Schneider National (NYSE:SNDR - Get Free Report) had its target price dropped by analysts at JPMorgan Chase & Co. from $30.00 to $29.00 in a research report issued on Thursday,Benzinga reports. The firm presently has a "neutral" rating on the stock. JPMorgan Chase & Co.'s price target indicates a potential downside of 6.15% from the company's previous close.

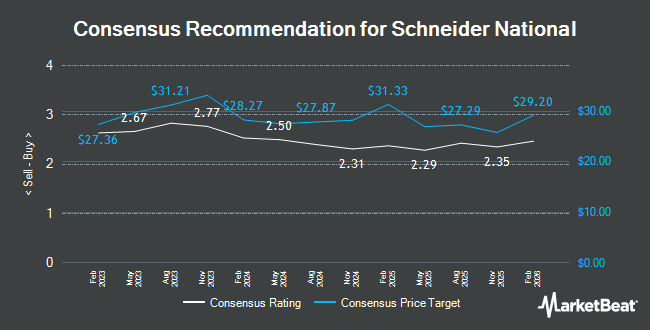

Several other equities analysts have also weighed in on the stock. Stifel Nicolaus lowered shares of Schneider National from a "buy" rating to a "hold" rating and set a $25.00 target price on the stock. in a report on Thursday, August 8th. Susquehanna reduced their target price on Schneider National from $29.00 to $26.00 and set a "neutral" rating on the stock in a research report on Thursday. Citigroup began coverage on Schneider National in a report on Wednesday, October 9th. They set a "neutral" rating and a $29.00 price target for the company. The Goldman Sachs Group reduced their price objective on shares of Schneider National from $26.00 to $25.00 and set a "neutral" rating on the stock in a report on Wednesday, October 9th. Finally, Benchmark lifted their price target on shares of Schneider National from $27.00 to $30.00 and gave the company a "buy" rating in a research report on Friday, August 2nd. Nine investment analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat, Schneider National presently has an average rating of "Hold" and a consensus price target of $27.54.

Read Our Latest Analysis on SNDR

Schneider National Price Performance

Shares of NYSE:SNDR traded up $0.46 during trading on Thursday, reaching $30.90. The stock had a trading volume of 420,878 shares, compared to its average volume of 822,433. The business has a fifty day moving average price of $27.82 and a 200-day moving average price of $25.23. The stock has a market cap of $5.41 billion, a PE ratio of 47.45, a PEG ratio of 2.90 and a beta of 0.85. The company has a debt-to-equity ratio of 0.04, a quick ratio of 1.46 and a current ratio of 1.59. Schneider National has a 1-year low of $20.50 and a 1-year high of $31.24.

Schneider National (NYSE:SNDR - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The company reported $0.18 EPS for the quarter, missing analysts' consensus estimates of $0.23 by ($0.05). The company had revenue of $1.32 billion for the quarter, compared to analysts' expectations of $1.33 billion. Schneider National had a return on equity of 4.08% and a net margin of 2.18%. On average, equities analysts forecast that Schneider National will post 0.84 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Schneider National

Hedge funds and other institutional investors have recently made changes to their positions in the stock. Russell Investments Group Ltd. grew its holdings in Schneider National by 76.5% during the 1st quarter. Russell Investments Group Ltd. now owns 281,747 shares of the company's stock worth $6,379,000 after acquiring an additional 122,077 shares in the last quarter. Tidal Investments LLC acquired a new stake in Schneider National in the first quarter valued at $468,000. Louisiana State Employees Retirement System purchased a new position in Schneider National in the third quarter valued at about $648,000. BNP Paribas Financial Markets lifted its position in shares of Schneider National by 4,602.7% during the 1st quarter. BNP Paribas Financial Markets now owns 135,862 shares of the company's stock valued at $3,076,000 after acquiring an additional 132,973 shares during the period. Finally, Quadrature Capital Ltd purchased a new stake in shares of Schneider National during the 1st quarter worth approximately $489,000. Hedge funds and other institutional investors own 28.54% of the company's stock.

Schneider National Company Profile

(

Get Free Report)

Schneider National, Inc, together with its subsidiaries, provides surface transportation and logistics solutions in the United States, Canada, and Mexico. It operates through three segments: Truckload, Intermodal, and Logistics. The Truckload segment offers over the road freight transportation services primarily through dry van, bulk, temperature-controlled, and flat-bed trailers across either network or dedicated configurations.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Schneider National, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Schneider National wasn't on the list.

While Schneider National currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.