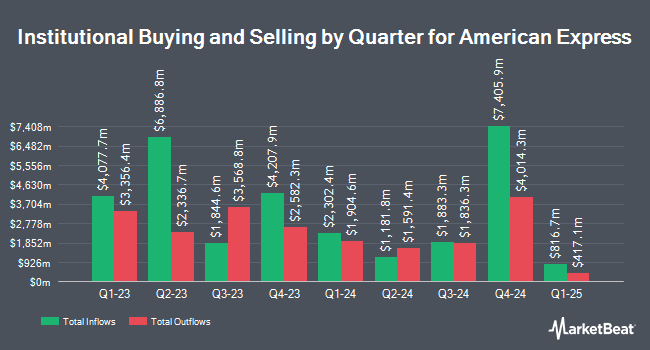

A number of other hedge funds and other institutional investors have also recently bought and sold shares of AXP. Geode Capital Management LLC increased its holdings in American Express by 0.8% during the 3rd quarter. Geode Capital Management LLC now owns 11,483,512 shares of the payment services company's stock worth $3,104,735,000 after purchasing an additional 86,100 shares during the period. FMR LLC grew its position in shares of American Express by 8.5% during the third quarter. FMR LLC now owns 11,003,715 shares of the payment services company's stock worth $2,984,208,000 after buying an additional 866,110 shares in the last quarter. Fisher Asset Management LLC increased its stake in shares of American Express by 1.1% during the fourth quarter. Fisher Asset Management LLC now owns 8,761,336 shares of the payment services company's stock worth $2,600,277,000 after buying an additional 95,927 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its stake in American Express by 5.5% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 4,606,986 shares of the payment services company's stock worth $1,249,415,000 after acquiring an additional 239,173 shares during the last quarter. Finally, Janus Henderson Group PLC lifted its stake in American Express by 0.8% in the third quarter. Janus Henderson Group PLC now owns 3,960,842 shares of the payment services company's stock worth $1,074,168,000 after acquiring an additional 33,193 shares during the last quarter. 84.33% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at American Express

In other American Express news, insider Ravikumar Radhakrishnan sold 9,485 shares of the stock in a transaction on Wednesday, February 5th. The stock was sold at an average price of $319.17, for a total value of $3,027,327.45. Following the completion of the transaction, the insider now owns 13,500 shares in the company, valued at approximately $4,308,795. This represents a 41.27 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, insider Raymond Joabar sold 15,179 shares of the business's stock in a transaction on Tuesday, January 28th. The stock was sold at an average price of $313.94, for a total transaction of $4,765,295.26. Following the sale, the insider now owns 23,866 shares in the company, valued at $7,492,492.04. The trade was a 38.88 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.12% of the stock is owned by insiders.

American Express Trading Down 0.9 %

Shares of AXP stock opened at $273.13 on Monday. The company has a market capitalization of $191.88 billion, a P/E ratio of 19.50, a price-to-earnings-growth ratio of 1.41 and a beta of 1.21. The company has a current ratio of 1.58, a quick ratio of 1.57 and a debt-to-equity ratio of 1.64. The business's 50 day moving average is $305.44 and its two-hundred day moving average is $288.17. American Express has a twelve month low of $214.51 and a twelve month high of $326.27.

American Express (NYSE:AXP - Get Free Report) last posted its quarterly earnings data on Friday, January 24th. The payment services company reported $3.04 earnings per share for the quarter, beating analysts' consensus estimates of $3.00 by $0.04. American Express had a net margin of 15.36% and a return on equity of 32.65%. Equities analysts forecast that American Express will post 15.33 EPS for the current year.

American Express Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, May 9th. Investors of record on Friday, April 4th will be issued a dividend of $0.82 per share. This is a boost from American Express's previous quarterly dividend of $0.70. This represents a $3.28 annualized dividend and a yield of 1.20%. The ex-dividend date of this dividend is Friday, April 4th. American Express's dividend payout ratio is currently 23.41%.

Wall Street Analysts Forecast Growth

A number of equities research analysts have commented on AXP shares. JPMorgan Chase & Co. increased their price objective on shares of American Express from $301.00 to $307.00 and gave the company a "neutral" rating in a research report on Tuesday, January 14th. Compass Point dropped their target price on American Express from $325.00 to $309.00 and set a "neutral" rating on the stock in a report on Monday, January 27th. William Blair reaffirmed an "outperform" rating on shares of American Express in a report on Monday, January 27th. HSBC increased their price objective on American Express from $270.00 to $294.00 and gave the company a "hold" rating in a report on Friday, January 24th. Finally, StockNews.com cut American Express from a "buy" rating to a "hold" rating in a research note on Monday, January 27th. Three analysts have rated the stock with a sell rating, thirteen have given a hold rating and nine have given a buy rating to the company. According to MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $296.38.

Get Our Latest Research Report on AXP

About American Express

(

Free Report)

American Express Company, together with its subsidiaries, operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally. It operates through four segments: U.S. Consumer Services, Commercial Services, International Card Services, and Global Merchant and Network Services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider American Express, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Express wasn't on the list.

While American Express currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report