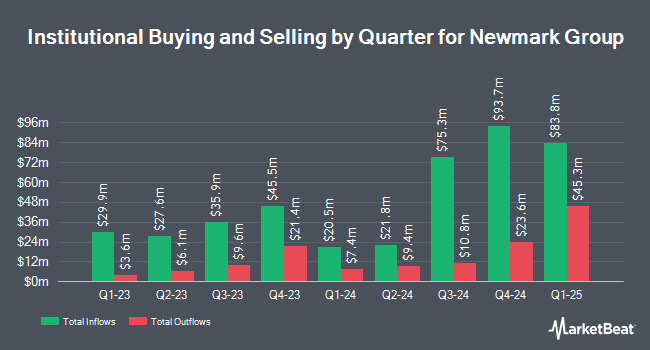

JPMorgan Chase & Co. raised its holdings in Newmark Group, Inc. (NASDAQ:NMRK - Free Report) by 13.5% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,388,913 shares of the company's stock after purchasing an additional 165,106 shares during the quarter. JPMorgan Chase & Co. owned 0.81% of Newmark Group worth $17,792,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other large investors have also recently made changes to their positions in the business. Ashton Thomas Securities LLC bought a new stake in shares of Newmark Group in the 4th quarter worth approximately $1,093,000. Vanguard Group Inc. raised its position in shares of Newmark Group by 0.4% in the fourth quarter. Vanguard Group Inc. now owns 21,114,662 shares of the company's stock valued at $270,479,000 after purchasing an additional 83,094 shares during the period. LPL Financial LLC purchased a new stake in shares of Newmark Group during the 4th quarter valued at approximately $184,000. Fox Run Management L.L.C. bought a new position in Newmark Group in the 4th quarter worth approximately $797,000. Finally, KLP Kapitalforvaltning AS bought a new stake in Newmark Group during the 4th quarter valued at $382,000. 58.42% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Separately, The Goldman Sachs Group reduced their price target on Newmark Group from $19.50 to $17.00 and set a "buy" rating for the company in a research report on Wednesday, March 19th.

Get Our Latest Analysis on Newmark Group

Newmark Group Price Performance

NASDAQ:NMRK traded down $0.19 during trading hours on Tuesday, hitting $10.52. The stock had a trading volume of 829,057 shares, compared to its average volume of 1,128,430. The firm has a market capitalization of $1.90 billion, a price-to-earnings ratio of 30.06 and a beta of 1.69. Newmark Group, Inc. has a one year low of $9.44 and a one year high of $16.10. The company has a 50 day simple moving average of $12.81 and a two-hundred day simple moving average of $13.81. The company has a debt-to-equity ratio of 0.52, a current ratio of 0.42 and a quick ratio of 0.42.

Newmark Group (NASDAQ:NMRK - Get Free Report) last announced its earnings results on Friday, February 14th. The company reported $0.55 earnings per share for the quarter, topping analysts' consensus estimates of $0.48 by $0.07. Newmark Group had a return on equity of 20.74% and a net margin of 2.22%. The business had revenue of $888.30 million for the quarter, compared to analyst estimates of $790.76 million. During the same period in the prior year, the company earned $0.46 EPS. The company's quarterly revenue was up 18.9% compared to the same quarter last year. Research analysts forecast that Newmark Group, Inc. will post 1.45 earnings per share for the current fiscal year.

Newmark Group Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, March 17th. Stockholders of record on Monday, March 3rd were given a dividend of $0.03 per share. This represents a $0.12 annualized dividend and a dividend yield of 1.14%. The ex-dividend date was Monday, March 3rd. Newmark Group's dividend payout ratio (DPR) is currently 34.29%.

About Newmark Group

(

Free Report)

Newmark Group, Inc provides commercial real estate services in the United States, the United Kingdom, and internationally. The company offers capital markets consisting of investment sales and commercial mortgage brokerage; landlord or agency representation leasing; valuation and advisory; property management; commercial real estate technology platform and capabilities; the United Kingdom business rates services; due diligence, consulting, and other advisory services; GSEs and the Federal Housing Administration lending services comprising multifamily lending and loan servicing; asset management; and flexible workspace solutions for owners.

Featured Articles

Before you consider Newmark Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Newmark Group wasn't on the list.

While Newmark Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.