Mercury Systems (NASDAQ:MRCY - Free Report) had its price target boosted by JPMorgan Chase & Co. from $36.00 to $40.00 in a report released on Thursday,Benzinga reports. The brokerage currently has a neutral rating on the technology company's stock.

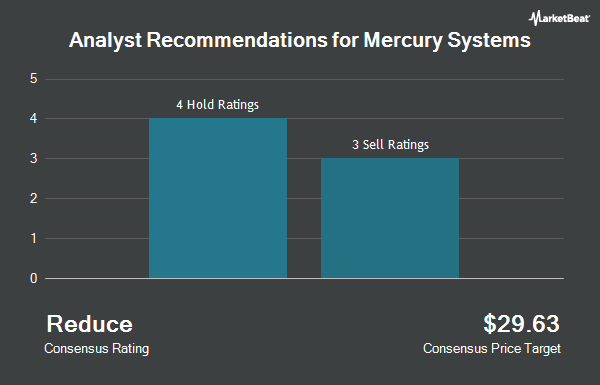

Other equities research analysts have also issued research reports about the stock. Robert W. Baird upped their target price on shares of Mercury Systems from $26.00 to $37.00 and gave the company a "neutral" rating in a research note on Wednesday, August 14th. Royal Bank of Canada upped their price objective on Mercury Systems from $30.00 to $35.00 and gave the company a "sector perform" rating in a research note on Wednesday, August 14th. StockNews.com upgraded Mercury Systems from a "sell" rating to a "hold" rating in a research report on Saturday, October 5th. Alembic Global Advisors raised Mercury Systems from a "neutral" rating to an "overweight" rating and set a $48.00 price target on the stock in a research report on Monday, August 19th. Finally, Truist Financial lifted their price objective on shares of Mercury Systems from $26.00 to $31.00 and gave the stock a "hold" rating in a report on Wednesday, August 14th. Four research analysts have rated the stock with a sell rating, four have issued a hold rating and one has assigned a buy rating to the company. Based on data from MarketBeat, the company presently has an average rating of "Hold" and an average price target of $34.00.

Read Our Latest Analysis on MRCY

Mercury Systems Stock Down 0.6 %

Shares of NASDAQ:MRCY traded down $0.27 during trading on Thursday, hitting $41.95. The company's stock had a trading volume of 981,853 shares, compared to its average volume of 586,928. The company has a market capitalization of $2.50 billion, a PE ratio of -17.55 and a beta of 0.71. Mercury Systems has a fifty-two week low of $25.31 and a fifty-two week high of $42.93. The company has a debt-to-equity ratio of 0.40, a quick ratio of 2.64 and a current ratio of 4.07. The stock's 50-day moving average price is $36.09 and its two-hundred day moving average price is $33.22.

Mercury Systems (NASDAQ:MRCY - Get Free Report) last announced its earnings results on Tuesday, August 13th. The technology company reported $0.09 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.23) by $0.32. Mercury Systems had a negative return on equity of 4.92% and a negative net margin of 16.48%. The company had revenue of $248.56 million for the quarter, compared to analyst estimates of $223.80 million. As a group, sell-side analysts expect that Mercury Systems will post -0.52 EPS for the current year.

Insider Activity at Mercury Systems

In other news, EVP Stephanie Georges sold 1,340 shares of the stock in a transaction on Monday, August 19th. The stock was sold at an average price of $39.49, for a total value of $52,916.60. Following the completion of the transaction, the executive vice president now owns 32,259 shares of the company's stock, valued at approximately $1,273,907.91. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this link. In other Mercury Systems news, EVP Stephanie Georges sold 1,340 shares of the business's stock in a transaction dated Monday, August 19th. The shares were sold at an average price of $39.49, for a total transaction of $52,916.60. Following the sale, the executive vice president now directly owns 32,259 shares in the company, valued at approximately $1,273,907.91. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO William L. Ballhaus sold 6,549 shares of the company's stock in a transaction that occurred on Monday, August 19th. The stock was sold at an average price of $39.49, for a total transaction of $258,620.01. Following the completion of the sale, the chief executive officer now directly owns 353,481 shares of the company's stock, valued at approximately $13,958,964.69. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 22,099 shares of company stock worth $865,740 in the last ninety days. 1.60% of the stock is owned by insiders.

Institutional Trading of Mercury Systems

Several institutional investors have recently modified their holdings of the company. Sei Investments Co. lifted its holdings in Mercury Systems by 27.0% in the 1st quarter. Sei Investments Co. now owns 216,956 shares of the technology company's stock valued at $6,400,000 after acquiring an additional 46,132 shares during the last quarter. Jane Street Group LLC lifted its stake in Mercury Systems by 102.6% during the first quarter. Jane Street Group LLC now owns 257,514 shares of the technology company's stock valued at $7,597,000 after purchasing an additional 130,396 shares during the last quarter. Natixis bought a new stake in Mercury Systems during the first quarter worth approximately $693,000. William Blair Investment Management LLC grew its position in Mercury Systems by 0.6% in the second quarter. William Blair Investment Management LLC now owns 6,416,449 shares of the technology company's stock worth $173,180,000 after buying an additional 36,923 shares during the last quarter. Finally, Dark Forest Capital Management LP acquired a new position in Mercury Systems in the second quarter worth approximately $526,000. Institutional investors and hedge funds own 95.99% of the company's stock.

About Mercury Systems

(

Get Free Report)

Mercury Systems, Inc, a technology company, manufactures and sells components, products, modules, and subsystems for aerospace and defense industries in the United States, Europe, and the Asia Pacific. Its products and solutions are deployed in approximately 300 programs with 25 defense contractors and commercial aviation customers.

Featured Stories

Before you consider Mercury Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mercury Systems wasn't on the list.

While Mercury Systems currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.