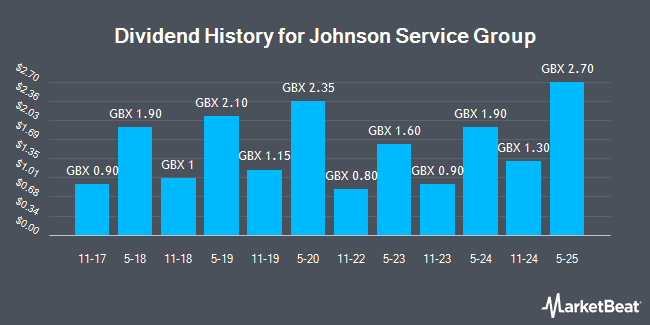

Johnson Service Group PLC (LON:JSG - Get Free Report) declared a dividend on Tuesday, March 4th, DividendData.Co.Uk reports. Stockholders of record on Thursday, April 10th will be paid a dividend of GBX 2.70 ($0.04) per share on Friday, May 9th. This represents a dividend yield of 1.97%. The ex-dividend date is Thursday, April 10th. This is a 107.7% increase from Johnson Service Group's previous dividend of $1.30. The official announcement can be seen at this link.

Johnson Service Group Price Performance

Shares of LON:JSG traded down GBX 0.60 ($0.01) during midday trading on Friday, hitting GBX 126.60 ($1.66). The company had a trading volume of 352,257 shares, compared to its average volume of 1,477,503. Johnson Service Group has a twelve month low of GBX 117.20 ($1.53) and a twelve month high of GBX 172 ($2.25). The stock has a market cap of £525.32 million, a price-to-earnings ratio of 16.87, a price-to-earnings-growth ratio of 10.18 and a beta of 1.80. The company has a debt-to-equity ratio of 44.23, a current ratio of 1.00 and a quick ratio of 0.80. The business's 50-day simple moving average is GBX 135.43 and its 200-day simple moving average is GBX 140.33.

Johnson Service Group (LON:JSG - Get Free Report) last issued its earnings results on Tuesday, March 4th. The company reported GBX 10.20 ($0.13) earnings per share (EPS) for the quarter. Johnson Service Group had a return on equity of 10.95% and a net margin of 6.29%.

Insiders Place Their Bets

In other Johnson Service Group news, insider Yvonne Monaghan sold 34,905 shares of the firm's stock in a transaction on Wednesday, April 2nd. The stock was sold at an average price of GBX 133 ($1.74), for a total transaction of £46,423.65 ($60,740.09). 1.61% of the stock is owned by insiders.

About Johnson Service Group

(

Get Free Report)

Johnson Service Group provides high quality textile rental and related services across a range of sectors throughout the UK.

Our family of high quality businesses includes “Johnsons Workwear”, “Johnsons Hotel Linen”, “Johnsons Hotel, Restaurant & Catering Linen” and “Johnsons Restaurant & Catering Linen”, each of which provides a high-quality and reliable service combined with outstanding customer care.

Across our entire family, our priorities are always clear and everything we do centres on the core values of Johnson Service Group – quality, reliability and service.

A strategy to consistently create value for shareholders, deliver outstanding customer service and offer fulfilling careers to employees lies at the heart of our business.

Further Reading

Before you consider Johnson Service Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Johnson Service Group wasn't on the list.

While Johnson Service Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.