Alphabet (NASDAQ:GOOGL - Get Free Report) had its price objective hoisted by equities researchers at JPMorgan Chase & Co. from $212.00 to $232.00 in a report released on Wednesday,Benzinga reports. The firm currently has an "overweight" rating on the information services provider's stock. JPMorgan Chase & Co.'s target price points to a potential upside of 18.72% from the stock's current price.

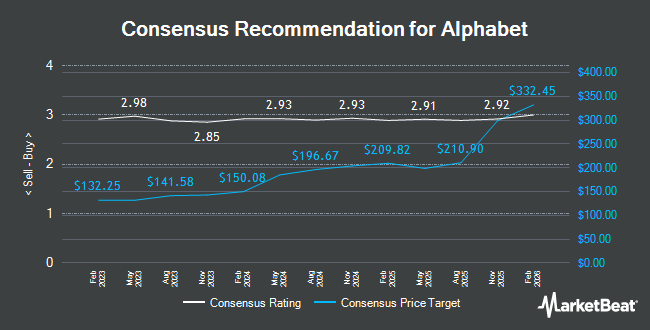

A number of other research analysts also recently issued reports on GOOGL. Seaport Res Ptn upgraded shares of Alphabet from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, October 29th. Piper Sandler restated an "overweight" rating and issued a $210.00 target price (up previously from $200.00) on shares of Alphabet in a research note on Wednesday, October 30th. KeyCorp raised their target price on Alphabet from $200.00 to $215.00 and gave the stock an "overweight" rating in a report on Wednesday, October 30th. Wedbush reissued an "outperform" rating and issued a $205.00 price target on shares of Alphabet in a report on Thursday, October 24th. Finally, Royal Bank of Canada raised their price objective on shares of Alphabet from $204.00 to $210.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 30th. Seven equities research analysts have rated the stock with a hold rating, thirty-one have given a buy rating and five have assigned a strong buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average price target of $206.69.

Check Out Our Latest Stock Analysis on GOOGL

Alphabet Stock Down 0.6 %

Alphabet stock opened at $195.42 on Wednesday. The company has a quick ratio of 1.95, a current ratio of 1.95 and a debt-to-equity ratio of 0.04. The firm has a market cap of $2.39 trillion, a P/E ratio of 25.92, a P/E/G ratio of 1.39 and a beta of 1.01. The business has a fifty day moving average of $172.93 and a two-hundred day moving average of $170.97. Alphabet has a twelve month low of $130.66 and a twelve month high of $201.42.

Alphabet (NASDAQ:GOOGL - Get Free Report) last announced its earnings results on Tuesday, October 29th. The information services provider reported $2.12 earnings per share for the quarter, beating the consensus estimate of $1.83 by $0.29. Alphabet had a net margin of 27.74% and a return on equity of 31.66%. The company had revenue of $88.27 billion during the quarter, compared to the consensus estimate of $72.85 billion. During the same period last year, the firm earned $1.55 earnings per share. On average, analysts forecast that Alphabet will post 8.01 earnings per share for the current fiscal year.

Insider Transactions at Alphabet

In other Alphabet news, CEO Sundar Pichai sold 22,500 shares of Alphabet stock in a transaction that occurred on Wednesday, October 2nd. The stock was sold at an average price of $167.07, for a total value of $3,759,075.00. Following the sale, the chief executive officer now owns 2,129,306 shares of the company's stock, valued at approximately $355,743,153.42. The trade was a 1.05 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director John L. Hennessy sold 1,500 shares of the firm's stock in a transaction that occurred on Monday, October 14th. The shares were sold at an average price of $164.95, for a total value of $247,425.00. Following the completion of the sale, the director now directly owns 26,324 shares of the company's stock, valued at $4,342,143.80. This represents a 5.39 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 178,957 shares of company stock worth $31,358,687. Insiders own 11.55% of the company's stock.

Institutional Investors Weigh In On Alphabet

A number of institutional investors and hedge funds have recently modified their holdings of the company. IMS Capital Management lifted its holdings in shares of Alphabet by 1.0% in the third quarter. IMS Capital Management now owns 13,708 shares of the information services provider's stock valued at $2,274,000 after purchasing an additional 131 shares in the last quarter. Brass Tax Wealth Management Inc. grew its holdings in Alphabet by 1.5% during the 3rd quarter. Brass Tax Wealth Management Inc. now owns 8,625 shares of the information services provider's stock valued at $1,431,000 after buying an additional 128 shares during the last quarter. Legacy Wealth Management LLC MS increased its position in Alphabet by 12.1% during the third quarter. Legacy Wealth Management LLC MS now owns 47,077 shares of the information services provider's stock worth $7,808,000 after buying an additional 5,091 shares in the last quarter. Alternative Investment Advisors LLC. raised its holdings in shares of Alphabet by 3.4% in the third quarter. Alternative Investment Advisors LLC. now owns 11,063 shares of the information services provider's stock worth $1,835,000 after acquiring an additional 360 shares during the last quarter. Finally, DGS Capital Management LLC lifted its position in shares of Alphabet by 8.7% in the third quarter. DGS Capital Management LLC now owns 17,621 shares of the information services provider's stock valued at $2,922,000 after acquiring an additional 1,414 shares in the last quarter. Institutional investors and hedge funds own 40.03% of the company's stock.

Alphabet Company Profile

(

Get Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.