Johnson & Johnson (NYSE:JNJ - Get Free Report) had its target price reduced by stock analysts at Barclays from $160.00 to $159.00 in a research note issued to investors on Tuesday. The brokerage currently has an "equal weight" rating on the stock. Barclays's target price suggests a potential upside of 7.65% from the stock's current price.

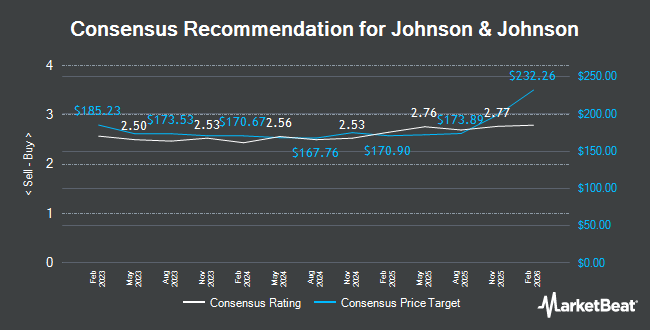

Several other equities research analysts have also recently commented on JNJ. StockNews.com cut Johnson & Johnson from a "strong-buy" rating to a "buy" rating in a research note on Friday. Bank of America cut their price target on Johnson & Johnson from $166.00 to $160.00 and set a "neutral" rating for the company in a research note on Friday. Citigroup cut their price target on Johnson & Johnson from $185.00 to $175.00 and set a "buy" rating for the company in a research note on Wednesday, December 11th. Cantor Fitzgerald reaffirmed an "overweight" rating and set a $215.00 price objective on shares of Johnson & Johnson in a report on Wednesday, October 16th. Finally, Royal Bank of Canada upped their price objective on Johnson & Johnson from $178.00 to $181.00 and gave the stock an "outperform" rating in a report on Wednesday, October 16th. Eight equities research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $173.27.

Read Our Latest Analysis on JNJ

Johnson & Johnson Stock Performance

NYSE JNJ traded up $0.67 on Tuesday, reaching $147.70. The stock had a trading volume of 6,320,937 shares, compared to its average volume of 8,374,427. The company has a debt-to-equity ratio of 0.45, a quick ratio of 0.79 and a current ratio of 1.03. Johnson & Johnson has a 12-month low of $140.68 and a 12-month high of $168.85. The business's 50-day moving average price is $148.35 and its 200 day moving average price is $156.11. The stock has a market cap of $355.59 billion, a P/E ratio of 21.37, a price-to-earnings-growth ratio of 2.39 and a beta of 0.51.

Insider Activity at Johnson & Johnson

In other Johnson & Johnson news, Director Mark A. Weinberger bought 1,000 shares of Johnson & Johnson stock in a transaction that occurred on Thursday, December 12th. The shares were purchased at an average cost of $147.22 per share, for a total transaction of $147,220.00. Following the completion of the transaction, the director now owns 1,000 shares of the company's stock, valued at $147,220. This represents a ∞ increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Corporate insiders own 0.16% of the company's stock.

Hedge Funds Weigh In On Johnson & Johnson

Several large investors have recently added to or reduced their stakes in JNJ. International Assets Investment Management LLC raised its holdings in shares of Johnson & Johnson by 20,130.0% in the 3rd quarter. International Assets Investment Management LLC now owns 3,454,473 shares of the company's stock worth $559,832,000 after purchasing an additional 3,437,397 shares during the period. Marshall Wace LLP raised its holdings in shares of Johnson & Johnson by 506.9% in the 2nd quarter. Marshall Wace LLP now owns 3,884,962 shares of the company's stock worth $567,826,000 after purchasing an additional 3,244,862 shares during the period. Janus Henderson Group PLC raised its holdings in shares of Johnson & Johnson by 228.1% in the 3rd quarter. Janus Henderson Group PLC now owns 3,389,361 shares of the company's stock worth $549,223,000 after purchasing an additional 2,356,359 shares during the period. Franklin Resources Inc. raised its holdings in shares of Johnson & Johnson by 11.4% in the 3rd quarter. Franklin Resources Inc. now owns 16,840,069 shares of the company's stock worth $2,721,355,000 after purchasing an additional 1,729,281 shares during the period. Finally, Holocene Advisors LP purchased a new position in shares of Johnson & Johnson in the 3rd quarter worth about $225,040,000. 69.55% of the stock is currently owned by hedge funds and other institutional investors.

About Johnson & Johnson

(

Get Free Report)

Johnson & Johnson, together with its subsidiaries, researches, develops, manufactures, and sells various products in the healthcare field worldwide. The company's Innovative Medicine segment offers products for various therapeutic areas, such as immunology, including rheumatoid arthritis, psoriatic arthritis, inflammatory bowel disease, and psoriasis; infectious diseases comprising HIV/AIDS; neuroscience, consisting of mood disorders, neurodegenerative disorders, and schizophrenia; oncology, such as prostate cancer, hematologic malignancies, lung cancer, and bladder cancer; cardiovascular and metabolism, including thrombosis, diabetes, and macular degeneration; and pulmonary hypertension comprising pulmonary arterial hypertension through retailers, wholesalers, distributors, hospitals, and healthcare professionals for prescription use.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Johnson & Johnson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Johnson & Johnson wasn't on the list.

While Johnson & Johnson currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.