JPMorgan Chase & Co. reduced its holdings in Vestis Co. (NYSE:VSTS - Free Report) by 39.5% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 133,579 shares of the company's stock after selling 87,143 shares during the quarter. JPMorgan Chase & Co. owned approximately 0.10% of Vestis worth $1,990,000 as of its most recent filing with the Securities and Exchange Commission.

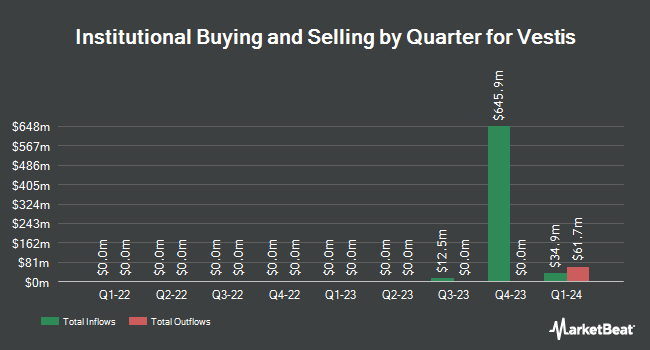

Other large investors have also recently added to or reduced their stakes in the company. AQR Capital Management LLC grew its position in Vestis by 223.0% during the second quarter. AQR Capital Management LLC now owns 3,753,889 shares of the company's stock valued at $45,197,000 after acquiring an additional 2,591,593 shares during the period. Jacobs Levy Equity Management Inc. increased its position in Vestis by 111.0% during the 3rd quarter. Jacobs Levy Equity Management Inc. now owns 2,631,652 shares of the company's stock worth $39,212,000 after purchasing an additional 1,384,413 shares in the last quarter. TOMS Capital Investment Management LP raised its holdings in Vestis by 22.7% in the third quarter. TOMS Capital Investment Management LP now owns 2,330,155 shares of the company's stock valued at $34,719,000 after buying an additional 430,555 shares during the period. Charles Schwab Investment Management Inc. increased its holdings in Vestis by 9.8% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 2,156,811 shares of the company's stock valued at $32,136,000 after purchasing an additional 192,525 shares in the last quarter. Finally, Dimensional Fund Advisors LP raised its holdings in shares of Vestis by 0.6% during the 2nd quarter. Dimensional Fund Advisors LP now owns 1,541,710 shares of the company's stock valued at $18,854,000 after buying an additional 8,997 shares during the period. 97.40% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several analysts have issued reports on the stock. The Goldman Sachs Group increased their price objective on shares of Vestis from $13.60 to $15.00 and gave the company a "neutral" rating in a research report on Friday, November 22nd. Barclays boosted their price objective on shares of Vestis from $10.00 to $13.00 and gave the stock an "underweight" rating in a report on Friday, November 22nd. Finally, JPMorgan Chase & Co. boosted their price target on Vestis from $15.00 to $16.00 and gave the stock a "neutral" rating in a research note on Friday, November 22nd. One research analyst has rated the stock with a sell rating and seven have given a hold rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average target price of $14.08.

View Our Latest Stock Report on VSTS

Vestis Stock Down 0.4 %

Shares of Vestis stock traded down $0.07 during trading on Thursday, reaching $16.24. The company had a trading volume of 347,631 shares, compared to its average volume of 1,135,851. The company has a market cap of $2.14 billion, a price-to-earnings ratio of 101.41 and a beta of 1.17. Vestis Co. has a fifty-two week low of $8.92 and a fifty-two week high of $22.37. The firm's fifty day moving average is $15.81 and its 200-day moving average is $14.54. The company has a debt-to-equity ratio of 1.40, a quick ratio of 1.36 and a current ratio of 1.73.

Vestis (NYSE:VSTS - Get Free Report) last posted its quarterly earnings results on Thursday, November 21st. The company reported $0.11 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.13 by ($0.02). The business had revenue of $684.28 million during the quarter, compared to the consensus estimate of $693.54 million. Vestis had a return on equity of 9.07% and a net margin of 0.75%. The business's quarterly revenue was down 4.4% on a year-over-year basis. On average, analysts anticipate that Vestis Co. will post 0.66 EPS for the current year.

Vestis Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Monday, January 6th. Stockholders of record on Friday, December 13th were given a dividend of $0.035 per share. The ex-dividend date of this dividend was Friday, December 13th. This represents a $0.14 annualized dividend and a dividend yield of 0.86%. Vestis's dividend payout ratio is currently 87.51%.

About Vestis

(

Free Report)

Vestis Corporation provides uniform rentals and workplace supplies in the United States and Canada. Its products include uniform options, such as shirts, pants, outerwear, gowns, scrubs, high visibility garments, particulate-free garments, and flame-resistant garments, as well as shoes and accessories; and workplace supplies, including managed restroom supply services, first-aid supplies and safety products, floor mats, towels, and linens.

Further Reading

Before you consider Vestis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vestis wasn't on the list.

While Vestis currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.