Wellington Management Group LLP boosted its stake in shares of Jones Lang LaSalle Incorporated (NYSE:JLL - Free Report) by 6.3% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 899,305 shares of the financial services provider's stock after purchasing an additional 53,066 shares during the quarter. Wellington Management Group LLP owned about 1.90% of Jones Lang LaSalle worth $242,641,000 at the end of the most recent quarter.

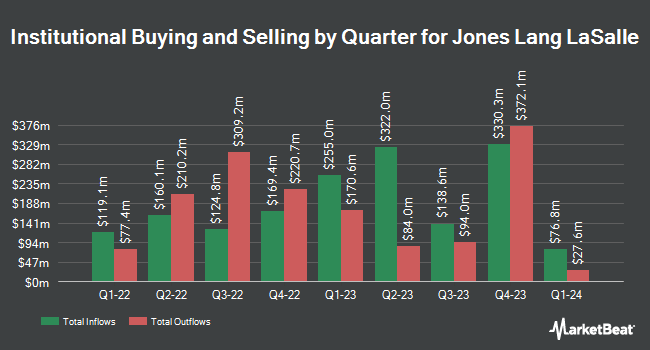

Several other hedge funds also recently modified their holdings of JLL. Tidal Investments LLC bought a new stake in shares of Jones Lang LaSalle in the first quarter valued at approximately $228,000. CWM LLC boosted its position in shares of Jones Lang LaSalle by 8.6% in the second quarter. CWM LLC now owns 1,535 shares of the financial services provider's stock valued at $315,000 after acquiring an additional 121 shares during the period. Wealth Enhancement Advisory Services LLC boosted its position in shares of Jones Lang LaSalle by 782.2% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 9,113 shares of the financial services provider's stock valued at $1,871,000 after acquiring an additional 8,080 shares during the period. Envestnet Portfolio Solutions Inc. boosted its position in shares of Jones Lang LaSalle by 31.2% in the second quarter. Envestnet Portfolio Solutions Inc. now owns 2,265 shares of the financial services provider's stock valued at $465,000 after acquiring an additional 538 shares during the period. Finally, Hunter Perkins Capital Management LLC boosted its position in shares of Jones Lang LaSalle by 32.9% in the second quarter. Hunter Perkins Capital Management LLC now owns 3,230 shares of the financial services provider's stock valued at $663,000 after acquiring an additional 800 shares during the period. 94.80% of the stock is owned by institutional investors.

Jones Lang LaSalle Price Performance

Jones Lang LaSalle stock traded down $4.36 during mid-day trading on Monday, hitting $273.01. 299,073 shares of the company were exchanged, compared to its average volume of 287,125. Jones Lang LaSalle Incorporated has a 1-year low of $163.47 and a 1-year high of $288.50. The company has a market capitalization of $12.95 billion, a PE ratio of 28.05 and a beta of 1.34. The company has a quick ratio of 2.29, a current ratio of 2.29 and a debt-to-equity ratio of 0.16. The business has a fifty day moving average of $268.56 and a 200 day moving average of $243.67.

Jones Lang LaSalle (NYSE:JLL - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The financial services provider reported $3.50 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.67 by $0.83. Jones Lang LaSalle had a return on equity of 8.95% and a net margin of 2.12%. The business had revenue of $5.87 billion during the quarter, compared to analysts' expectations of $5.62 billion. During the same period in the previous year, the business posted $2.01 earnings per share. The firm's revenue for the quarter was up 14.8% compared to the same quarter last year. As a group, sell-side analysts expect that Jones Lang LaSalle Incorporated will post 13.37 earnings per share for the current year.

Analyst Ratings Changes

A number of research analysts recently commented on JLL shares. Wolfe Research upgraded Jones Lang LaSalle from a "peer perform" rating to an "outperform" rating and set a $353.00 target price for the company in a research note on Monday, November 25th. The Goldman Sachs Group started coverage on Jones Lang LaSalle in a research note on Friday. They issued a "buy" rating and a $352.00 target price for the company. StockNews.com upgraded Jones Lang LaSalle from a "buy" rating to a "strong-buy" rating in a research note on Friday, September 13th. Finally, Keefe, Bruyette & Woods upped their target price on Jones Lang LaSalle from $280.00 to $292.00 and gave the company a "market perform" rating in a research note on Tuesday, November 12th. One analyst has rated the stock with a hold rating, five have assigned a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Buy" and an average target price of $283.00.

Get Our Latest Stock Analysis on Jones Lang LaSalle

About Jones Lang LaSalle

(

Free Report)

Jones Lang LaSalle Incorporated operates as a commercial real estate and investment management company. It engages in the buying, building, occupying, managing, and investing in a commercial, industrial, hotel, residential, and retail properties in Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Featured Articles

Before you consider Jones Lang LaSalle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jones Lang LaSalle wasn't on the list.

While Jones Lang LaSalle currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.