Jones Financial Companies Lllp boosted its holdings in The Toronto-Dominion Bank (NYSE:TD - Free Report) TSE: TD by 82.5% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 21,233 shares of the bank's stock after buying an additional 9,601 shares during the period. Jones Financial Companies Lllp's holdings in Toronto-Dominion Bank were worth $1,130,000 as of its most recent filing with the Securities and Exchange Commission.

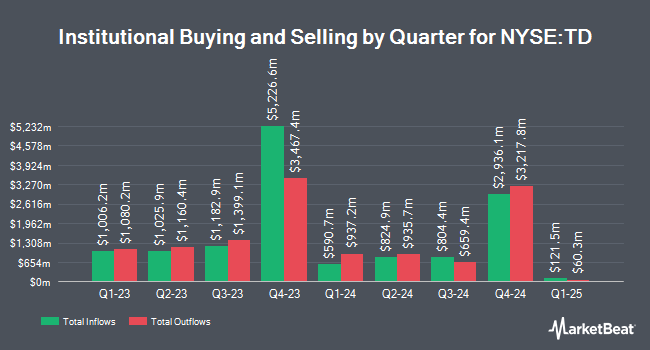

Other hedge funds also recently made changes to their positions in the company. Asahi Life Asset Management CO. LTD. bought a new position in shares of Toronto-Dominion Bank in the fourth quarter worth approximately $416,000. Cerity Partners LLC increased its holdings in shares of Toronto-Dominion Bank by 57.1% in the 3rd quarter. Cerity Partners LLC now owns 26,755 shares of the bank's stock worth $1,693,000 after buying an additional 9,725 shares during the last quarter. Connor Clark & Lunn Investment Management Ltd. raised its position in shares of Toronto-Dominion Bank by 1.5% during the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 9,761,308 shares of the bank's stock valued at $617,166,000 after buying an additional 144,427 shares in the last quarter. Healthcare of Ontario Pension Plan Trust Fund lifted its holdings in shares of Toronto-Dominion Bank by 61.1% during the 3rd quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 6,011,579 shares of the bank's stock worth $380,118,000 after acquiring an additional 2,279,864 shares during the last quarter. Finally, FMR LLC grew its position in Toronto-Dominion Bank by 9.9% in the third quarter. FMR LLC now owns 6,553,761 shares of the bank's stock worth $414,417,000 after acquiring an additional 587,947 shares in the last quarter. 52.37% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of equities analysts have recently issued reports on the company. Royal Bank of Canada reduced their price objective on Toronto-Dominion Bank from $82.00 to $77.00 and set a "sector perform" rating on the stock in a research report on Friday, December 6th. Jefferies Financial Group cut Toronto-Dominion Bank from a "buy" rating to a "hold" rating in a report on Tuesday, February 18th. Scotiabank cut shares of Toronto-Dominion Bank from a "sector outperform" rating to a "sector perform" rating in a research report on Friday, December 6th. Barclays cut Toronto-Dominion Bank from an "equal weight" rating to an "underweight" rating in a research note on Thursday, November 21st. Finally, BMO Capital Markets raised shares of Toronto-Dominion Bank from a "market perform" rating to an "outperform" rating in a research note on Thursday, December 19th. Two equities research analysts have rated the stock with a sell rating, six have issued a hold rating, two have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $80.50.

View Our Latest Analysis on TD

Toronto-Dominion Bank Stock Performance

Shares of Toronto-Dominion Bank stock traded down $1.00 during trading hours on Tuesday, reaching $57.76. 2,223,222 shares of the stock traded hands, compared to its average volume of 2,454,849. The company has a 50 day moving average price of $57.53 and a 200 day moving average price of $57.64. The Toronto-Dominion Bank has a one year low of $51.25 and a one year high of $64.91. The company has a quick ratio of 1.03, a current ratio of 1.03 and a debt-to-equity ratio of 0.11. The firm has a market capitalization of $101.20 billion, a price-to-earnings ratio of 16.64, a P/E/G ratio of 1.95 and a beta of 0.83.

Toronto-Dominion Bank Cuts Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, April 30th. Stockholders of record on Thursday, April 10th will be paid a dividend of $0.7278 per share. This represents a $2.91 annualized dividend and a dividend yield of 5.04%. The ex-dividend date is Thursday, April 10th. Toronto-Dominion Bank's dividend payout ratio is presently 85.29%.

Toronto-Dominion Bank Profile

(

Free Report)

The Toronto-Dominion Bank, together with its subsidiaries, provides various financial products and services in Canada, the United States, and internationally. It operates through four segments: Canadian Personal and Commercial Banking, U.S. Retail, Wealth Management and Insurance, and Wholesale Banking.

Read More

Before you consider Toronto-Dominion Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toronto-Dominion Bank wasn't on the list.

While Toronto-Dominion Bank currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.